The Complete Guide to the Choice Privileges Rewards Program

Here's what you need to know about earning and redeeming points in the Choice Hotels' loyalty program.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

With more than 7,400 hotels covering 22 brands, Choice Hotels and its Choice Privileges loyalty program can offer a lot of value for the frequent traveler.

After joining the free Choice Privileges program, members earn hotel points when staying at any of the brands within the portfolio. These include everything from affordable city hotels to all-inclusive resorts in the Caribbean.

These are the things you can do with Choice points:

- Use Choice points for hotel redemption stays.

- Transfer other hotel program points into your Choice Privileges account.

- Transfer Choice Privileges points to airline frequent flyer accounts.

- Use Choice points to redeem for other people’s travel.

- Use Choice points to redeem for gift cards, cruises and other benefits.

🤓 Nerdy Tip

NerdWallet values Choice Hotels points at 0.8 cent each based on real-world data, not necessarily their maximized value. Since many Choice Privileges brands are part of the midscale and economy segments, you have to be familiar with how to maximize points on unique redemptions like those with luxury hotels from other brands to get the best value. Another feature to maximize your points is the RewardSaver program, which allows travelers to redeem points at a cheaper price point (as few as 6,000 points per night) on certain dates.

» Learn more: Your guide to Choice Privileges hotel brands

On this page

Choice Privileges elite tiers

Elite status can deliver perks during your stay like preferred parking, room upgrades and welcome gifts, depending on your status tier.

Here are Choice’s tiers:

Gold

How to earn: Previously 10 nights needed; in 2026, the requirement changes to 5 nights, or 10,000 elite qualifying credits or EQCs, earned via hotel stays or spending on Choice Privileges co-branded credit cards.

What you get: Benefits include a 10% points bonus, space-available room upgrades and a welcome bonus.

Platinum

How to earn: Previously 20 nights needed; in 2026, 15 nights, or 30,000 EQCs needed.

What you get: Benefits include a 25% points bonus plus Gold tier perks.

Diamond

How to earn: Previously 40 nights needed; in 2026, 35 nights, or 70,000 EQCs needed.

What you get: Benefits include a 50% points bonus plus Gold tier perks.

Titanium (a new tier launching early 2026)

How to earn: 55 nights or 110,000 EQCs.

What you get: Benefits include Diamond tier perks plus a half-off award redemption.

What’s changing in 2026

Recently announced changes include many positive moves that can help members earn elite status faster and enjoy more benefits on future stays. Here is what has changed.

Faster elite status

Choice Privileges elite status will be easier to earn starting in 2026, since the program has lowered the number of elite status-qualifying nights required. It has also added a new way to achieve status: Elite Qualifying Credits or EQCs (earned via hotel stays or spending on Choice Privileges co-branded credit cards).

Members will earn 10 EQCs per dollar spent during eligible stays as well as an additional bonus 10 EQCs per dollar spent when using a Choice co-branded credit card. On other purchases, cardholders earn 1 EQC per dollar spent unless spending on certain multiplier categories (like grocery stores), which can earn a bonus of as much as 3 EQCs per dollar spent.

Traveler-friendly policy changes

For Choice Privileges elite status members, points will never expire, which gives you more flexibility on when you want to redeem them. Normally, Choice points expire after 18 months of inactivity.

Choice is also introducing a “soft landing” program in 2027. This means that no matter how many nights you stayed in a given year, your status tier will only drop by one level from the year before. That’s useful if your travel gets disrupted due to changes in your job or daily life.

New points and perks for frequent stays

Part of the program overhaul includes Milestone perks that arrive after every 5 qualifying nights. These are designed to incentivize additional business in between attaining the next tier status level. Rewards include bonus points and gift cards.

And for every second and third stay in the calendar year, Choice Privileges will offer 1,000 bonus points as a gift while working your way up the status ladder.

Titanium status is the program’s new top tier that offers an especially exciting perk. After reaching Titanium, members receive a 50% discount on one redemption room at more than 400 hotels for at least 7 nights. This represents excellent value, especially at higher-tier hotels like Radisson Blu and Cambria Hotels or vacation rentals via Bluegreen Vacations.

Transfer points to Choice Privileges

Several credit card programs offer points transfer opportunities into Choice Privileges. We recommend this only if you are short on a Choice redemption and really need the points.

You could find a better use of your transferable points than using them for a hotel stay (unless you're redeeming for a particularly expensive redemption). Otherwise, it is better to redeem credit card points for higher-value things like moving them to an airline program for a business class ticket or paying in points outright for the cost of a flight. If you still want more Choice points, the following credit card programs transfer points to Choice Privileges.

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

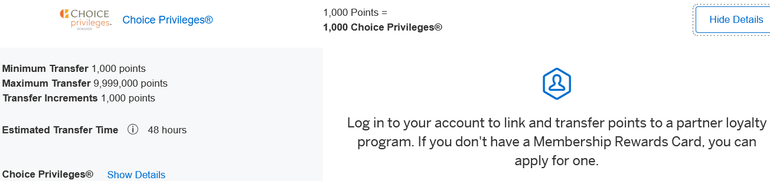

American Express Membership Rewards

The American Express Membership Rewards program offers numerous paths to points earnings, from AmEx Offers to bonus points by booking travel through the American Express Travel platform.

AmEx cardholders who earn Membership Rewards points can convert 1,000 AmEx points into 1,000 Choice Privileges points.

To transfer points from AmEx Membership Rewards to Choice Privileges, log in to your Membership Rewards account and go to the “Rewards & Benefits” tab on the menu.

Select "Transfer Points to a Loyalty Program," choose the Choice Privileges program and then enter your Choice details.

Is it worth it to transfer AmEx points to Choice? Only if you can maximize the value from your Choice points. NerdWallet values Membership Rewards points at 1.6 cents apiece, while NerdWallet found that Choice points are worth a median of 0.8 cent each.

Moving points to Choice generally represents a reduction in value unless you can score a transfer bonus.

» Learn more: The best hotel credit cards right now

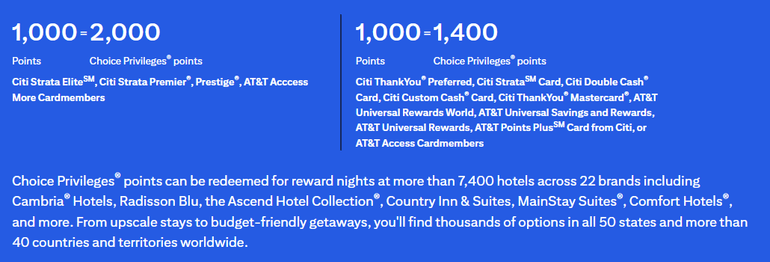

Citi ThankYou points

Citi ThankYou points transfer to Choice at a 1:1.5 or 1:2 ratio, depending on the card you're using. To transfer points, go to the “Partner Programs Listing” on the ThankYou redemption page. If you have a Citi card with an annual fee, like the Citi Strata Premier® Card, you can get more value than with one of the more basic cards.

NerdWallet values Citi ThankYou points at between 1 cent and 1.3 cents each, which means that transferring from Citi ThankYou to Choice Privileges is not always a great idea unless you have a lot of points in your account.

Capital One miles

Capital One miles convert to Choice Privileges with a 1:1 transfer ratio as long as you have a U.S.-based Choice account. This is because NerdWallet values Capital One miles at 1 cent to 1.6 cents each and Choice Privileges at 0.8 cent each. It’s not the best deal, but if you need the Choice points, it could make sense.

Transfer miles by signing into your account and choosing the card from which you will be transferring miles. Select "View Rewards," and choose Choice Privileges to make the transfer.

Wells Fargo Rewards

Move Wells Fargo Rewards points to Choice Privileges at a 1:2 ratio. This is another so-so swap because NerdWallet generally values Wells Fargo Rewards at 1 cent. Sure, you’re getting more Choice points than what you transfer from Wells Fargo, but they are still worth less.

The Wells Fargo Rewards card also awards Choice Privileges points directly, which is a better method to rack up Choice points than transferring them from a credit card where they hold more value. Two cards are available for fans of the Choice program: the Choice Privileges® Mastercard® and the Choice Privileges® Select Mastercard®.

How the cards compare

Annual Fee

Choice Privileges® Select Mastercard®

$95.

Choice Privileges® Mastercard®

$0.

Sign-Up Bonus

Choice Privileges® Select Mastercard®

Earn 60,000 bonus points when you spend $3,000 in purchases in the first 3 months - enough to redeem for up to 7 reward nights at select Choice Hotels® properties. Additional fees may apply.

Choice Privileges® Mastercard®

Earn 40,000 bonus points when you spend $1,000 in purchases in the first 3 months - enough to redeem for up to 5 reward nights at select Choice Hotels® properties. Additional fees may apply.

» Learn more: The best hotel credit cards right now

Frequent flyer programs and other travel partners

There are several frequent flyer programs that allow you to convert Choice Privileges points into airline miles. They include:

- Aer Lingus: 5,000 Choice Privileges points = 1,000 Avios.

- Aeromexico: 5,000 Choice Privileges points = 1,000 Aeromexico Rewards.

- Aeroplan: 5,000 Choice Privileges points = 1,000 Aeroplan miles.

- Air France-KLM Flying Blue: 5,000 Choice Privileges points = 1,000 Flying Blue miles.

- Alaska Airlines and Hawaiian Airlines: 5,000 Choice Privileges points = 1,000 Atmos points.

- Avianca: 5,000 Choice Privileges points = 1,000 LifeMiles.

- The British Airways Club: 5,000 Choice Privileges points = 1,000 Avios points.

- Club Iberia: 5,000 Choice Privileges points = 1,000 Avios points.

- LATAM: 5,000 Choice Privileges points = 1,000 LATAM Pass miles.

- Qantas: 2,000 Choice Privileges points = 800 Qantas Frequent Flyer points.

- Saudia Al Fursan: 5,000 Choice Privileges points = 1,000 AlFursan miles.

- Southwest Airlines: 6,000 Choice Privileges points = 1,800 Rapid Rewards points.

- Turkish Airlines: 5,000 Choice Privileges points = 1,000 Miles&Smiles miles.

- United Airlines: 5,000 Choice Privileges points = 1,000 MileagePlus miles.

- Virgin Australia: 2,000 Choice Privileges points = 800 Velocity Frequent Flyer points.

If you are hoping to move points from Choice Privileges to airline frequent flyer programs, you won’t get very much value unless you can score one of the Air France-KLM Flying Blue Promo Rewards, like 18,750 miles for a one-way economy class ticket from cities such as New York or Chicago to Europe.

Visit the Rewards Exchange section of Choice Privileges’ website to select your preferred partner and move points to miles. You can only transfer points to your own account, and it can take 72 hours to transfer points to miles.

Transfer Choice Privileges to family and friends

Currently, you cannot move Choice points to family and friends although you can book an award stay under their name using your points. Later in 2026, this will change so that members can share points with friends and family.

Other Choice Privileges transfer partners

If you want to use Choice points for other redemptions, whether they are travel-related or for everyday things, there are options. Here’s how to extract value from Choice Privileges.

Cruises

While you cannot transfer points directly to a cruise loyalty program, you can use them to pay for a part of your next cruise vacation via Choice Privileges Cruises. For 85,000 points, you can receive a $250 cruise credit; 160,000 points equals a $500 cruise credit.

This represents poor value because, according to our calculations, Choice points are worth 0.8 cent apiece (85,000 points would yield $680 in value for a hotel stay, far more than $250 for a cruise credit).

Gifts

You can redeem Choice Privileges points for magazine subscriptions or gift cards, but this is another example of not getting top-notch value from your points. To see the restaurants, retailers or magazine titles available, log into your Choice Privileges account and go to the “Redeem” section.

VIP experiences

You can bid Choice points on special VIP auctions for exclusive access to events and experiences. These include concerts and sporting events, some with behind-the-scenes access or extra perks that are hard to buy on your own. While the bids may be high, this is a great example of using your points for something that you really want that may otherwise be out of your price range.

Nonprofit donations

You can move points from Choice to many charities.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

More like this

Related articles