2026 Home Buyer Report – 48% of Prospective Buyers Will Use AI

Around 1 in 7 Americans hope to buy a home soon and many plan to use AI in the process, NerdWallet’s annual home buyer survey finds.

Some or all of the mortgage lenders featured on our site are advertising partners of NerdWallet, but this does not influence our evaluations, lender star ratings or the order in which lenders are listed on the page. Our opinions are our own. Here is a list of our partners.

Note: You have reached the most recent version of this annual NerdWallet report. Previous years’ reports are available at the bottom of this page.

The last few years in the housing market saw rising prices and interest rates, low inventory and bidding wars to boot. But there may be some much needed breathing room for homebuying hopefuls on the horizon. NerdWallet’s most recent analysis of first-time home buyer data shows promise: List prices fell slightly and inventory rose nationwide in the third quarter of 2025.

This doesn’t necessarily mean it’s the ideal time to buy: Fannie Mae and the Mortgage Bankers Association aren’t expecting big interest rate drops in 2026, and home prices are well above where they were just a few short years ago. NerdWallet’s mortgage and loan expert, Kate Wood, predicts that interest rates will remain pretty stable and home prices may soften, but higher property taxes and insurance costs could complicate affordability.

Still, we often make financial moves when we feel we’re ready for them and many Americans think this will be their year to take the leap into homeownership (or at least, into a new home).

Around 1 in 7 Americans (15%) say they plan to purchase a home in the next 12 months, according to NerdWallet’s annual homebuying survey, conducted online by The Harris Poll in November 2025. This survey of more than 2,000 U.S. adults found that the younger generations — Gen Z (ages 18-28) and millennials (ages 29-44) — are more likely to plan on purchasing a home in the next 12 months than their older counterparts, Gen X (ages 45-60) and baby boomers (ages 61-79): 22% and 21%, vs. 13% and 6%, respectively.

Key findings

Fewer than 3 in 10 Americans who had plans to purchase a home as of Jan. 1, 2025 (29%) say they bought or are in the process of buying a home, according to the survey. The top reasons would-be 2025 buyers postponed or cancelled their plans were not being able to afford the homes available or not finding an available home that met their needs (both 18%).

Just 37% of Americans know that a 20% down payment isn’t required to buy a home. According to the National Association of Realtors, the median for first-time buyers is just half that, at 10% down.

A third of homeowners (34%) consider themselves house poor. And more than 3 in 5 homeowners (62%) say owning a home has been much more expensive than they thought it would be.

About half of Americans who plan to buy a home in the next 12 months (48%) say they’ll use AI tools during the homebuying process, for things like estimating housing costs (27%) or guiding them in the homebuying process (26%).

“Affordability isn't just a challenge for home buyers — it's also a hurdle for homeowners,” says Kate Wood, a NerdWallet home and mortgage expert. “Rising home values also raise property taxes, and the frequency of intense weather and natural disasters has pushed up homeowners insurance premiums. It's vital to look at how much it's going to cost to own the home, not just to buy it.”

Less than a third of would-be 2025 buyers bought a home

New year’s plans don’t always work out: Of Americans who say they had plans on Jan. 1, 2025 to purchase a home during the year, just 29% of them ended up buying a home or were in the process of buying a home when this survey was fielded in Nov. 2025.

The remaining 71% postponed or cancelled their plans, or otherwise didn’t successfully make a home purchase. Some of the top reasons why include not being able to afford the homes that were available or not finding an available home that met their needs (both 18%).

Sixteen percent of 2025 hopeful buyers say they postponed or cancelled their homebuying plans because they think it will be easier to buy a home in 2026. But it’s likely a lot of 2026 prospective buyers won’t succeed in buying a home this year either.

The survey found that 15% of Americans want to buy a home in the next 12 months (since this survey was fielded in Nov. 2025, most of these prospective buyers would be looking at 2026 purchases). In 2024, between existing homes and new builds, around 4.7 million homes were sold. Even taking into consideration that multiple adults may purchase homes together, the likelihood of all 40 million adults who say they plan to purchase a home in 2026 actually accomplishing this is slim.

What prospective home buyers can do: Be patient. A home could be the most expensive purchase of your life. About 1 in 5 homeowners (21%) regret buying their current home, and you don’t want to unwittingly join them only to hit a self-imposed deadline. It makes sense to take your time and find a home that fits your needs and budget.

Fewer than 2 in 5 Americans know 20% down is optional

It’s a pervasive myth, but a 20% down payment isn’t required to buy a home, though just 37% of Americans know that, according to the survey. In fact, the required down payment for typical conventional mortgages can be as low as 3% and VA and USDA loans typically don’t require any down payment.

According to the Federal Reserve Bank of St. Louis, the median sales price of houses sold in the U.S. is $410,800, as of Q2 2025. A 10% down payment — the current median among first-time home buyers, according to the National Association of Realtors — would be $41,080, which is a sizable chunk of money that could take years to amass.

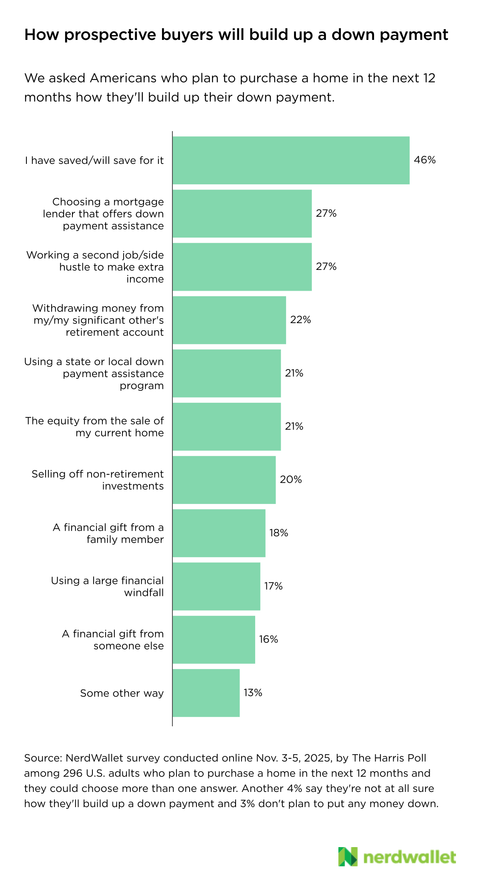

The survey finds that 46% of prospective buyers — or Americans who plan to buy a home in the next 12 months — say they have saved or will save for their down payment. And 39% plan on getting down payment assistance from their mortgage lender (27%) and/or state/local programs (21%).

More than 1 in 5 prospective buyers (22%) say they’ll withdraw money from their or their significant other’s retirement accounts to build up a down payment. While there may be options to withdraw up to $10,000 from your retirement plan without penalty for a down payment (for first-time home buyers), consider the implications of using this money. Left in a retirement account, ten thousand dollars invested over 30 years at 7% returns would end up being $81,165.

Twenty percent is a pretty big down payment, but what about 100%? A quarter of prospective buyers (25%) say they plan to make a cash offer on their next home. While this sounds like a large share, it aligns with the NAR report: All-cash purchases have reached an all-time high — 26% during the time of the study, between 2024 and 2025.

What prospective home buyers can do: Set a realistic down payment goal. Consider putting down more than is required, even if it’s less than 20%. Having a larger down payment may help you get a better interest rate and give home sellers more confidence in your financial stability. And putting more money towards the purchase means you have more equity in the home, which increases your ability to stay right-side-up if the housing market in your area faces volatility.

Though it isn’t required by lenders, there are benefits to putting down 20%, if you can swing it. You’ll avoid private mortgage insurance (PMI), which typically costs between 0.46% - 1.5% of the loan amount annually, according to the most recent data from The Urban Institute.

You can also look into the eligibility requirements for down payment assistance. Whatever amount you decide to aim for, consider saving it in a high-yield savings account to reach your goal even faster.

“When you're deciding on a down payment amount, bear in mind that you'll also need to save for all the other costs associated with buying a home,” Wood says. “Closing costs generally run between 2% to 6% of the loan amount. You'll also want to have cash on hand for any necessary repairs, and for fun stuff, like new furniture. If you're a repeat buyer, coming up with these funds might be less of an issue, since you'll likely use proceeds from the sale of your current home. But if you're a first-time home buyer, that's a lot to sock away.”

The down payment and closing costs are just the first big expense of buying a home. It’s important to go in with eyes wide open, because being a homeowner can be even costlier than you might expect.

A warning to buyers: One-third of homeowners are house poor

More than 3 in 5 homeowners (62%) say owning a home has been much more expensive than they thought it would be. For some, it might be so expensive that it eats up most of their earnings.

Around a third of homeowners (34%) — and 40% of prospective buyers — consider themselves “house poor”. This means that most of their household income goes toward homeowning expenses and there’s not much left to spend on other things.

The costs of homeownership are many, and can include: property taxes, homeowners insurance, homeowners association fees and taking on the financial responsibility of home repairs and maintenance. And even with a fixed-rate mortgage, your monthly payment can increase over time.

Just 44% of Americans know that if you have a fixed-rate mortgage, your monthly payment could still change. While it’s true that the principal and interest are fixed in this scenario, property taxes and homeowners insurance — which are typically paid through an escrow account — may change over time. Since these costs are generally handled by the mortgage servicer, the “mortgage” payment can change, sometimes by quite a lot.

Around a third of homeowners (34%) say the cost of their homeowners insurance increased in the past twelve months, and 12% of homeowners had an escrow shortage in the past year.

All that said, it’s easy to see why some homeowners are struggling to do much more than pay for housing costs.

What prospective home buyers can do: Don’t skip the math of homeownership when homebuying. More than 4 in 5 Americans (84%) agree that buying a home is a good investment, but it’s not just an asset, it’s where you spend most of your life. And many homeowners put feelings first: 44% of homeowners say buying their current home was more of an emotional decision than a financial one.

This isn’t inherently a bad thing. But a dream home can quickly become a nightmare if making the monthly payments becomes stressful.

» MORE: How Much House Can I Afford?

One in 10 homeowners (10%) say the mortgage they took out for their current home was the maximum amount the lender approved them for, according to the survey. Depending on other financial priorities, that amount may not leave you with cash to do much else.

Instead determine your budget before getting preapproved. Use a mortgage calculator to figure out how much you can reasonably afford at the current interest rates, with the understanding that taxes and insurance could rise over time.

“A tenth of homeowners say their current mortgage was the maximum amount the lender approved them for, but being approved for it doesn't necessarily mean it's affordable,” Wood says. “Maxing out your buying power could leave you struggling with a hefty mortgage. Research property taxes and homeowners insurance costs in the area where you're hoping to buy, and work those numbers into your homebuying budget. That way, you can approach lenders knowing how much you hope to spend rather than asking how much you could borrow.”

Nearly half of prospective buyers will use AI

About half of Americans who plan to buy a home in the next 12 months (48%) say they have or will use AI tools during the homebuying process. The survey finds that 27% have or will use them to help estimate housing costs, 26% to guide them in the homebuying process and 25% to visualize how they’d design or renovate a potential home.

What prospective home buyers can do: Use helpful tools, but always verify. AI tools, like ChatGPT and Gemini, can be helpful for thinking through financial decisions. But these tools may give answers that lack nuance, so don’t make them your only source. Check out the Federal Trade Commission’s guide on shopping for a mortgage and find a trustworthy buyer’s agent to help you navigate the homebuying process.

“Buying a home isn't going to be easy in 2026, but here's the thing — it's never really been that easy,” Wood says. “Focusing on your goal of homeownership can make the rough spots a little smoother. All the hurdles — budgeting and saving, searching and making offers, compromising and negotiating — can be overcome. When you've found the right home and gotten an offer accepted, the stress of the homebuying process will quickly fade.”

Cite as NerdWallet (2026). “2026 Home Buyer Report – 48% of Prospective Buyers Will Use AI.” Retrieved from https://www.nerdwallet.com/mortgages/studies/home-buyer-report

Methodology

The 2026 Home Buyer Report was conducted online by The Harris Poll on behalf of NerdWallet from Nov. 3-5, 2025, among 2,094 U.S. adults ages 18 and older, among whom 296 plan to buy a home in the next 12 months. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact [email protected].

The number of homes sold in 2024 was determined by combining estimates from the National Association of Realtors and the U.S. Census Bureau.

Disclaimer

NerdWallet disclaims, expressly and impliedly, all warranties of any kind, including those of merchantability and fitness for a particular purpose or whether the article’s information is accurate, reliable or free of errors. Use or reliance on this information is at your own risk, and its completeness and accuracy are not guaranteed. The contents in this article should not be relied upon or associated with the future performance of NerdWallet or any of its affiliates or subsidiaries. Statements that are not historical facts are forward-looking statements that involve risks and uncertainties as indicated by words such as “believes,” “expects,” “estimates,” “may,” “will,” “should” or “anticipates” or similar expressions. These forward-looking statements may materially differ from NerdWallet’s presentation of information to analysts and its actual operational and financial results.