6 Things to Know About United TravelBank

You can purchase TravelBank credits that you can later use toward a future United Airlines flight.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Whether you're saving up for a special occasion — like a honeymoon — or just an upcoming getaway, many travelers opt to save future travel funds in a dedicated bank account. For United Airlines loyalists, this process can be even simpler.

United MileagePlus account members can access a budgeting tool called United TravelBank. Let's dive into the things you'll want to know about the service, how to use it and if it's worth "saving" money in this account at all.

What is United TravelBank? How does it work?

United's TravelBank is pretty much what it sounds like — an online account designed for accumulating travel funds for future United flights. It aims to simplify United MileagePlus members’ budgeting for future personal and/or business flights.

Once the account is set up and has money in it, it syncs with both united.com or the United mobile app as a payment option.

» Learn more: How to use the United MileagePlus X app to earn miles

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

What to know about United TravelBank

1. You can purchase United TravelBank credits for your account

United gives MileagePlus members the opportunity to buy deposits for their own TravelBank account. However, you can only purchase TravelBank credits in one of six amounts:

- $50.

- $100.

- $250.

- $500.

- $750.

- $1,000.

If you want to deposit a different amount, you can do so across multiple transactions. Say you want to deposit $150. Just purchase $50 in funds and then make another purchase of $100.

The only limitation is that you can't exceed $5,000 per day per MileagePlus account, meaning that you can do at least five purchases per day.

2. United TravelBank credits are valid for five years

Does United TravelBank expire? Yes. Purchased funds are valid for five years from the date the funds are deposited into your TravelBank account. That gives you plenty of time to use the funds.

That's a much longer validity than other types of airline travel credits. For instance, when purchasing airfare on United, you generally only have 12 months from the date of purchase to use those funds for a flight. So, if you really aren't sure that you'll be able to travel in the next year, you can use the United TravelBank to stash money away for future airfare purchases.

Even with the generous expiration policy, we recommend using up your full TravelBank balance whenever possible to avoid leaving money on the table.

3. You can get United TravelBank credits by holding an IHG card

One of the unexpected ways to get United TravelBank credits is through select IHG credit cards. IHG One Rewards Premier Credit Card and IHG One Rewards Premier Business Credit Card customers can enroll to get up to $50 in TravelBank Cash each calendar year. Cardholders get one deposit of $25 in early January of each year and another $25 deposit in early July.

However, these funds work differently from purchased TravelBank funds. Instead of having five years of validity, you only have a little over six months to use these funds before they expire. The $25 deposited in early January expires on July 15 of the same calendar year, and the $25 funded in July will expire on Jan. 15 of the next year.

During the two-week crossover period, you could have up to $50 in active TravelBank funds from this IHG credit card benefit. That's probably not going to be enough to cover an entire flight, but at least it can save you some out-of-pocket cost on your next United flight.

Eligible cardholders can go to ihg.com/united to register to start receiving this new card benefit. You'll need to log into your IHG One Rewards account and then provide your United MileagePlus number and last name to complete registration. The terms and conditions note that it may take up to two weeks after registration before you receive your first $25 TravelBank deposit.

Annual fee

$99

$99

4. It’s possible to use credit card travel credits to fund your United TravelBank

United TravelBank purchases often code as travel expenses on your credit card bill. That means you can earn bonus points when using credit cards with a travel bonus category. And you might even be able to use credit card travel credits — such as the Chase Sapphire Reserve® $300 annual travel credit or other credit card incidental fee credits.

» Learn more: The best airline credit cards right now

5. You can't use United TravelBank funds for other travel purchases

A major downside of the United TravelBank is that funds can only be used to book United-operated or United Express-operated flights, plus certain subscription products.

Travelers living near an airport with a strong United presence may not mind being limited to flying United. However, if Delta Air Lines, Alaska Airlines or American Airlines offers a much cheaper airfare, you won't be able to use your United TravelBank funds to purchase those flights. If you want to go abroad on another airline, you won't be able to use these funds either, even with United's Star Alliance partners.

Likewise, United TravelBank funds can't be used for hotels or car rental purchases.

» Learn more: United vs. Delta — Which is best?

Nerdy Perspective

What's your experience flying United? Do you have status?

6. United TravelBank funds don't earn interest

Another downside of saving funds through the United TravelBank is that you won't earn interest on the saved funds. If you're hoping to grow your travel funds faster through saving, you're better off using an actual savings account to do so rather than the United TravelBank.

» Learn more: Compare savings account rates in your ZIP code

How to use United TravelBank

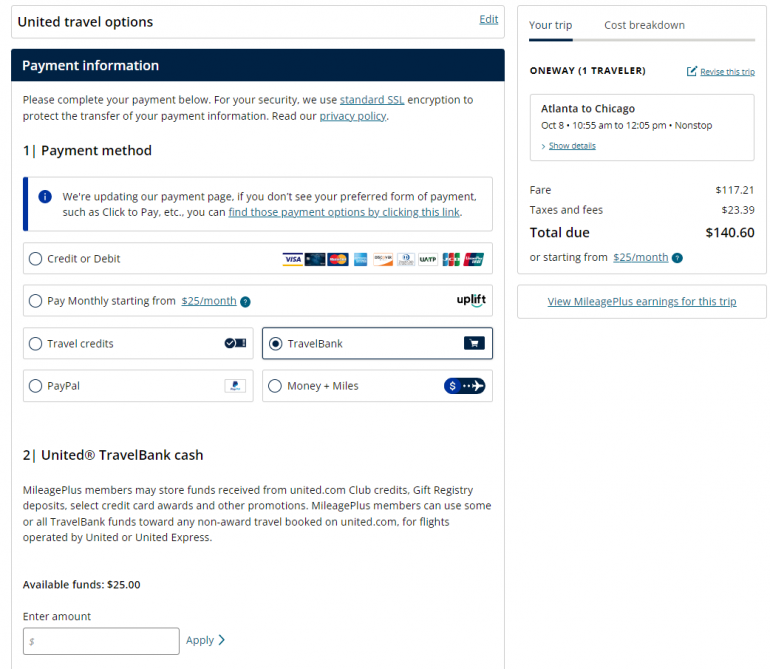

Once you’ve added money to the TravelBank account, you can select TravelBank cash as a payment option when logged into united.com or the United app.

When you're ready to use your travel funds, just log into your United MileagePlus account and search for a paid flight. On the checkout page, select the TravelBank payment option. Then, you can then enter precisely how much of your funds you want to apply to this booking.

Note that you can only use TravelBank funds for flights priced in U.S. dollars. And unfortunately, you can't use TravelBank funds to pay taxes and fees on a MileagePlus award ticket. For cash bookings, TravelBank monies can be used to cover the ticket price, taxes and surcharges.

🤓 Nerdy Tip

You can choose how much of your TravelBank funds you want to apply toward your purchase. Even if you have enough to cover everything, consider charging part of your flight booking to a credit card that provides travel insurance. TravelBank cash can be used alone or in combination with other accepted forms of payment, such as Apple Pay, Visa Checkout or PayPal. You can't combine TravelBank cash with travel certificates or future flight credits.

Is United TravelBank worth it?

The United TravelBank provides travelers with another way of stashing away funds for future travel. MileagePlus members can fund as little as $50 at a time, up to $5,000 per day. Your funds are valid for five years from the date of deposit, giving you plenty of time to use them.

However, funding the United TravelBank locks you into booking paid flights through United, decreasing the flexibility of your money. You can't even use TravelBank to pay for taxes and fees on award travel. So, you may only want to deposit funds in the TravelBank if you're sure that you will be paying for a United flight in the near future.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles