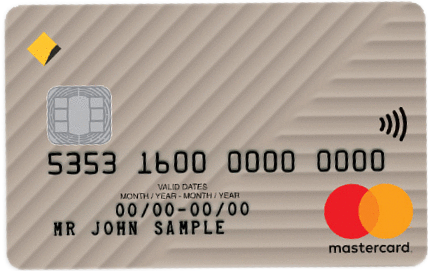

The Commonwealth Bank of Australia (also known as CommBank) is one of Australia’s Big Four banks and offers six personal credit cards. This low-fee option has the smallest monthly cost out of the bunch if the minimum spend is not met.

The CommBank Low Fee credit card does not earn reward points, but cardholders can access cashback offers through the CommBank Yello Cashback Offers program.

Fees, interest rates and other details

Toggle product details

| Feature | CommBank Low Fee credit card |

|---|---|

| Monthly fee | $3 ($0 if you spend at least $300 per statement period). |

| Purchase rate | 20.99% per annum. |

| Cash advance rate | 21.99% per annum. |

| Cash advance fee | $4 or 3% of the transaction, whichever is higher. |

| Balance transfers | Balance transfers are not offered on CommBank credit cards as of December 1, 2023. |

| Cash advance fee | $4 or 3% of the transaction, whichever is higher. |

| International transaction fee | 3.5% of the transaction. |

| Late payment fee | $20. |

| Minimum credit limit | $500. |

| Interest-free days on purchases | Up to 55 days interest-free (excluding cash advances). |

| Additional cardholders | Free (up to one, and applicants must be at least 16 years old). |

| Card network | Mastercard. |

| Intro offer | For existing Commbank Yello customers, get up to $300 cashback in the first six months ($50 per month when you spend at least $500 per billing cycle). Additional terms and conditions apply. |

| Cashback program | Access to the CommBank Yello Cashback Offers program Cardholders must activate the offers through the CommBank mobile app and redeem it with their CommBank mastercard. |

| Insurance | Purchase protection and extended warranty coverage. Additional terms and conditions apply. |

Basic overview

The CommBank Low Fee credit card doesn’t charge a monthly fee if you spend at least $300 in a statement period. Otherwise, a $3 monthly fee (equal to a $36 annual fee) applies.

Whilst the Low Fee Credit Card does not earn reward points, cardholders may be eligible for cashback perks through the CommBank Yello Cashback Offers program. They can also access offers from Priceless.com — a discount platform for Mastercard customers.

Understanding the monthly fee

To avoid paying the monthly fee, you’d need to spend at least $300 each statement period.

Alternatively, you can cover the fee by using the CommBank Yello Cashback Offers program to earn cashback. The amount of cashback you get depends on the offer. Avoid buying items you may not need just to earn the cash back. Any cashback earned is deposited into your account within 14 days.

Offers and rewards

Existing CommBank Yello customers can get up to $300 in cashback when they spend at least $500 per month within the first six months of card ownership (during which they can earn $50 each month).

The above offer was current at the time of writing and is subject to change.

The CommBank Low Fee credit card doesn’t earn points or cashback directly. However, eligible cardholders can earn cashback via the CommBank Yello Cashback Offers program, which is available through the CommBank app.

Activate the offers you want, and then use your CommBank Low Fee card to shop.

Any cashback you earn from a CommBank Yello Offer will typically be deposited into your account automatically within 14 days of the purchase.

Eligibility

Who may be eligible?

To apply for the CommBank Low Fee credit card, you must:

- be at least 18 years old

- be legally allowed to work in Australia

- not be currently in bankruptcy.

Who might be suited to this card?

According to CommBank’s Target Market Determination (TMD)[1], the CommBank Low Fee credit card is suited for customers who:

- meet CBA’s credit assessment criteria, which includes demonstrating the capacity to service the credit facility without substantial hardship;

- choose a credit limit typically above $500; and

- will pay a higher interest rate.

Who might not be suited to this card?

CommBank’s TMD also states that this product is not suited for customers who:

- require a card with a lower interest rate on purchases; and/or

- are likely to carry a substantial balance over a prolonged period of time (unless a promotional rate and/or grace period applies).

How to submit an application

If you already bank with CommBank, you can apply for the CommBank Low Fee credit card online by using your NetBank details. If you are new to the bank, you must apply through the CommBank app (available on the Google Play Store and the Apple App Store).

Click on ‘Sign up to CommBank’, select the CommBank Low Rate Credit Card and follow the prompts.

CommBank will also ask you to provide your personal contact information, complete their identification process, and set a credit limit.

» MORE: How to activate your new credit card

Customer satisfaction ratings

Note: Customer review websites can be insightful, but keep in mind that the reviews may not accurately reflect the average experience; for example, unhappy customers may be overrepresented in these reviews. Products also change over time, and reviews may reflect experiences with features and benefits that are no longer available. Nevertheless, these sites are one way to learn more about the company and the products on offer before you make a decision.

As of this writing:

- Based on over 200 Trustpilot reviews, CommBank scored: 1.9 out of 5 stars.

- Based on over 49 Product Review ratings, the Commonwealth Bank Low Fee credit card scored: 3.7 out of 5 stars.

NerdWallet does not endorse the above scores or reviews and provides them for illustrative purposes only.

Frequently asked questions

The CommBank Low Fee credit card is free if you spend at least $300 monthly. Otherwise, a $3 monthly fee applies. Don’t forget, there are also other fees and charges that you may need to pay.

The CommBank Low Fee credit card is available to applicants over 18 who are legally allowed to work in Australia and are not currently in bankruptcy. Other criteria will also apply.

Article Sources

-

CommBank, “Target Market Determination: Low Fee Credit Card,” accessed February 4, 2025.

DIVE EVEN DEEPER

What Is A No-Annual-Fee Credit Card?

A no-annual-fee credit card doesn’t charge a yearly usage fee. Managing repayments is key to unlocking its long-term value.

Credit Card Fees: What They Are And How To Avoid Them

Credit card fees can vary among providers. Find which charges are inescapable and which ones you can avoid.

Pros and cons of using credit cards

Whether shopping in-store or online, know the pros and cons of using credit cards to benefit from fraud protection and other perks.

How Do Credit Card Interest Rates Work?

Everything you need to know about credit cards to use them responsibly.