5 Things to Know Before Getting the AmEx Gold Card

Know your spending habits and travel plans before diving in with this card.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Whether you’re looking for your first credit card or your wallet is already bursting with plastic, you’ll want to do your research before acquiring a new card. After all, every credit card is different; from application requirements to card benefits, different banks have done their best to entice you as a customer.

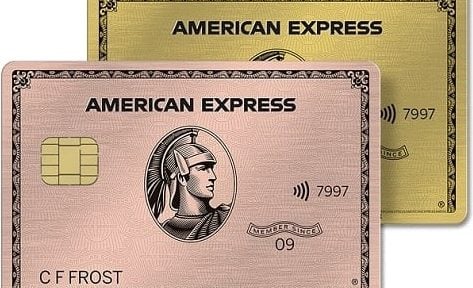

A mid-tier card offered by American Express, the American Express® Gold Card is a solid option for many consumers. This is thanks to its strong earning structure and travel perks, among other benefits. It's also made of metal, which some cardholders love.

If you’re thinking about applying for the card, check out these five things to know before getting the American Express® Gold Card.

What to know before getting the American Express® Gold Card

1. Your credit score

Odds are that you’ve heard of credit scores. These numbers, derived from your financial history, indicate to creditors whether you’re a risky investment.

Generally speaking, your credit score is built on five different factors, including the number of accounts you have, the type of accounts you hold, the length of your credit history, your credit utilization and your payment history.

American Express will pull your credit when you apply. And since it features some pretty decent benefits, the American Express® Gold Card requirements for approval tend to be a little stricter.

» Learn more: The difference between a charge card and a credit card

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

2. How to use American Express Membership Rewards

You don’t have to be a points expert to apply for the American Express® Gold Card. That being said, American Express Membership Rewards points are highly versatile, and knowing how to maximize them can greatly improve your travel experiences.

There are a variety of ways in which AmEx points can be redeemed, including transferring them to hotel and airline partners, redeeming them via the AmEx travel portal or using them for statement credits. However, not all options are created equal; the value you’ll receive for each point will vary based on how they’re redeemed.

This is especially pertinent when you consider the welcome offer available for the American Express® Gold Card: You may be eligible for as high as 100,000 Membership Rewards® Points after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

NerdWallet estimates that AmEx points can be worth up to 2 cents each, making the welcome offer worth more than the annual fee by a longshot.

» Learn more: Advanced tips for using AmEx Membership Rewards points

3. Your lifestyle

Many cards offer different spending benefits, so you’ll always want to make sure that you’re applying for one that suits your needs. The American Express® Gold Card is no different — it’s a heavy hitter when it comes to all things food, but falls behind on other purchases:

• 4 points per $1 at restaurants worldwide (on up to $50,000 in purchases per year).

• 4 points per $1 at U.S. supermarkets (on up to $25,000 in purchases per year).

• 3 points per $1 on flights booked directly with airlines or through American Express' travel portal.

• 2 points per $1 on prepaid hotels and other eligible purchases made through American Express' travel portal.

• 1 point per $1 on other eligible purchases.

Terms apply.

Whether you’re a home chef or a takeout fanatic, the American Express® Gold Card has good earning potential for your purchases. It also has decent point earning on airfare, though this falls behind the 5 points per $1 spent on flights up to $500,000 on these purchases per calendar year offered by the American Express Platinum Card®. Terms apply.

🤓 Nerdy Tip

The American Express® Gold Card comes with a $10 monthly dining credit good for Grubhub, The Cheesecake Factory, Goldbelly, Wine.com and more. Enrollment required. Terms apply. If most of your spending falls within these categories, the American Express® Gold Card could be an excellent option for you. Otherwise, you may be better off going for a card that offers high earnings categories that better fit your needs.

4. Your travel plans

Along with great dining benefits, the American Express® Gold Card comes with strong travel perks. Among other questions, you may be wondering, “Does the American Express® Gold Card cover rental car insurance?”

While the rental car insurance provided by the American Express® Gold Card is secondary to your existing insurance, it does provide damage and theft coverage for select vehicle types in most countries. (Cards such as the Chase Sapphire Preferred® Card offer primary rental car insurance.)

The American Express® Gold Card also features other perks, such as baggage insurance, no foreign transaction fees and access to The Hotel Collection by American Express. You’ll also get $10 monthly Uber credits (up to $120), which can be used for either Uber rides or Uber Eats purchases in the U.S. Your American Express® Gold Card must be added to the Uber app to receive the Uber Cash, and you must use an AmEx card to pay. Enrollment required. Terms apply.

If you’re not a big traveler, these perks won’t mean much to you. But they may be worthwhile for someone who travels often.

» Learn more: The best travel credit cards right now

5. Your existing credit cards

Did you know that American Express will allow you to receive a welcome offer for a specific card only one time? This means that if you already hold the American Express® Gold Card or have held it in the past, you won’t be able to receive another welcome bonus. AmEx may also look at the number of its cards you have opened and closed before determining your welcome offer eligibility.

You’ll also want to consider other credit cards you hold. Do your current cards have better benefits than the American Express® Gold Card? How much do you pay in annual fees each year?

The American Express® Gold Card has an annual fee of $325, which is steeper than many other mid-tier cards. In this case, is the American Express® Gold Card worth it for your particular needs?

AmEx also limits the amount of American Express cards you can have at once. If you’re already at the limit, you’ll be denied the American Express® Gold Card no matter how good of an applicant you may be.

» Learn more: AmEx Green, Gold and Platinum: Which one should I get?

If you’re considering the American Express® Gold Card

There are a number of factors you’ll want to think about before applying for the American Express® Gold Card. An important factor is knowing some information about yourself — including your highest-spend purchase categories, credit score, travel plans and existing credit cards. Knowing how to use AmEx points is also important and can greatly affect how you benefit from this card.

All that being said, if you’re in the market for a card with strong earnings on food and decent travel benefits, the American Express® Gold Card may be worth a look.

To view rates and fees of the American Express® Gold Card, see this page.

Insurance Benefit: Baggage Insurance Plan

- Baggage Insurance Plan coverage can be in effect for Eligible Persons for eligible lost, damaged, or stolen Baggage during their travel on a Common Carrier (e.g. plane, train, ship, or bus) when the entire fare for a Common Carrier Vehicle ticket for the trip (one-way or round-trip) is charged to an eligible Account. Coverage can be provided for up to $1,250 for carry-on Baggage and up to $500 for checked Baggage, in excess of coverage provided by the Common Carrier (e.g. plane, train, ship, or bus). For New York State residents, there is a $10,000 aggregate maximum limit for all Covered Persons per Covered Trip.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company.

Insurance Benefit: Car Rental Loss & Damage Insurance

- Car Rental Loss and Damage Insurance can provide coverage up to $50,000 for theft of or damage to most rental vehicles when you use your eligible Card to reserve and pay for the entire eligible vehicle rental and decline the collision damage waiver or similar option offered by the Commercial Car Rental Company. This product provides secondary coverage and does not include liability coverage. Not all vehicle types or rentals are covered. Geographic restrictions apply.

- Eligibility and Benefit level varies by Card. Terms, Conditions and Limitations Apply.

- Please visit americanexpress.com/benefitsguide for more details.

- Underwritten by AMEX Assurance Company. Car Rental Loss or Damage Coverage is offered through American Express Travel Related Services Company, Inc.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles