Uber to Charge Currency Conversion Fees Abroad

You can avoid currency conversion fees when you pay in local currency.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Uber, which operates in almost 70 countries, is a popular way to get around when traveling internationally. You can avoid airport taxi driver scams, compare prices, type in your destination address in English, follow along the route using the app and pay with a credit card instead of having to exchange money.

But the rideshare company’s newest fee could make your rides abroad a little more expensive.

Uber’s “preferred currency pricing” feature, launches for riders in the U.S., Canada, the European Union and the United Kingdom on Feb. 27, 2025. It automatically shows prices of Uber rides in your home currency when traveling abroad, adding a 1.5% conversion fee.

Yes, it’s convenient to see the total in U.S. dollars so you don’t have to do math in your head. But if you don’t want to waste your travel dollars on another pesky fee, you can — and should — side-step the charge by switching off this feature before your next international trip.

What’s a currency conversion fee?

Uber’s latest feature isn’t unique. If you’ve ever made a purchase abroad in U.S. dollars, you might have paid a currency conversion fee. These show up when merchants ask you if you want to pay in U.S. dollars. If you say yes, they’ll show you a converted total, including additional charges for the service of making the conversion at the point-of-sale. This is basically what Uber is doing with its new feature.

Currency conversion fees are separate from foreign transaction fees, the 1% to 3% fees charged by financial institutions when you make international purchases on debit or credit cards. It’s possible to pay both of these fees on the same transaction. With Uber, you can avoid the currency conversion fee by turning off the preferred currency feature.

Separately, you can avoid a foreign transaction fee by using cards that don’t charge these.

How to turn off preferred currency pricing in the Uber app

Uber turns on preferred currency pricing by default, converting international transactions to your home currency. For U.S.-based riders, that means your charges for Uber trips abroad will be displayed in U.S. dollars, with a 1.5% fee added. Uber is essentially including a currency conversion fee into your total charge.

But you can avoid this by going into your account and switching off this feature.

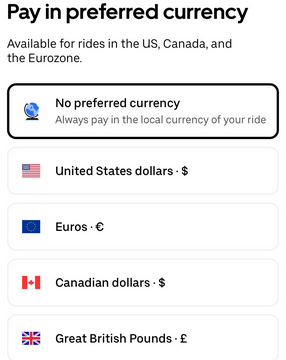

Open your Uber app, and click on the “Account" button in the bottom right of the app. Then click on “Wallet” toward the top, and scroll down to where it says “Preferred currency.”

Then click on “No preferred currency” and then “Confirm.” This means you will always see the cost for your trip in the local currency where you are booking the ride.

Avoid foreign transaction fees, too

Uber’s currency conversion fees aren’t the only fees to watch out for when traveling abroad. Even when the merchant converts an international purchase into U.S. dollars, debit and credit cards will still charge foreign transaction fees on those transactions. If you want to earn rewards and avoid these fees, check out NerdWallet’s list of the best credit cards with no foreign exchange fee.

Cards with 2x points on rideshare services

Foreign transaction fee

None.

None.

None.

Rideshare benefits

2 miles per $1 spent on rideshare purchases.

2 points per $1 spent on travel (including rideshare services).

2 miles per $1 spent on all purchases.

Still not sure?

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles