When Should I Ask for a Credit Limit Increase?

The best time: when you're making more money than before and you have good credit.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Asking your credit card issuer to increase your credit limit can not only boost your buying power, but also lower your credit utilization, which could help your credit scores. Whether your request will be approved, however, is a matter of timing. It's often said that the best time to ask for new credit is when you don't need it (at least, not yet).

The right time to ask for a credit limit increase

When you’ve recently gotten a raise. An increase in income means you’ll be able to cover an increase in credit card expenses. Note: You may need to provide proof of your new income to get approved for a higher credit limit.

When your credit is good. A good credit score signals to your credit card issuer that you’re responsible with borrowed money. Therefore, you’re more likely to make payments on time and understand how much you can afford to charge each month. You can track your credit score for free via personal finance websites, including NerdWallet. Remember, good credit isn’t the same thing as good financial health, but creditors assume that these qualities are linked. Aim to have both.

When you have a good track record. If you’ve made all of your payments on time and never maxed out your card, you’re more likely to get approved for a limit increase. (Late payments and high credit utilization can suggest someone having money troubles.) You’ll also have a better chance if you’ve had your account with this particular creditor for at least six months to a year.

The wrong time to ask for a credit limit increase

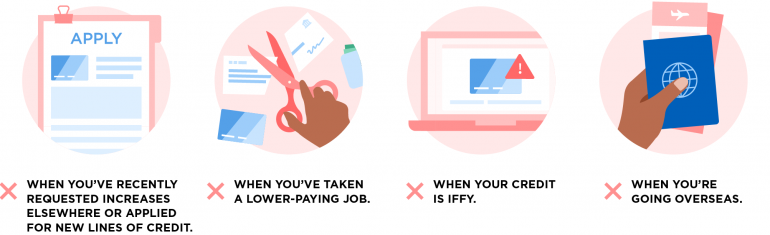

When you’ve recently requested increases elsewhere or applied for new lines of credit. A flurry of requests for new credit can be a sign of financial distress. When you apply for new credit, and sometimes when you apply for a credit limit increase, a hard inquiry appears on your credit report. New credit applications trigger a new credit penalty, which may hurt your credit, especially if the length of your credit history is short.

When you’ve taken on a lower-paying job. If you’ve recently taken on a lower-paying job, even if it's more fulfilling, this isn’t the time to ask for an increase. Your spending power has decreased, so the issuer has no reason to extend more credit to you.

When your credit is iffy. If your credit score isn’t good or excellent, it’s likely that you won’t get approved for more credit because you haven’t shown good judgment with credit in the recent past. Build up your score before asking for a higher limit.

When you’re embarking on an overseas adventure. Travel feeds the soul, but it also makes you more susceptible to credit card fraud. Travel also frees our (financial) inhibitions, leading us to spend more than we normally would. By upping your limit, you’ll give yourself more leeway to run up an expensive credit card bill you’ll have to pay when you get back to reality. Wait to increase your limit until you get back.

The worst they can say is no. Shouldn’t I try?

Oftentimes, a limit increase request will trigger a hard pull on your credit report. This can hurt your credit, especially if you have a short credit history. If you call your credit card issuer, you can ask whether a hard inquiry will be initiated. Sometimes you can take a smaller increase and forgo the pull.

If you decide it’s the right time to up your limit, either call customer service or request a credit limit increase online. It’s a very simple procedure. Don’t be discouraged if your request is denied. Your credit card issuer might increase your credit limit in the future when the timing is right.

Bottom line: Try to time your credit limit increase request so it’s more likely to get approved. And, of course, try to keep your spending low enough that you can pay your credit card in full each month.

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.