5 Reasons Transferable Points Are Worth More

Prioritize transferable points for maximum flexibility, value and lasting benefits.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The best travel rewards are the ones that get you where you want to go, and some do a better job of that than others. Airline miles can help you book free flights and hotel points can help you book free rooms, but transferable points (like Chase Ultimate Rewards® and AmEx Membership Rewards) can do both — and more.

Here are six reasons why transferable points are at the apex of travel rewards, and why you should prioritize earning them over other types of points and miles.

1. Transferable points provide flexibility

One simple way to illustrate the value of transferable points is with a thought experiment.

Suppose you’re in the market for a new travel credit card and you’ve narrowed your decision to two choices: the first card earns points that can be redeemed with your favorite airline, while the second card earns points that can be redeemed not only with your favorite airline, but also with your favorite hotel chain. The cards are functionally identical otherwise. Which do you choose?

The second card is the obvious answer. The option to redeem with both airline and hotel partners makes the rewards you earn from it more useful, since they can meet a broader range of award travel needs. In short, the rewards earned by the second card are more valuable because they’re more flexible.

Transferable points programs expand on that premise by partnering with a variety of airline and hotel loyalty programs, giving you a diverse range of redemption options instead of just one.

Flexibility isn’t the only ingredient needed to add value, since making points transferable doesn’t necessarily mean transferring them is worthwhile. For example, you can transfer Hilton Honors points to more than two dozen airline partners, but in most cases the transfer ratio is a dismal 10:1 (i.e., 10,000 Hilton points becomes 1,000 airline miles).

That provides marginal value because it’s only useful in marginal situations, like if you urgently need a small number of miles to book a highly valuable award flight. While Hilton Honors points are technically “transferable,” their transferability doesn’t add much.

In contrast, the major transferable points programs generally offer neutral or favorable transfer ratios, as well as transfers that process quickly (or in many cases, instantly). That kind of flexibility adds more clear and consistent value.

» Learn more: Tips for collecting AmEx Membership Rewards

2. Transferable points have greater upside

Suppose you’re booking a long weekend trip from Denver to San Francisco in the spring. You’ll be attending a wedding at the Hyatt Regency San Francisco and plan to pay out of pocket for your room there, but you have 60,000 United Airlines MileagePlus miles you can use to book your flight.

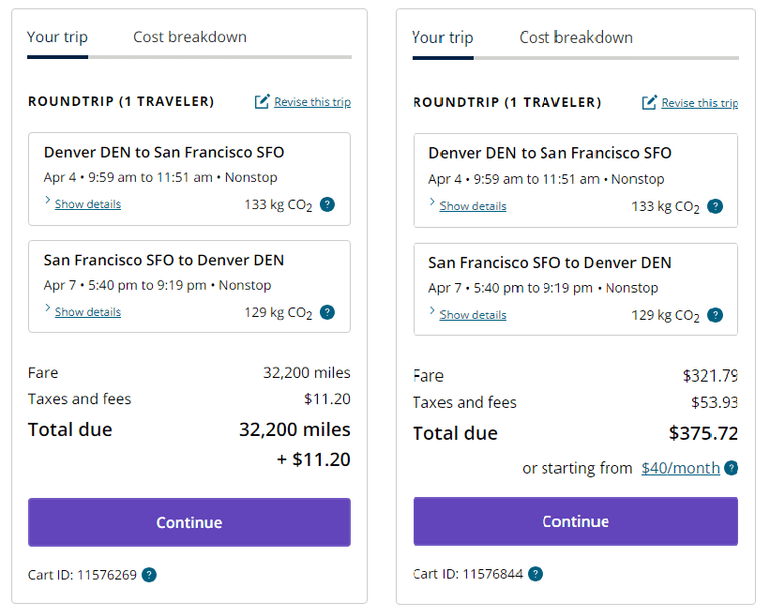

You want to arrive Thursday morning and return Sunday evening, so you search United's website and find an itinerary that suits your needs for 32,200 miles and $11.20 in fees. You compare that with the cash price of $375.72 and calculate a redemption value of 1.13 cents per mile. That’s quite close to NerdWallet’s valuation of 1.2 cents per mile, so you’re satisfied.

Now imagine that instead of United miles, you have a reserve of 60,000 Chase Ultimate Rewards points. Instead of being able to redeem them solely for United flights, you can transfer those points to 11 airlines and three hotels based on which one suits your needs and offers the best value.

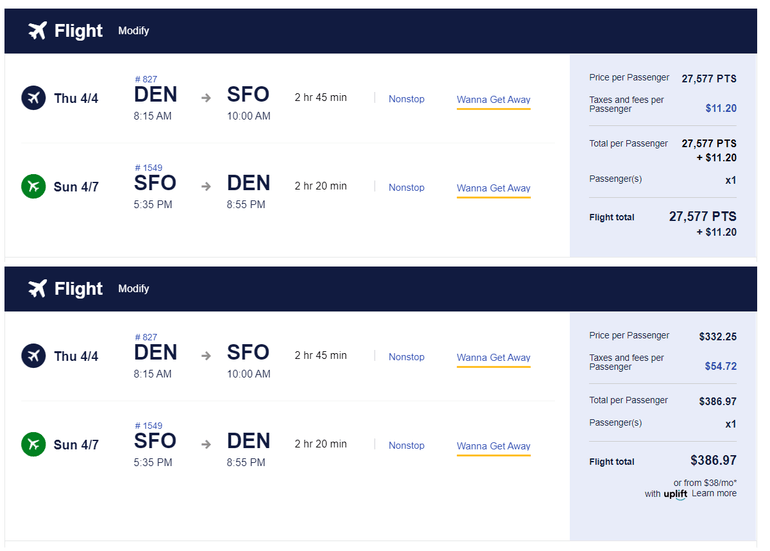

For example, instead of booking with United, you could transfer points to Southwest Airlines and book a comparable (though not identical) itinerary for 27,577 points and $11.20 in fees, versus a cash price of $386.97.

Assuming you’re not bothered by the earlier outbound departure and you don’t have a strong preference for one airline, the ability to choose between them saves you about 4,600 points on your flight.

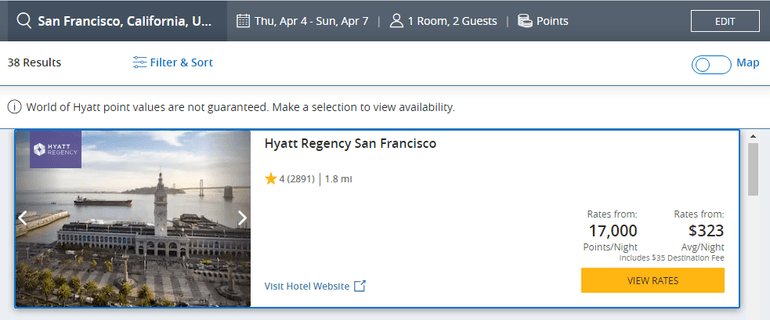

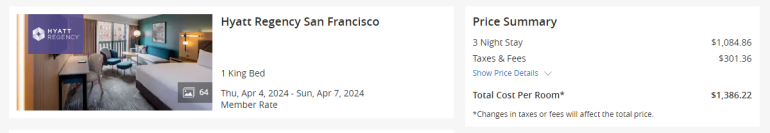

Alternatively, you could transfer points to Hyatt to book your stay at the Hyatt Regency San Francisco. The award cost is 17,000 points per night, totaling 51,000 points for your three-night visit.

Cash rates start at $323 per night, but the cheapest rates require advance purchase and are nonrefundable, while booking with points generally allows you to cancel with no penalty until two days before arrival.

A cash rate with a comparable cancellation policy totals $1,386.22 after taxes and fees, which yields a redemption value of over 2.7 cents per point (more than double what you’d get by redeeming for the United flights above).

This is just one example about a set itinerary, but it illustrates how the versatility of transferable points provides an upside when you’re not locked into specific travel providers.

Having more redemption options yields more opportunities to use points efficiently, which in turn raises the expected value of each redemption.

» Learn more: The best Chase transfer partners — and ones to avoid

3. Transferable points have more favorable expiration policies

Many loyalty programs have expiration policies that can cause your rewards to vanish over time. While you’ll generally have 12 to 36 months to keep rewards active, some points and miles expire in as little as six months.

It’s easy to let rewards lapse and disappear in that timeframe if you’re not a frequent traveler and you don’t monitor your loyalty accounts vigilantly.

In contrast, transferable points generally don’t expire as long as your account remains open and in good standing. That means you won’t have to keep track of when you last logged activity in each loyalty program or take action to keep dormant rewards from expiring.

4. Transferable points offer lucrative transfer bonuses

Most transfers to airline and hotel partners are done at a 1:1 ratio, so transferring typically gets you the same number of rewards you put in.

For example, transferring 1,000 Chase Ultimate Rewards® points to United Airlines gets you 1,000 United miles, or transferring 1,000 Citi ThankYou Rewards points to Wyndham Hotels gets you 1,000 Wyndham points. While exchange rates vary depending on the loyalty program and credit card you’re using, a 1:1 transfer ratio is the industry standard.

However, transferable points programs offer occasional transfer bonuses that boost the exchange rate, commonly by 20%-50%. Instead of the usual 1:1, every 1,000 points you transfer with a bonus could get you 1,200 to 1,500 points with the partner program (or in some cases, more).

These higher exchange rates can save you points when a transfer bonus aligns with your travel plans, since booking the trip you want requires fewer transferable points than it would normally.

Transfer bonuses also create opportunities to top up your loyalty account balances by sending points to the programs you use most (even if you don’t have immediate plans to redeem them).

» Learn more: Best Citi ThankYou point redemptions

5. Transferable points reduce the risk of devaluation

Loyalty programs change over time, and while they sometimes add features, lower award prices or introduce new redemption options that make rewards more valuable, the opposite is more common.

Devaluations are a regular occurrence among airline and hotel programs and sometimes take place with no warning. When your points or miles are suddenly in decline, you have little recourse.

Transferable points programs aren’t immune from devaluations; they add, remove and modify features just like airline and hotel programs.

However, transferable points are insulated from devaluation by the sheer number of available redemption options — when a single airline or hotel program devalues, other transfer partners are unaffected, so transferable points retain the bulk of their worth.

In short, earning transferable points is the award travel equivalent of diversifying investments: By having a share of many loyalty programs, you’re less affected by a downturn in one of them.

» Learn more: What to know before you start earning Capital One miles

Why you should be using transferable points

Among travel rewards, transferable points have the best chance to provide useful redemption options, yield a high return and retain their value over time.

That’s why they’re broadly prized above rewards from individual airline and hotel programs, and why earning them should be the focus of your award travel strategy.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles