TravelSafe Insurance Review: Is It Worth the Cost?

TravelSafe offers two tiers of coverage — compare these to the coverage your travel credit card provides before deciding.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

at SquareMouth

TravelSafe

TravelSafe is a good option for tight layovers, as its Classic plan includes up to $2,500 in missed connection coverage.

at SquareMouth

Pros

- Covers up to $300 redepositing points and miles on eligible canceled award flights.

- Optional add-on protection for business equipment or sports rentals.

Cons

- Multi-trip or year-long plans aren’t available.

Are you wondering whether to buy travel insurance? There are a ton of companies out there offering protection from unexpected events like illness, flight cancellations and lost baggage. TravelSafe insurance is one such provider — it features a range of protections to give you peace of mind when on the road. It’s one of the most expensive travel insurance companies, but it offers protection that you don’t usually find elsewhere.

Why trust NerdWallet?

Our Nerdy editorial team aims to be a starting point in your travel insurance research. We default toward transparency and follow a comprehensive methodology for rating and reviewing travel insurance companies. Advertisers and advertising relationships do not influence our ratings. Learn more about our strict editorial guidelines.

What is TravelSafe?

Unlike many other travel insurance companies, TravelSafe is privately owned. TravelSafe has just two plans from which to choose, so it may seem like your options are limited, but that’s far from the case. TravelSafe’s travel insurance policies are wholly comprehensive and provide coverage for mishaps you won’t find elsewhere.

TravelSafe’s policies are underwritten by United States Fire Insurance Co., which holds an AM Best rating of A (excellent).

What does TravelSafe cover?

TravelSafe travel insurance coverage is better than what you’ll find at many other companies. You’ll find the standard TravelSafe travel insurance medical coverage and trip cancellation coverage but also much more:

- TravelSafe health insurance coverage: Covers accident or injury that occurs during your travels.

- Trip cancellation and trip interruption: Repays you for nonrefundable costs incurred in the event your trip is canceled or interrupted for a covered reason.

- Emergency evacuation and repatriation: Reimburses the cost of a medical evacuation or the repatriation of remains back to your home country.

- Luggage insurance: Offers protection and reimbursement in the event your luggage is delayed, damaged or lost.

- Frequent traveler reward insurance: Reimburses the costs for redepositing frequent flyer rewards back into your account in the event you need to change or cancel your plans.

- Missed connection insurance: Helps cover the costs of a new flight if you miss your connection.

TravelSafe policies

There are two travel insurance policies available from TravelSafe:

| Trip cancellation | Trip interruption | Medical coverage | Luggage | |

|---|---|---|---|---|

| Basic | Up to 100% of trip cost. | Up to 100% of trip cost. | Up to $35,000. | Up to $100 for delay, up to $500 for lost luggage. |

| Classic | Up to 100% of trip cost. | Up to 150% of trip cost. | Up to $100,000. | Up to $250 for delay, up to $2,500 for lost luggage. |

Add-on options

Because TravelSafe’s plans are already comprehensive, there isn’t much to add on. Your only option is to include Cancel For Any Reason (CFAR) insurance.

What’s not covered by a TravelSafe plan

While TravelSafe provides excellent coverage to travelers, there are some situations in which your plan won’t apply. These include:

- Anything that happens under the influence of drugs and alcohol.

- Epidemics.

- Storms after they’ve already been named.

- Participation in athletic events.

How TravelSafe compares to its competitors

On a five-star scale, NerdWallet rated TravelSafe four stars. While there are a few competitors that scored higher, including Berkshire Hathaway, Trawick, WorldTrips and Arch RoamRight, TravelSafe is still among the best we’ve reviewed.

| Company | Star rating | Basic plan cost | Premium plan cost | Generate a quote |

|---|---|---|---|---|

| Berkshire Hathaway Travel Protection | | $26. | $75. | |

| Tin Leg | | $36. | $188. | |

| WorldTrips Travel Insurance | | $47. | $66. | |

| World Nomads | | $63. | $115. | |

| Trawick International | | $100. | $194. | |

| AXA Assistance USA | | $114. | $159. | |

| AEGIS (GoReady) Travel Insurance | | $139. | $208. | |

| HTH Travel Insurance | | $146. | $233. | |

| Seven Corners | | $154. | $225. | |

| Travel Insured International | | $164. | $218. | |

| Allianz Global Assistance | | $166. | $291. | |

| USI Affinity Travel Insurance Services | | $169. | $297. | |

| AAA | | $183. | $222. | |

| IMG | | $183. | $252. | |

| Travel Guard | | $135. | $236. | |

| Arch RoamRight | | $202. | $225. | |

| These star ratings are based on a separate analysis of each travel insurance provider’s offerings. For more detailed scoring, see our recommendations for the best travel insurance companies, read each individual provider's NerdWallet review or view our methodology at the end of this article. Pricing is subject to change based on your specific trip details. You can verify the latest price by clicking through to Squaremouth (a NerdWallet partner). | ||||

How much is TravelSafe travel insurance?

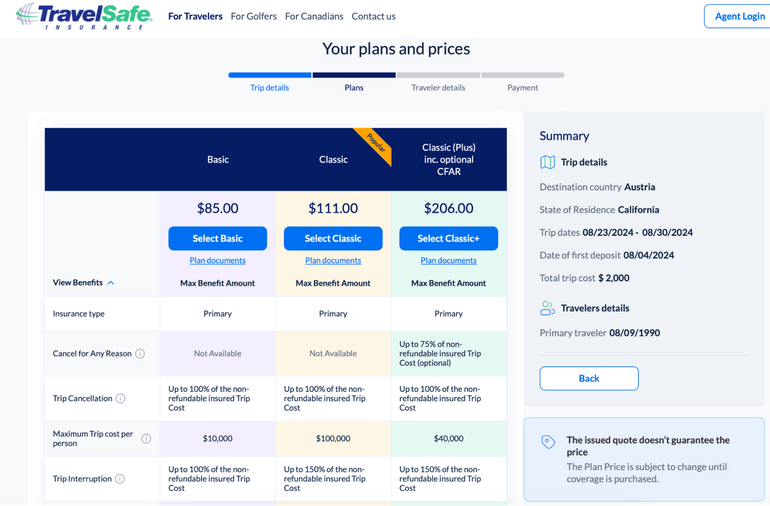

How much does TravelSafe travel insurance cost? A sample trip for a 36-year-old traveler from Indiana to Canada for five days found that the cheapest TravelSafe plan cost $200. If you were to spring for the premium plan, which includes CFAR coverage, expect to pay $468.

Other providers charged anywhere from $10 to $202 for their basic plan for the same sample trip. Note that price isn't the only differentiating factor. Travel insurance cost and coverage are not identical across plans; each company offers various levels of scope, limits and exclusions.

How to buy a TravelSafe policy

Purchasing a TravelSafe insurance policy is simple and can be done online. To do so, you’ll first want to head to TravelSafe’s website.

From there, you’ll be able to generate a quote for your trip based on where you live, where you’re going, when you’re traveling and other important details.

TravelSafe will then show you a comparison of available plans, including their cost and their coverage levels.

Once you select a plan, you’ll be taken through the checkout process. After you’ve purchased the plan — you’re covered! It’s as easy as that.

Consider comparison shopping

If you're not 100% sold on purchasing a plan from TravelSafe, you can use a travel insurance aggregator to compare policies across multiple companies at once.

Which TravelSafe travel insurance plan is best for me?

Finding a TravelSafe plan that suits your needs is not complicated. Since there are only two plans available to travelers, you’ll just need to choose the one whose coverage fits your expenses.

For example, if you’re worried about becoming injured or ill during your journey, you may want to opt for the more expensive Classic plan because its emergency medical coverage limit is much higher than that of the Basic plan.

Does TravelSafe offer 24/7 travel assistance?

Yes, TravelSafe offers 24/7 travel assistance for all of its customers. Your best bet is to call:

- Toll-free: 866-509-7713.

- Collect: 603-952-2047.

How to file a claim with TravelSafe travel insurance

To file a claim with your TravelSafe policy, you have two options. The first is to file online via TravelSafe’s self-service claim portal. Otherwise you can call to make a claim:

- Toll-free (U.S. only): 877-539-6729.

- Direct: 727-475-2808.

Is TravelSafe travel insurance worth it?

Is TravelSafe travel insurance good? TravelSafe insurance is among the most expensive travel insurance you can buy, but it’s for a good reason. Its coverage includes all the standard protections you’d expect, as well as some you might not. If you’re looking only for minimal coverage, you may want to search elsewhere — but if you have specialty circumstances, such as having redeemed rewards for your trip, you may want to consider purchasing a TravelSafe policy.

Frequently Asked Questions

Does TravelSafe cover flight cancellation?

Both of TravelSafe’s plans provide coverage if your trip is delayed or canceled due to a flight cancellation.

How long does a TravelSafe refund take?

TravelSafe doesn’t publish its refund timeline, but there are a few factors that can impact how quickly your claim is processed. It’s important to submit all your documentation at one time, and provide as much as possible, to have it go smoothly.

Is TravelSafe travel insurance primary or secondary?

TravelSafe travel insurance is primary.

Does TravelSafe cover COVID-19?

Yes, TravelSafe travel insurance covers COVID-19.

TravelSafe review recapped

TravelSafe’s two travel insurance plans offer comprehensive coverage for when you’re away from home. Compare the benefits of both before deciding on a purchase — and be sure to double-check whether you already have existing coverage from a travel credit card.

Star rating methodology

Travel insurance rating and review methodology

Travel insurance

NerdWallet's ratings for travel insurance companies take into account the following details about each insurer:

- Scope of coverage.

- Customizability.

- Consumer experience and complaints.

- Cost.

The best travel insurers excel in all of these categories. They provide the information people need to make a purchase without any surprises along the way. They offer insurance at a fair price and allow customers to customize plans to meet their coverage preferences. They're also able to keep their customers happy throughout the relationship.

Data collection and review process

NerdWallet collects over a dozen data points for each insurer we analyze from their public-facing websites and third-party analyses. These data points are then compared against one another and against NerdWallet's standards for good travel insurance companies to determine a star rating.

Data is collected on a regular basis and reviewed by our editorial team for consistency and accuracy. Final star ratings are presented on a scale of one to five stars, where a one-star score represents "poor" and a five-star score represents "excellent."

The reviews team

The writers and editors behind NerdWallet's travel insurance reviews are insurance specialists who have had their work featured by or appear in The Associated Press, The Washington Post, The New York Times, the Chicago-Sun Times, U.S. News & World Report and the Society for Advancing Business Editing and Writing. Each writer and editor follows NerdWallet’s strict guidelines for editorial independence.

In addition to travel insurance, the team covers travel rewards programs, airlines and hotels.

Rating specifics

Our star ratings are weighted based on our editorial and professional opinions. We use the following weightings when rating travel insurers:

- Scope of coverage (25%).

- Customizability (25%).

- Consumer experience and complaints (25%).

- Cost (25%).

Scope of coverage ratings are based on assessments of a company’s standard protections, including:

- Travel medical insurance.

- Trip cancellation.

- Trip interruption.

- Trip delay.

- Baggage and personal belongings, lost luggage.

- Emergency medical assistance.

- Emergency medical evacuation.

- Emergency medical repatriation.

- Accidental death and dismemberment insurance.

- Rental car coverage.

Customizability ratings factor in whether coverage limits are fixed prices or a percentage of the trip cost (the percentage is generally better), whether a policy has customizations available, and the number of bonus features.

- 24-hour assistance.

- Pre-existing medical conditions coverage.

- Extreme sport coverage.

- CFAR add on availability.

- Travel health insurance.

- Interruption for Any Reason.

- Travel Inconvenience.

- Cancel for Work Reasons.

- Electronics coverage.

Consumer experience ratings are based on provider reviews on Squaremouth.com. If the company is not in the Squaremouth database, we default to Google reviews.

Affordability ratings are based on the percentage of total trip cost a plan costs a policyholder. Less than 4% is considered excellent, whereas over 9% is considered poor.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles