USI Affinity Travel Insurance Review: Is It Worth the Cost?

Breadth of coverage and a smooth user experience make USI a solid option for travel insurance buyers.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

at SquareMouth

USI Affinity

USI Affinity emphasizes tailoring plans and offers unique coverage for individuals versus groups.

at SquareMouth

Pros

- Can add on a Pre-existing Medical Condition Exclusion Waiver up to 21 days of the date your initial trip deposit for higher cost plans.

- <a href="https://www.nerdwallet.com/article/travel/blue-ribbon-bags">Blue Ribbon Bag</a> coverage included.

Cons

- CFAR upgrade is only available for higher-cost plans.

- Trip Delay benefits only kick in after a 12 hour delay.

USI Affinity Travel Insurance Services is one of several travel insurance companies that specialize in selling coverage for travelers planning different kinds of trips.

Let’s look at its coverage options and cost — plus other considerations to make — so you can find the right plan for you.

What is USI Affinity Travel Insurance Services?

USI Insurance Services is an insurance company founded in 1994. It provides coverage for law firms, professional liability as well as travel organizations.

USI Affinity Travel Insurance Services is a subsidiary of USI Insurance Services that focuses on providing travel insurance to groups and individuals, including long-term travelers, student travelers and visitors to the U.S.

» Learn more: What to know before buying travel insurance

USI Affinity travel insurance plans

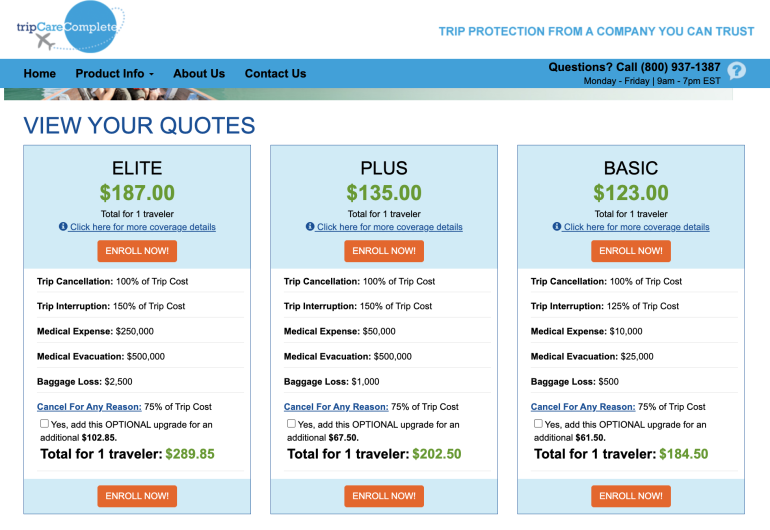

If you’re not traveling with a group or a travel organization, USI Affinity Travel recommends its Trip Care Complete insurance offerings. With it, you have three plans to choose from: Basic, Plus and Elite. Here are the coverages offered by each policy type:

- Basic: The budget quote comes with 100% trip cancellation, 125% trip interruption, $10,000 medical expenses, $25,000 medical evacuation and $500 baggage loss coverage.

- Plus: This midrange plan covers 100% trip cancellation, 150% trip interruption, $50,000 medical expenses, $500,000 medical evacuation and $1,000 baggage loss.

- Elite: The premium plan offers coverage for 100% trip cancellation, 150% trip interruption, $250,000 medical expenses, $500,000 medical evacuation and $2,500 baggage loss.

» Learn more: The best credit cards for travel insurance benefits

Costs and coverage

Let’s compare USI Affinity travel insurance plans, the costs and coverage inclusions for a 10-day trip to Sri Lanka that costs $2,500 for a 35-year-old traveler from Utah.

In our example, the traveler is on an individual trip, not a group tour.

Basic

Coverage and limits for the Basic plan from USI Affinity include:

- Trip delay: $100 per day, with a $500 maximum (kicks in after six hours).

- Trip cancellation: 100% of the trip cost (with a $10,000 limit).

- Trip interruption: 125% of the trip cost.

- Baggage delay: $100 per day (with a $100 maximum limit).

- Lost baggage: $250 per item, combined limit of $500 for valuables, $500 total limit.

- Missed connection: $500.

- Emergency medical evacuation: $25,000.

- Emergency accident and sickness medical expense: $10,000.

- Emergency dental: $500.

- Accidental death and dismemberment: $10,000 (air only).

- Repatriation of remains: $10,000.

- Rental car collision: N/A.

- Pre-existing medical conditions waiver: Must be purchased within 14 days after your initial trip payment.

The plan cost for our sample trip to Sri Lanka is $123.

Plus

Coverage and limits for the Plus plan from USI Affinity include:

- Trip delay: $250 per day, with a $750 maximum (kicks in after six hours).

- Trip cancellation: 100% of the trip cost (with a $25,000 limit).

- Trip interruption: 150% of the trip cost.

- Baggage delay: $100 per day (with a $300 maximum limit).

- Lost baggage: $250 per item, combined limit of $500 for valuables, $1,000 total limit.

- Missed connection: $750.

- Emergency medical evacuation: $500,000.

- Emergency accident and sickness medical expense: $50,000.

- Emergency dental: $750.

- Accidental death and dismemberment: $50,000 (air only).

- Repatriation of remains: $250,000.

- Rental car collision: N/A.

- Pre-existing medical conditions waiver: Must be purchased within 14 days after your initial trip payment.

This plan will set you back $135.

Elite

Coverage and limits for the Elite plan from USI Affinity include:

- Trip delay: $250 per day, with a $1,500 maximum (kicks in after six hours).

- Trip cancellation: 100% of the trip cost (with a $30,000 limit).

- Trip interruption: 150% of the trip cost.

- Baggage delay: $200 per day (with a $500 maximum limit).

- Lost baggage: $250 per item, combined limit of $500 for valuables, $2,500 total limit.

- Missed connection: $750.

- Emergency medical evacuation: $500,000.

- Emergency accident and sickness medical expense: $250,000.

- Emergency dental: $750.

- Accidental death and dismemberment: $200,000 (air only).

- Repatriation of remains: $250,000.

- Rental car collision: $5,000.

- Pre-existing medical conditions waiver: Must be purchased within 14 days after your initial trip payment.

This level of coverage will cost $187.

🤓 Nerdy Tip

Expect to get the best bang for your buck with the Plus insurance plan. For just $12 more than the Basic plan, the Plus plan provides higher coverage limits in almost every category over the Basic plan. The Elite plan does have higher emergency accident and sickness medical expense coverage limits and offers renters collision waiver, but most of the other coverage is on par with the Plus plan.

Among other pros, trip delay coverage kicks in after six hours on all plans, and trip interruption starts at 125% at the lower plan and goes up to 150% with the other two plans.

It’s also possible to upgrade the plans with the Cancel For Any Reason add-on, which will cover 75% of the trip cost.

How to get a quote from USI Affinity Travel Insurance Services

Visit the USI Affinity Travel Insurance Services homepage and answer the following questions:

- Who are you buying insurance for? Myself and/or other travelers or a group of more than five people?

- Are you traveling to study outside of your home country?

- Are you a resident of the United States or other country?

- Are you traveling within the U.S.?

- Is your trip more than 30 days?

- Are you traveling with a tour group or other organization?

Depending on your answers, USI Affinity will recommend the right type of travel insurance for you. For example, the Trip Care Complete is recommended for an individual trip, and the Travel Insurance Select is better suited for a group trip.

Annual plans are available for those living abroad who are concerned about high medical costs. For example, a WorldMed Insurance plan covers trips between five and 364 days and provides coverage for political evacuation and terrorism.

» Learn more: Trip cancellation insurance explained

Once the software finds the best type of plan, you’ll be redirected to a page where you can request a quote. Fill out the form with your travel details, including:

- What organization you’re traveling with.

- Your state of residence.

- Destination country.

- Travel dates.

- Initial deposit and final payment dates.

- Dates of birth for travelers.

- Trip cost.

The follow-up questions may vary based on your previous answers. Once you fill out the form, click on the “Submit for quote” button and compare the quotes.

» Learn more: Does travel insurance cover award flights?

Is USI Affinity Travel Insurance Services worth it?

Trip insurance is a personal decision, and USI Affinity Travel Insurance Services can help you make it with its array of coverage for all kinds of travelers.

Medical coverage, trip protection and Cancel For Any Reason add-ons — USI Affinity has options, and its intuitive software makes it easy to find the right plan for you, which makes it worth exploring.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles