12 Benefits of the Citi Strata Premier Card

Earn points faster and use them for cash back, travel rewards, or to transfer to airline and hotel loyalty programs.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The Citi Strata Premier® Card is the mid-priced travel credit card that earns Citi ThankYou points, a transferable currency that can be redeemed in Citi's travel portal or moved to a variety of hotel and airline loyalty programs. It's an excellent card for people who want to earn 3x points on several popular bonus categories (such as supermarkets, restaurants, air travel and hotels) and want the ability to transfer points to Citi transfer partners.

For a $95 annual fee, this card packs in a lot of benefits. Here are the most notable.

» Learn more: The best travel credit cards right now

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

1. New cardmember bonus

Eligible new Citi Strata Premier® Card holders can earn the following sign-up bonus: Earn 60,000 bonus ThankYou® Points after spending $4,000 in the first 3 months of account opening, redeemable for $600 in gift cards or travel rewards at thankyou.com.

You can get even more value from those points by strategically transferring them to airline and hotel transfer partners.

Note that this welcome offer isn’t available to people who have received another welcome bonus for a Citi Premier® Card or Citi Strata Premier® Card account in the past 48 months or have converted another Citi account where you earned a bonus during the past 48 months.

2. Generous bonus spending categories

Aside from the welcome bonus, the Citi Strata Premier® Card earns a points multiplier in the following spending categories:

- 10 points per $1 spent on hotels, car rentals and attractions booked through CitiTravel.com.

- 3 points per $1 spent on air travel.

- 3 points per $1 spent on hotel purchases.

- 3 points per $1 spent at restaurants.

- 3 points per $1 spent at supermarkets.

- 3 points per $1 spent at gas stations.

- 3 points per $1 spent at electric vehicle (EV) charging stations.

- 1 point per $1 spent on all other purchases.

With so many bonus-earning categories, points can add up fast.

» Learn more: Citi ThankYou points — How to earn and use them

3. Access to transfer partners

One of the main Citi Strata Premier® Card benefits is the opportunity to transfer points to airline and hotel loyalty programs. American Airlines' AAdvantage program is an exclusive transfer partner of Citi, and this card has the lowest annual fee among the cards that allow 1:1 point transfers from Citi to American. The no-fee cards from Citi that allow transfers to American Airlines only transfer at a 1:0.7 ratio.

By wisely transferring points to these partners, you should be able to leverage points for more than the base redemption rate of 1 cent per point.

Citi Strata Premier Card rewards transfer partners:

- American Airlines AAdvantage.

- Aeroméxico Rewards.

- Air France-KLM Flying Blue.

- ALL – Accor Live Limitless.

- Avianca LifeMiles.

- Cathay Pacific Asia Miles.

- Choice Privileges.

- Emirates Skywards.

- Etihad Guest.

- EVA Air Infinity MileageLands.

- JetBlue TrueBlue.

- Leading Hotels of the World Leaders Club.

- Preferred Hotels & Resorts.

- Qantas Frequent Flyer.

- Qatar Airways Privilege Club.

- Shop Your Way.

- Singapore Airlines KrisFlyer.

- Thai Airways Royal Orchid Plus.

- Turkish Airlines Miles&Smiles.

- Virgin Atlantic Flying Club.

- Wyndham Rewards.

With this card, points transfer to most Citi transfer partners at a 1:1 ratio with a minimum increment of 1,000 points. However, points transfer to a handful of Citi transfer partners at a different rate. Here are the exceptions:

- ALL - Accor Live Limitless – 2:1.

- Choice Privileges – 1:2.

- Emirates Skywards – 5:4.

- Leaders Club – 5:1.

- Preferred Hotels & Resorts - 1:4.

- Shop Your Way – 1:10.

If you're planning to build up a massive points balance, note that Citi caps points transfers at 500,000 ThankYou points per transfer. That’s a limitation many cardholders shouldn’t have to worry about.

There are also periodic bonuses where your points are worth more than their 1:1 value when transferring to a specific partner.

» Learn more: The 6 best Citi ThankYou partners

4. Reasonable points cash-out rate

While Citi's airline and hotel transfer partners are going to provide the best value for your ThankYou points, Citi Strata Premier® Card holders also have the option to cash out points at 0.75 cents per point, which equals $75 for every 10,000 points.

You have the option to get a statement credit, bank account direct deposit or even a check in the mail. Only the check option has a minimum redemption requirement — just 500 points for $5.

Alternatively, Citi Strata Premier® Card holders can redeem ThankYou points through Citi's travel portal at a rate of 1 cent per point. However, it's arguably better to redeem your points for a statement credit and purchase travel outright in the travel portal. That way you'll earn 10 points per dollar spent on these travel purchases.

5. Points sharing

Besides transferring points to loyalty programs, you can also transfer points to another Citi cardmember. This option comes in handy if you’re short on points for a specific redemption and a friend or family member can give you points to complete the redemption.

Each calendar year, you can share and receive up to 100,000 ThankYou points with other Citi cardholders. Just note that shared points expire 90 days after a transfer, so have a plan to use these points before moving them between accounts.

While 100,000 points is the max, there isn’t a minimum number of points required to use the Points Sharing feature.

6. $100 annual hotel savings benefits

Another Citi Strata Premier® Card provides a $100 hotel stay travel benefit once a year. For the credit to apply, you must book a single stay through Citi's travel portal totaling at least $500. As long as you prepay for the stay with the Citi Strata Premier® Card, the savings will apply at the time of booking.

You'll earn a whopping 10 points per $1 spent on the remaining balance.

🤓 Nerdy Tip

Remember that the Citi Strata Premier® Card has an annual fee of just $95, which means you can offset the fee with one hotel booking. 7. No foreign transaction fees

The Citi Strata Premier® Card doesn’t charge foreign transaction fees. These fees can tack on up to an additional 3% charge on other cards.

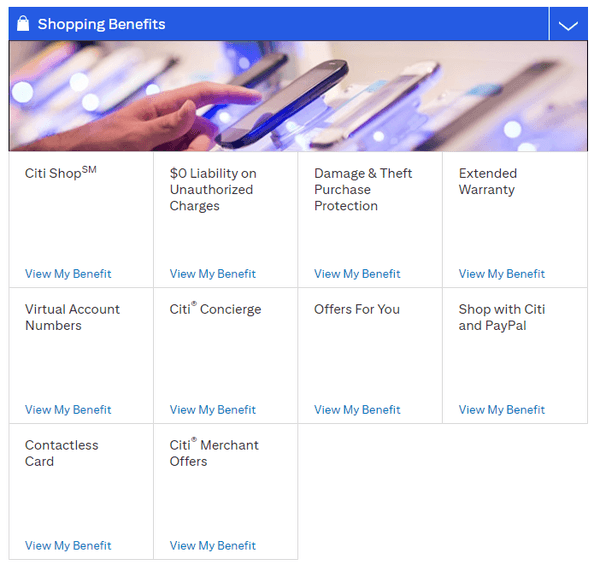

8. Purchase protections

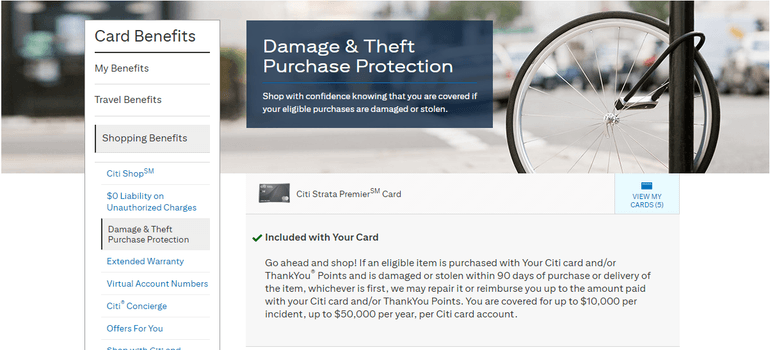

While not the flashiest of the Citi Strata Premier® Card benefits, shopping protections can come in handy when things don't go as planned with a purchase. Cardholders automatically get damage and theft purchase protection and extended warranty when using their Citi Strata Premier® Card to make a purchase.

Damage and theft protection covers if a new item is damaged or stolen within 90 days of purchase or delivery, whichever is first. Your purchase is covered up to $10,000 per incident and up to $50,000 per year per card.

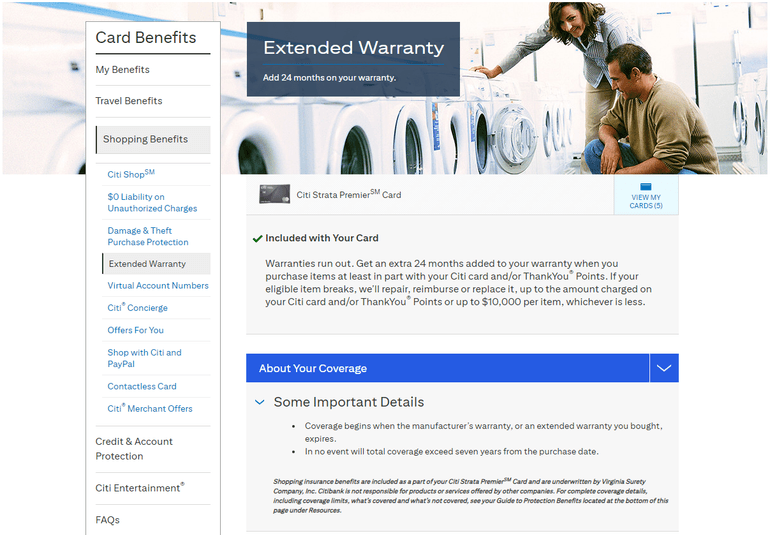

Extended warranty protection adds up to an extra 24 months to your manufacturer's warranty, up to a cap of seven years from the purchase date. If your purchased item breaks, Citi's benefits provider will repair, reimburse or replace that item, up to the amount charged or $10,000 per item.

9. World Elite Mastercard benefits

The Citi Strata Premier® Card is a World Elite Mastercard, unlocking an entire list of additional benefits such as:

- $5 Lyft credit per month when you take three rides with Lyft. Plus, 10% off scheduled rides to U.S. airports when using your card. Valid through 1/31/27.

- $10 off your second order each month at Instacart. Offer is valid through 1/31/27.

- $3 off Peacock Premium or Peacock Premium Plus each month when you use your World Elite or World Legend Mastercard to subscribe. Offer is valid through 12/31/27.

- Access to Priceless Experiences.

10. Access to Citi Entertainment

Looking for tickets to see your favorite performer or watch your team play? Citi Strata Premier® Card holders get access to Citi Entertainment, which boasts special access to “presale tickets and exclusive experiences to music, sports, arts and cultural events.”

» Learn more: What Is Citi Entertainment?

11. Travel protections

The Citi Strata Premier® Card has some key travel protections including:

- Trip cancellation and interruption: Coverage for prepaid, nonrefundable trip costs if your trip is canceled or interrupted due to covered reasons.

- Trip delay: Reimbursement for expenses incurred due to covered trip delays.

- Lost or damaged luggage: Compensation for lost, stolen or damaged luggage.

- Rental car insurance: Coverage for rental car damage or theft, often with specific terms and conditions.

There are several travel cards that come with travel insurance, so it is a welcome change for Citi to offer a mid-tier card with these benefits, although some of it is secondary coverage only.

12. Shop with points

With the Citi Strata Premier® Card, you can shop with points at retailers like Amazon, CVS, Dollar General, Walgreens, Walmart, and more. This benefit allows cardholders to use their ThankYou® Points to cover recent purchases with a statement credit.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles