2016 Travel Credit Card Study

Americans are missing out on more than 15,000 rewards points by applying for travel credit cards at the wrong time.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Free travel is arguably one of the best perks of rewards credit cards. But consumers can leave thousands of bonus points on the table — equal to hundreds of dollars’ worth of hotel stays, airfare and more — if they don’t apply for travel cards at the best possible time.

NerdWallet analyzed data from multiple sources to determine when the best offers on travel credit cards are generally available. The data make clear that timing is everything when it comes to applying for a credit card.

In keeping with NerdWallet’s mission to provide clarity for all of life’s financial decisions, we examined whether consumers are getting the best deals — and, if not, how they could.

This is the 2016 edition of NerdWallet's annual travel credit card study. For other editions and more research, see our credit cards data page.

Key findings

83% of consumers apply for credit cards at the wrong time, forfeiting an average of 15,338 miles or points.

Consumers miss out on an average of $177 worth of rewards when they apply for travel cards at the wrong time. But waiting for the right time has a cost, too.

Consumers should apply for a travel card at least five months before they intend to travel to take advantage of the sign-up bonus.

In this report, we’ll look at patterns in limited-time offers and credit card applications; the cost of choosing to wait for an increased sign-up bonus or forgo it for regular rewards; and the ideal time to apply for a credit card based on your travel dates. Sean McQuay, NerdWallet’s resident credit card expert and a former strategy analyst at Visa, shows how consumers can use this information to get the most out of their travel rewards cards.

Bad timing: Consumers are missing out on thousands of rewards points

83% of consumers apply for credit cards at the wrong time, forfeiting an average of 15,338 miles or points.

Credit card issuers put out limited-time offers — temporarily increased sign-up bonuses — on their travel cards, sometimes once or twice per year.

The additional rewards are substantial. The limited-time offers we analyzed ranged from 5,000 to 50,000 points more than their cards’ normal sign-up bonuses.

Based on our analysis of the most popular travel credit cards, consumers miss out on an average of 15,338 points or miles when they apply at the “wrong time” and get the regular sign-up bonus instead of the bigger limited-time offer. The exact amount lost varies by situation.

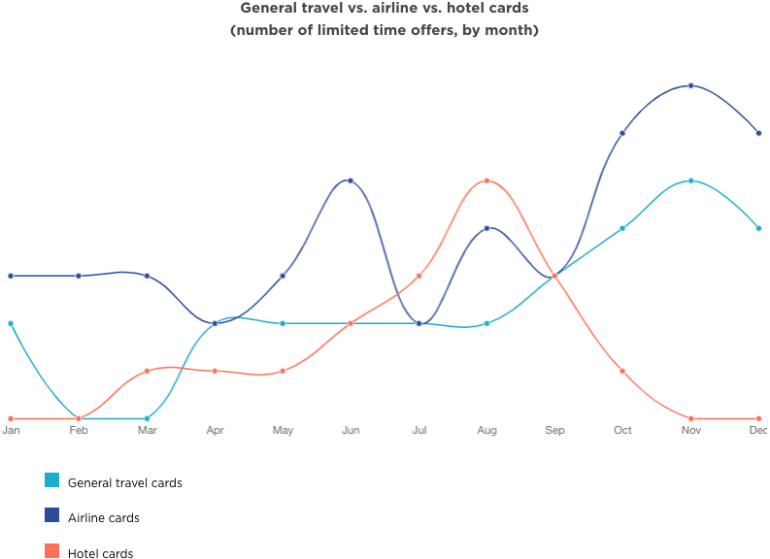

The best and worst times to apply for a travel credit card depend on the type of card.

The best time to apply: General travel vs. airline vs. hotel cards

The type of card consumers choose often determines when they’re most likely to get an increased sign-up bonus. When it comes to general travel, airline and hotel cards, we found that applications and limited time offers peaked at different times.

For general travel cards and airline cards, the best month for limited-time offers was November, but most people applied in July and January, respectively. For hotel cards, August had the most offers, but most consumers applied in April.

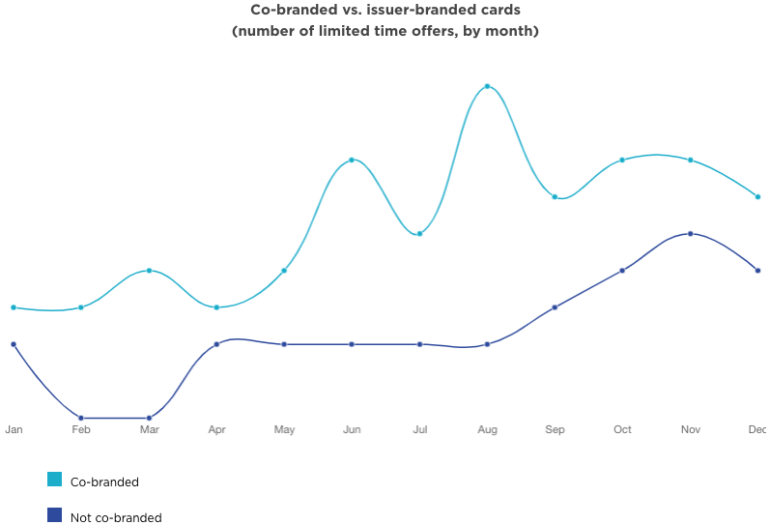

The best time to apply: Co-branded vs. issuer-branded cards

Co-branded credit cards carry the name of a specific airline or a hotel chain and are issued by a bank in partnership with that brand. Issuer-branded cards, on the other hand, don’t have partnerships; they carry only the name of the issuer. Our analysis found that applications and limited-time offers were at their highest levels at different times for each type of card.

Co-branded credit card applications were highest in January, while the most limited-time offers were available in August. Issuer-branded cards got the most applications in July, but the highest sign-up bonuses were offered in November.

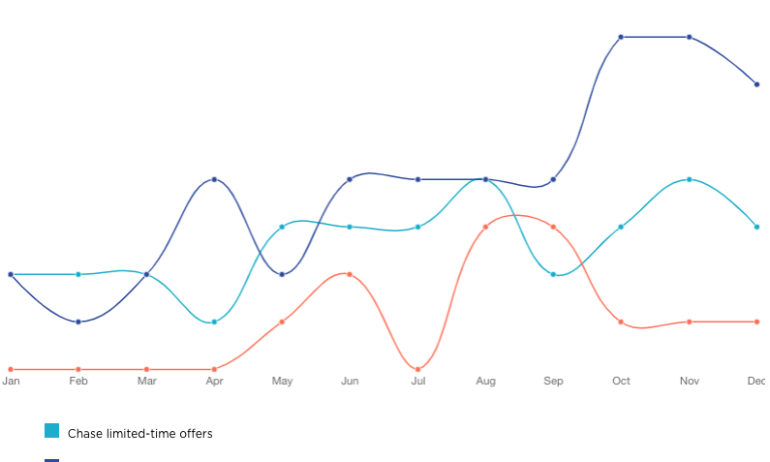

The best time to apply: Chase vs. Citi vs. American Express

Looking at limited-time offers from popular credit card issuers, we found that all three of these companies tended to offer increased sign-up bonuses in late summer and into fall.

Chase’s limited-time offers usually came in August and November. Citi increased its travel card sign-up bonuses more often in October and November. And American Express has historically had its best offers in August and September.

What consumers should do

“When only 17% of applications were during limited-time-offer months, it’s clear that the ‘best time’ to apply for the cards we analyzed was never the most popular time to apply,” McQuay says. “Moral of the story? To get the best deals, try to plan ahead and apply during the off season — like in the late summer and fall.”

Weighing whether it's worth it to wait

Consumers miss out on an average of $177 worth of rewards when they apply for travel cards at the wrong time. But waiting for the right time has a cost, too.

According to NerdWallet’s calculations, the average travel point or mile is worth around 1.16 cents. That means consumers who apply for a travel credit card without waiting for a limited-time offer are losing an average of $177 worth of travel (15,338 points at about 1.16 cents apiece).

But waiting for a limited-time offer on a given card has a cost as well — an opportunity cost. If you don’t have the card, then you can’t use it to earn rewards. Depending on how much you spend, how long you have to wait for a limited-time offer and whether you already have a rewards card, the rewards you miss out on could exceed what you’d gain by waiting.

Let’s say you currently spend $2,000 a month on a credit card that doesn’t earn rewards. That’s a potential loss of $23.20 a month in rewards, assuming a standard rewards earning rate of 1 point per dollar spent and the average redemption rate of 1.16 cents.

While $23.20 probably isn’t a life-changing amount, it does add up over time. If you waited eight months or more for a limited-time offer, you would have been better off taking the regular sign-up bonus. You’d have missed out on about $186 worth of rewards to gain $177.

What consumers should do

McQuay says: “If you already have a good rewards card, you can probably wait for a limited-time offer on your next card. But consumers who aren’t earning rewards will need to make an informed decision about whether they should wait to apply. A couple of factors to consider are how often your card of choice offers an increased sign-up bonus and if your spending is high enough that you’ll miss out on a lot of rewards by waiting. In the end, only you can make the best decision about when you apply for a credit card.”

T-minus five months: When to get a travel credit card for your upcoming trip

Consumers should apply for a travel card at least five months before they intend to travel to take advantage of the sign-up bonus.

A credit card sign-up bonus is a great way to get a lot of rewards in a short period of time, but consumers likely need to apply for a travel card sooner than they think to take advantage of these extra points or miles.

Why you should apply five months before your trip

Assuming it takes a full three months to earn the sign-up bonus, a consumer should apply for a credit card approximately five months before takeoff because:

After getting approved for a card, you’ll likely receive it in seven to 10 business days, or approximately two weeks, depending on the issuer.

Most travel cards give you three months to hit the minimum spending requirement to qualify for the sign-up bonus.

According to travel website CheapAir, the ideal time to book your domestic trip is 47 days prior to travel.

That’s around 151 days from application to takeoff, give or take a few days depending on how long it takes for rewards to post to an account. If it takes exactly five months, here’s when a consumer should expect to apply for a new card based on the month of travel:

When to apply for a travel credit card

Travel date | Apply before |

|---|---|

January 1 | August 1 |

February 1 | September 1 |

March 1 | October 1 |

April 1 | November 1 |

May 1 | December 1 |

June 1 | January 1 |

July 1 | February 1 |

August 1 | March 1 |

September 1 | April 1 |

October 1 | May 1 |

November 1 | June 1 |

December 1 | July 1 |

What consumers should do

“If you’re planning on taking a trip later this year and you’re in the market for a new travel card, apply as early as possible. Five months seems like a long lead time, but a good sign-up bonus could potentially pay for your entire ticket — maybe with miles left over,” McQuay says.

Methodology

NerdWallet reviewed internal and external data sources. Internal data has been identified as such throughout this study and external data has been linked to its original sources.

To calculate the average points or miles lost by applying for a card without a limited time offer, we took the difference between a card’s best offer and regular offer and weighted it based on the popularity of the cards we analyzed. We multiplied the points by the weighted average value of the rewards of these cards to get a dollar amount.

We pulled card application rates for January 2013 - December 2015 from our internal database to determine when consumers tend to apply for specific credit cards.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.