The Guide to United Travel Insurance

It's convenient to bundle insurance with your United airfare purchase, but review your options before deciding.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

United Airlines' travel insurance aims to protect you if your trip is delayed, your baggage is lost or other travel mishaps occur. But the United Airlines flight insurance plan is far from comprehensive. Let’s look at what the policy covers, how to buy it and whether it's a good fit for you.

About United Airlines travel insurance

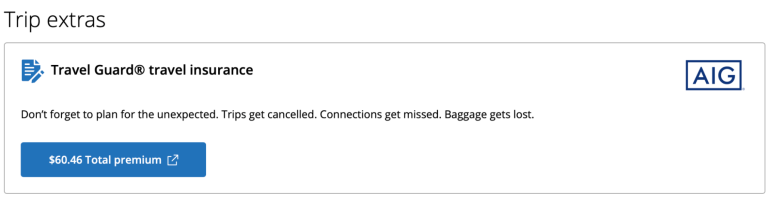

United’s flight insurance isn’t underwritten by United Airlines. While you can purchase a policy via United’s website, it’s actually issued by AIG and is called the Travel Guard plan.

United Travel Guard insurance is focused on benefits during your air travel, though it does have limited coverage beyond your flight time.

» Learn more: How much is travel insurance?

United trip insurance

Two policies are available via the United website: The Domestic Air Ticket plan and the International Air Ticket plan.

To get a sample quote, we put in two different flights. The first was a one-way economy class flight from San Diego to Newark, New Jersey. The total for the flight came out to $755.70, and the insurance premium offered totaled $60.46.

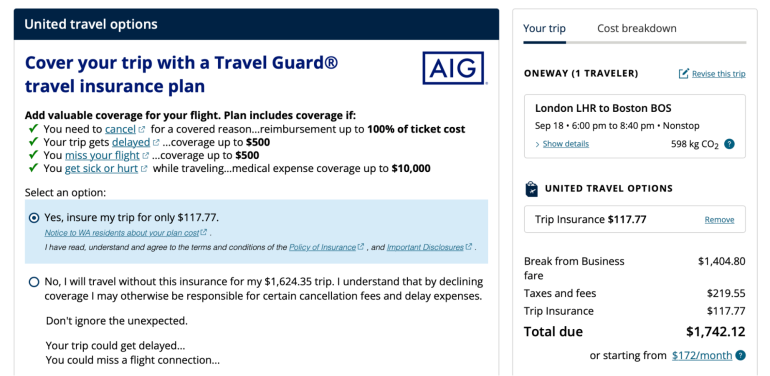

In our second quote, we checked out an economy class flight from London-Heathrow to Boston. A one-way ticket came out to $1,624.35, and the insurance policy quote was returned at $117.77

Here’s how the plans compare to one another.

| Coverage | Domestic Air Ticket Plan | International Air Ticket Plan |

|---|---|---|

| Trip cancellation | 100% of trip cost (up to $100,000). | 100% of trip cost (up to $100,000). |

| Trip interruption | 125% of trip cost (up to $125,000). | 125% of trip cost (up to $125,000). |

| Trip delay | $100 per day (up to $500). | $100 per day (up to $500). |

| Missed connection | $500. | $500. |

| Baggage delay | $100 per day (up to $300). | $100 per day (up to $500). |

| Lost luggage | $500. | $1,000. |

| Emergency medical expense | Coverage not included. | $10,000. |

| Emergency evacuation and repatriation | Coverage not included. | $20,000. |

| Non-flight accidental death and dismemberment | $27,500. | $25,000. |

The coverage for the policies is fairly similar whether you’re traveling domestically or internationally. However, international travel includes emergency medical and higher limits for issues with luggage. It’s also correspondingly more expensive.

» Learn more: How does travel insurance work?

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

What isn’t covered by United Airlines insurance

United’s travel insurance has generous policy limits.

They don’t ask you how much your trip cost and price the maximums accordingly; instead, there’s a flat rate benefit for trip interruption and trip delay, which can be great if you’re embarking on a more expensive vacation.

🤓 Nerdy Tip

United’s travel insurance includes coverage for pre-existing conditions if you purchase a policy when booking your ticket. However, this travel insurance isn’t comprehensive. While you’ll get superior benefits if you’re traveling abroad, other plans offer more customization.

Notably, these plans don't allow you to add any supplemental coverage, such as Cancel For Any Reason (CFAR) insurance, flight accidental death and dismemberment (AD&D) coverage and rental car insurance.

» Learn more: Trip cancellation insurance explained

Note that United’s website specifically calls out COVID-19 as a foreseen event, meaning that trip cancellation, trip interruption and trip delay as a result of quarantine will not be covered.

However, emergency medical benefits will still apply.

How to buy United Airlines trip insurance online

When purchasing a ticket

There are two ways to purchase United Airlines travel insurance online. The first is to do so when you’re booking your flight.

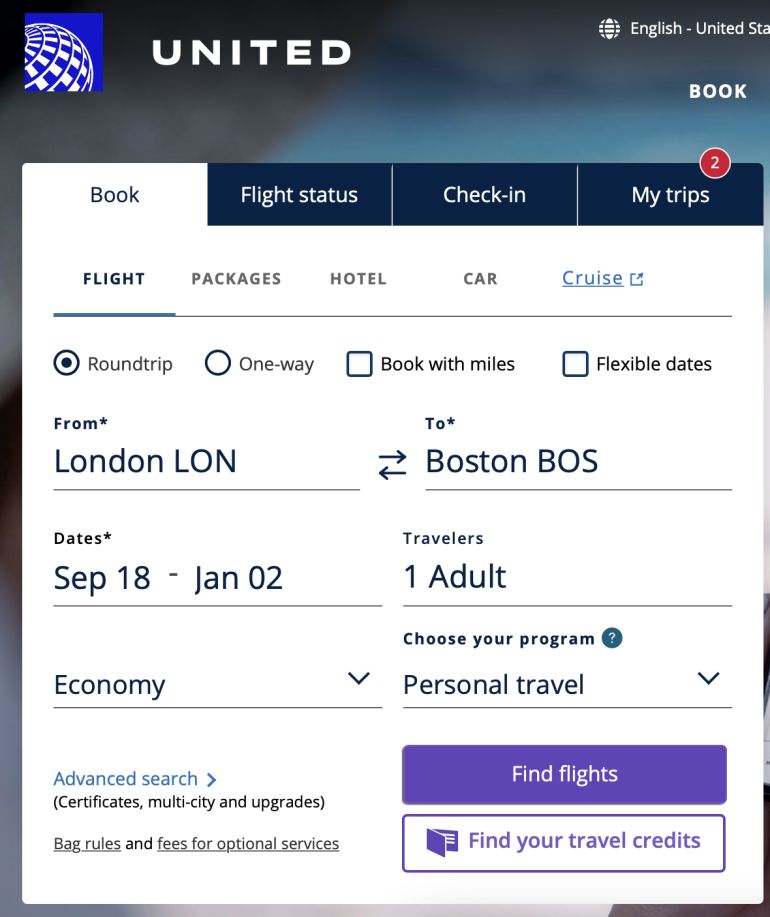

You’ll want to start at United’s home page, where you can input your travel information.

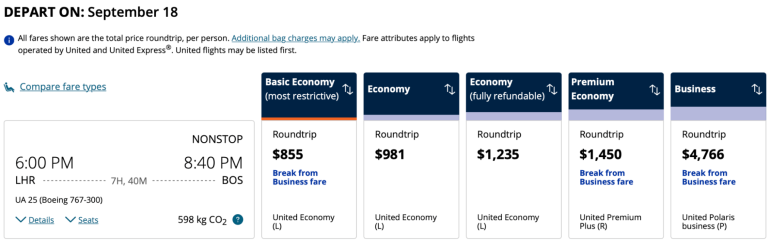

After you click Find Flights, you’ll be taken to a results page, where you can peruse available options.

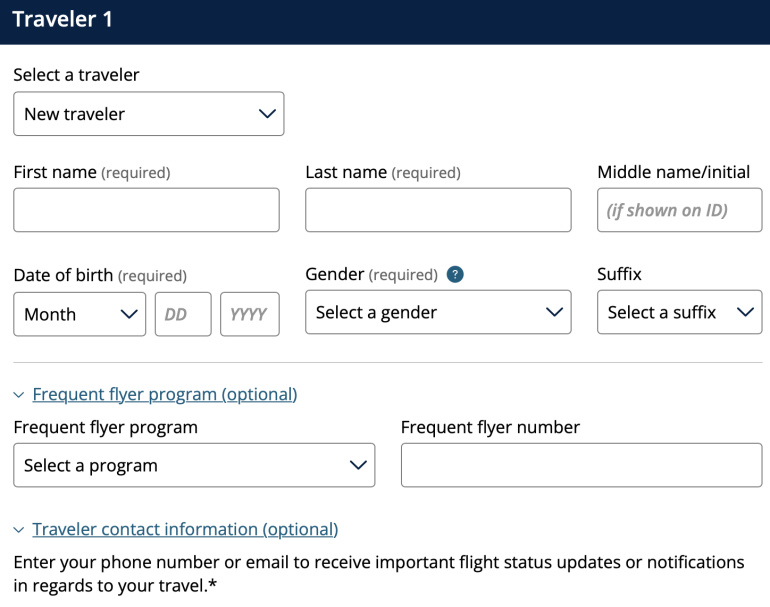

You’ll be able to select which flight suits your needs, after which you’ll begin the checkout process. Here you’ll need to put down all your personal information, including name, date of birth and frequent flyer number.

United will then take you through a couple pages of extras asking you if you’d like to purchase Wi-Fi or choose your seats. Once this is done, you’ll be presented with the United insurance page.

Here you can select whether or not you’d like to purchase the insurance. After this, you’ll be prompted to input your card information. Your payment will be processed (including the insurance) and then your ticket will be issued.

» Learn more: What to know before buying travel insurance

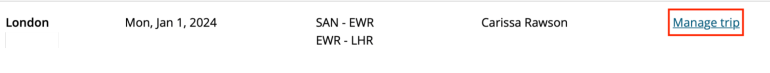

If you already have a ticket

Adding United’s insurance to a ticket you’ve already purchased is possible. To do so, you’ll either want to log into your account or search for your trip using your booking code and name.

If you’re logging in, you’ll want to click My Trips, then Manage Trip to get to the insurance page.

This will bring up of your trip details including flight numbers and upgrade options. Scrolling down to the Trip Extras section, you can purchase insurance.

» Learn more: Common travel insurance myths

Should you buy United travel insurance?

United Airlines makes it easy to purchase travel insurance by bundling it with your airfare purchase. However, you’ll always want to double-check the coverage and customizability to see if it fits your travel plans.

You’ll also want to gather multiple quotes before committing to a purchase. Sites such as Squaremouth gather providers from a variety of companies to generate a quote and get you the best deal.

Otherwise, many travel credit cards offer complimentary travel insurance as long as you pay for the trip with your card.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles