What Is a Good Credit Score and How Do I Get One?

On a scale of 300-850, a "good" credit score falls somewhere in the mid-600s to mid-700s. Knowing what affects your score — and how to build or fix it — can help you qualify for better credit cards, loans, and interest rates.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is a good credit score?

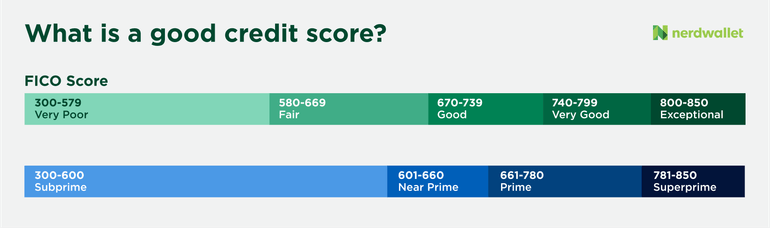

A good credit score usually falls between the mid-600s and mid-700s on the 300-850 scale. Scores in the high 700s and above are often seen as excellent. Scores in the low 600s to mid-500s are considered fair, and anything between 300 and the low 500s is seen as poor credit.

Credit card companies and mortgage lenders — set their own rules for what counts as "good credit." They use your score to decide whether to approve you and what interest rate to offer.

FICO vs. VantageScore

Two major companies create credit scores: and. Both use the same 300 to 850. But, the two companies define “good credit” a little differently.

According to FICO, a good score is 670 to 739. A good VantageScore is 661 to 780, which the company calls a "prime" credit tier.

Both companies use information from the three major credit bureaus — TransUnion, Equifax and Experian — to calculate your scores.

Some industries use their own versions of these scores. For example, the FICO Auto score ranges from 250 to 900 and is used by car lenders.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

How to get a good credit score

If you want to, focus on building strong credit habits and keeping them up over time. Here are some of the most important steps:

Pay bills on time

Your payment history has the biggest effect on your score. Missing or paying a bill late can lower your score a lot, and that mark can stay on your credit reports for up to seven years. The good news: its effect fades as time passes.

Keep credit use below 30%

Try to keep your credit card balances well below your credit limits. NerdWallet recommends using no more than 30% of your available credit. Using too much credit at once can lower your score, but your score will improve again after you pay down the balances.

You can also lower your by asking for a higher credit limit or by becoming an on a trusted adult’s card who has a strong credit history and a record of paying on time, all the time.

Leave credit cards open

Keeping older credit cards open can help your score because it increases the average age of your accounts. Closing a card lowers your total credit limit, which can push your credit utilization higher and hurt your score. Still, it might make sense to close a card if it has high fees or poor service.

Space out credit applications

Avoid applying for several credit or loan applications at once. Each application causes a, which can temporarily lower your score. Too many hard inquiries close together can add up and drive your score down even further. That's why it helps to research credit cards before you apply.

Check your credit reports

Mistakes on your credit reports can hurt your score. Review your reports often and you think is incorrect or too old to be included. Most negative marks fall off your credit reports after seven years.

What a good credit score can get you

Having good credit matters because it affects whether you can borrow money — and how much interest you'll pay when you do.

A good credit score can make it easier to get approved for credit cards with higher credit limits, better perks and other rewards. In many states, people with higher credit-based insurance scores pay less for car insurance.

Here are some other things a good credit score can help you get:

- A credit card with a fair interest rate. You may even qualify for a balance-transfer card, which lets you move debt from another card at a lower interest rate.

- A car loan or lease with better terms. If your credit score is around 700 or lower, lenders may ask questions about negative marks on your credit report before approving you for a car loan.

- A mortgage with a lower interest rate. You don’t need a perfect credit score to get a home loan — some lenders accept scores in the 500s. But credit scores show how risky it might be to lend to you, so higher scores usually mean lower interest rates.

- An edge when renting a home or apartment. Landlords or property managers often check credit scores when choosing tenants. They usually care more about your full credit history than having a perfect score.

- Access to new credit when needed. A good credit score gives you flexibility. It can help you cover costs in an emergency or qualify you for rewards and travel cards.

What is the highest credit score?

The highest score possible on most scales is 850.

It can be tempting to chase that perfect number, but credit scores change from month to month. Even if you reach 850, it’s hard to stay there.

The good news is you don't need a perfect credit score to get the best deals. Scores in the high 700s and above are considered excellent, and anything 800 or higher usually qualifies you for the best rates and terms.

What is a bad credit score?

A bad credit score is usually 600 or lower on the 300-850 scale. Scores in this range can make it hard to qualify for credit cards, loans or good interest rates.

A bad score could be caused by one or more factors:

- Late or missed payments.

- Using too much of your credit limit.

- Collections or charge-offs to existing accounts.

- Filing for bankruptcy.

- Identity theft or fraud.

- Having little or no credit history.

Having bad credit doesn’t mean you’re stuck. Credit scores can bounce back with time, steady on-time payments, and keeping balances low. By checking your credit regularly and building healthy habits, you can see your score improve step by step.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

On this page

Related articles