WorldTrips Travel Insurance Review: Is it Worth The Cost?

WorldTrips offers single-trip policies for U.S. travelers and international students but lacks annual plan options.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

WorldTrips Travel Insurance

WorldTrips offers comprehensive plans with benefits like award redeposit fee coverage.

Pros

- Available to U.S. and non-U.S. residents, including international students.

- All travel protection plans include a pre-existing conditions waiver.

- Cancel For Any Reason add-ons are available on most plans.

Cons

- Rental car coverage isn’t automatically included with any plan.

- Baggage delay coverage takes 12 hours to kick in.

Since 1998, WorldTrips has provided medical insurance and trip protection to travelers from the U.S. and around the world in addition to coverage for international students. The company also provides coverage for various tour groups, missionary work and student exchange programs. The insurance policies are underwritten by Tokio Marine HCC, a Houston-based insurance company.

Whether you’re a U.S. resident looking for comprehensive travel insurance plans or a student looking for a medical-only policy, WorldTrips insurance has coverage options.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

What kind of plans does WorldTrips provide?

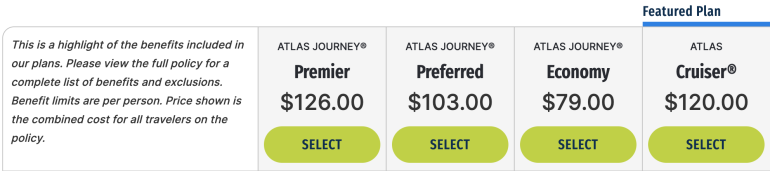

If you’re a U.S. resident, WorldTrips offers four single-trip comprehensive travel insurance plans: Atlas Cruiser, Atlas Journey Economy, Atlas Journey Preferred and Atlas Journey Premier. Here's a quick overview of the coverage offered by each plan.

- Atlas Cruiser: This plan comes with 100% trip cancellation, 100% trip interruption, $25,000 medical expenses, $100,000 medical evacuation and $1,500 baggage loss coverage (up to $500 per item). This plan also offers optional Cancel For Any Reason coverage for up to 75% of the total trip cost (as long as you purchase it within 21 days of your initial trip payment and more than 48 hours before your trip begins).

- Atlas Journey Economy: This budget plan covers 100% trip cancellation, 100% trip interruption, $10,000 medical expenses, $250,000 medical evacuation and $1,000 baggage loss (up to $250 per item).

- Atlas Journey Preferred: This mid-range plan offers coverage for 100% trip cancellation, 150% trip interruption, $100,000 medical expenses, $1 million medical evacuation and $1,500 baggage loss (up to $500 per item). You can add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

- Atlas Journey Premier: The priciest plan also provides the most coverage, including 100% trip cancellation, 150% trip interruption, $150,000 medical expenses (primary coverage), $1 million medical evacuation and $2,000 baggage loss (up to $500 per item). You have the option to add Cancel For Any Reason coverage for 50% or 75% of the total trip cost.

Non-U.S. residents and international students have access to medical-only policies. Annual plans aren’t available for U.S. residents.

» Learn more: The best travel insurance companies

WorldTrips travel insurance cost and coverage

WorldTrips offers several comprehensive single-trip plans that include basic trip protections and medical coverage. The cost varies based on coverage limits.

| Coverage | Atlas Cruiser | Atlas Journey Economy | Atlas Journey Preferred | Atlas Journey Premier |

|---|---|---|---|---|

| Trip delay | $150 per day, with a $750 maximum (kicks in after five hours). | $100 per day, with a $500 maximum (kicks in after five hours). | $150 per day, with a $2,000 maximum (kicks in after five hours). | $200 per day, with a $2,000 maximum (kicks in after five hours). |

| Trip cancellation | 100% of the trip cost (with a $25,000 limit). | 100% of the trip cost (with a $10,000 limit). | 100% of the trip cost (with a $150,000 limit). | 100% of the trip cost (with a $150,000 limit). |

| Trip interruption | 100% of the trip cost. | 100% of the trip cost. | 150% of the trip cost. | 150% of the trip cost. |

| Baggage delay | $750 (kicks in after 12 hours). | $200 (kicks in after 12 hours). | $300 (kicks in after 12 hours). | $500 (kicks in after 12 hours). |

| Lost baggage | $500 per item, $1,500 total limit. | $250 per item, $1,000 total limit. | $500 per item, $1,500 total limit. | $500 per item, $2,000 total limit. |

| Missed connection | $500. | $500. | $1,500. | $2,000. |

| Emergency medical transportation | $100,000. | $250,000. | $1,000,000. | $1,000,000. |

| Emergency medical | $25,000 (secondary coverage). | $10,000 (secondary coverage). | $100,000 (secondary coverage but with option to upgrade to primary coverage). | $150,000 (primary coverage). |

| Accidental death and dismemberment | $10,000. | $10,000. | $20,000. | $25,000. |

| Pre-existing medical conditions waiver | Must be purchased within 14 days of your initial trip payment. | Must be purchased within 21 days of your initial trip payment. | Must be purchased within 21 days of your initial trip payment. | Must be purchased within 21 days of your initial trip payment. |

WorldTrips single-trip plan cost

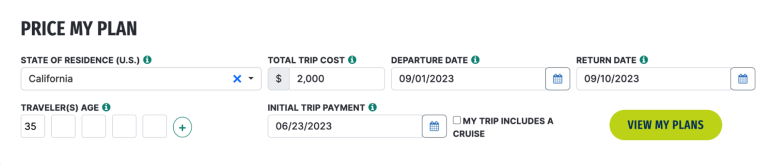

Here's a comparison of the cost of WorldTrips insurance plans for a 10-day trip that costs $2,000 for a 35-year-old traveler from California. In our example, the destination isn’t specified, and the trip doesn’t include a cruise.

The Atlas Journey Premier plan comes in at $126, the most expensive option. The Atlas Cruiser plan has a similar cost of $120. The Preferred and Economy plans, which cost $103 and $79, respectively, are a bit cheaper, but come with lower coverage limits.

» Learn more: What to know before buying travel insurance

Which WorldTrips travel insurance plan is for me?

The kind of coverage you’re seeking for your upcoming travels is going to affect your plan selection. Here are a few situations which might influence your decision:

- If you’ve made nonrefundable deposits for your trip: If you’re going on a safari to Kenya or on a cruise to Antarctica and you’ve prepaid nonrefundable expenses, you probably want to go with plans that offer more coverage, such as Atlas Journey Preferred or Atlas Journey Premier.

- If you need to add on Cancel for Any Reason coverage: For single-trip insurance plans, go with either Atlas Cruiser, Atlas Journey Preferred or Atlas Journey Premier because they offer this optional upgrade.

- If travel insurance is mandatory and you hold a premium travel rewards credit card: If a tour operator requires you purchase travel insurance but you hold a credit card that already provides some trip protections, you can probably get away with the least expensive Atlas Journey Economy policy.

» Learn more: What does travel insurance cover?

How to get a quote from WorldTrips

To get an online quote, go to the WorldTrips home page and select whether you’re a U.S. resident, a non-U.S. resident or an international student. If you’re a U.S. resident, click on that box, then fill out the form to price your plan.

Make sure to provide your state of residence, total trip cost, departure and return dates, traveler’s age and initial trip payment date. If you’re going on a cruise, be sure to check the box. Once the form is complete, select “View my plans” and compare the plan types.

What isn’t covered by WorldTrips insurance?

As with any travel insurance policy, there are some exclusions to coverage. Here’s a sampling of things WorldTrips doesn’t cover:

- Intentional self-inflicted injuries, including suicide.

- War, invasion or acts of foreign enemies.

- Speed or endurance competitions as well as athletic stunts.

- Piloting or learning how to pilot an aircraft.

- Being engaged in illegal activities.

- Medical tourism.

- Traveling against a physician’s advice.

- Operating a motor vehicle without a license.

» Learn more: How much is travel insurance in 2023?

Is WorldTrips travel insurance worth it?

WorldTrips insurance offers multiple plans for U.S. travelers looking for trip insurance and medical coverage abroad as well as non-U.S. travelers and students looking for medical coverage in case of an unexpected injury or illness.

If you travel once or twice per year, WorldTrips offers several comprehensive single-trip policy options that are worth checking out. However, if you need an annual plan, you'll want to look elsewhere.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles