How a Broken Dishwasher Tested My Rewards Resolve

What happens when you get so worked up over which credit card to use that you can't make a decision? You suffer the twin scourges of stress and dishpan hands.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The trouble started when the dishwasher stopped.

As someone who thinks about credit cards for a living and as a hobby (shut up), I see a silver lining in every home-maintenance disaster. Sure, I may have to spend hundreds of dollars to make water stop coming out of the ceiling or to get that rotating doohickey to rotate again. But I console myself knowing that in doing so, I'll earn credit card rewards from 2% to 5%. I might save even more with a discount through the card issuer. The possibilities are endless!

Sometimes, however, the desire to squeeze every last bit of reward value out of a transaction gets in the way of, you know, getting things done. It's great to want the best deal possible, but preoccupation easily becomes paralysis — and what happens then? You end up doing dishes by hand for weeks while your broken dishwasher mocks you with its dead LEDs.

Which card to use?

Homeownership means that when something breaks, it's on you to either fix it or replace it. Handle enough DIY repairs and pay enough service techs to come out and shrug at your nonfunctioning whatever, and you'll develop a sense of when to bother trying to fix something. This dishwasher didn't tickle my fix-it bone, so a replacement was in order.

“Sometimes, the desire to squeeze every last bit of reward value out of a transaction gets in the way of, you know, getting things done. ”

I'm fortunate that I have a little bit of savings for this kind of first-world emergency, so I could pay for a new dishwasher out of pocket. Putting it on a credit card, though, allowed me to earn rewards and made it so I didn't have to actually pay for the thing until after it was delivered.

Now for the big question — which credit card to use? The one that pays the highest rewards rate, right?

In the past, I would have gone to my card issuers' bonus malls and looked for the best deal. For something like an appliance, you could usually find a discount or bonus rewards that amounted to 5% to 10%. But issuers have been closing their bonus malls in favor of targeted offers that are harder to incorporate into your shopping process. Using a bonus mall is like going to a shopping mall: If you go once, the same merchants are usually there when you go back. Using targeted deals is more like standing on a street corner while random merchants shout their offers at you. It all depends on who's shouting that day.

Terms and conditions apply. Credit products subject to lender approval.

Two competing offers

After looking through the offers available on my cards, I found two that applied to my dishwasher problem. Note that these offers were specific to my accounts — you might see different offers:

On my Chase Sapphire Preferred® Card: "Earn 10% back on your Lowe's purchase, with a $12.00 back maximum! Offer valid one time only. Offer expires 12/19/2018."

On my Blue Cash Preferred® Card from American Express: "Get a one-time $10 statement credit by using your enrolled Card to spend a minimum of $75+ in one or more transactions in-store or online at select home improvement stores by 12/31/2018."

Seems simple enough: I would get $12 back from Chase vs. $10 back from AmEx, so Chase it is. I was ready to head to Lowe's.

But wait.

“Which credit card to use? The one that pays the highest rewards rate, right? If only it were that simple.”

Looking at those dollar figures, I neglected to think in percentage terms. And when it comes to rewards, it's all about percentages. The dishwasher I wanted came to $735 after taxes and a haul-away fee for the old machine. Getting $10 or $12 back amounted to a discount of 1.4% or 1.6%. I carry another card — the Citi Double Cash® Card — that gives me 2% cash back on all purchases (1% when I buy something and 1% when I pay it off). For a $735 purchase, that comes to $14.70.

So it's settled! We'll go with Citi, and AmEx and Chase can go pound sand with their "offers."

Discounts plus rewards

Wait again — I forgot something else. On top of the statement credit from each targeted offer, I would earn rewards on the purchase itself. See how deep this rabbit hole goes? Oh, it gets deeper.

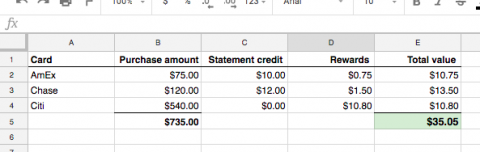

The Blue Cash Preferred® Card from American Express would pay 1% cash back on the purchase.* Terms apply. The Chase Sapphire Preferred® Card would pay 1 point per dollar; those points are worth 1.25 cents apiece the way I redeem them. So now my rewards math looks like this:

Chase Sapphire Preferred® Card: $12 statement credit + $9.18 in rewards (735 points @ 1.25 cents apiece) = $21.18.

Blue Cash Preferred® Card from American Express: $10 statement credit + $7.35 in rewards = $17.35.

Both of these dunk on the $14.70 available from the Citi card. So we're back to Chase again. Getting $21.18 worth of value on a $735 purchase is about a 2.9% return. Pretty good!

But ... what if I could do better?

I should note here that my dishwasher died right before Thanksgiving, and with Christmas bearing down, I was still dithering, not because I didn't have the money, but because I'd become so preoccupied with Sticking It To The Man that I was afraid to pull the trigger. I'd dithered so long, in fact, that the offer on the Chase Sapphire Preferred® Card was about to expire.

And that's when my colleague Robin made a simple suggestion: "Split the purchase between the cards. Net a cool $22."

Whoa.

How about a 3-way split?

I felt deep shame that I had not thought of this myself. I've split purchases across cards to redeem rewards — I once bought a treadmill with the accumulated cash back on four different cards. But I had not done so to maximize my upfront savings.

And because I can't leave well enough alone, I thought: Instead of splitting the purchase across two cards, why not three? Why not put just enough on the AmEx and Chase cards to cash in the offers, then put the rest on the Citi card? I had to move everything to a spreadsheet to get it straight, and if that's not a red flag ...

I don't think I need to say that this is just not normal behavior. I had pushed my total value to $35.05, or 4.8% of the dishwasher. That's a pretty darn good return if I say so myself (and I do). But the catch was that I still didn't have a dishwasher. For the sake of stretching my savings from $14.70 to $35.05, I'd lost another week to indecision and dishpan hands. This was madness.

It was Dec. 17 and my Chase offer was just about kaput, so I put on my hat and coat and went to Lowe's. (That's just an expression; I didn't wear a hat.) The time for talking was over. The time for thinking was over. Let's do this!

“I had to move everything to a spreadsheet to get it straight, and if that's not a red flag.”

What have I become?

Once in the store, I found a friendly associate who applied some discounts and knocked the total price down to $655. We did the paperwork, and it came time to pay ... and I couldn't do it.

I had all three cards out, ready to line 'em up and mow 'em down. But at that moment, I saw myself as the tool I was (am). There are people who spread things out over three or four or five cards because it's the only way they can afford what they need. And here I am, some bozo juggling cards for a few bucks when the nice Lowe's associate had already saved me $80.

So no, I didn't split the purchase among three cards.

Judgment day

I split the purchase between two cards! I put $200 on the AmEx and $455 on the Chase card for a total return of $29.69, or 4.5%. (Had I optimized with three cards, the total would have been $33.45, or 5.1%.) I still can't look myself in the mirror, but I've long since painted over all the mirrors in my house anyway.

Optimizing credit card rewards requires finding your comfort level. How far are you willing to go? How complicated are you willing to make things to maximize your savings?

“It's all about where you draw the line between having fun gaming the system and stressing yourself out over nickels and dimes. I'd crossed my line, and I didn't like it.”

Plenty of people would be totally cool with splitting this purchase among three or more cards and maybe even throwing in the balance of a gift card, too. It doesn't matter much to the person at the register — using an additional card adds maybe 10 seconds to the transaction. If they allow you to do it, feel free to do so.

It's all about where you draw the line between having fun gaming the system and stressing yourself out over nickels and dimes. I'd crossed my line, and I didn't like it.

Personal strategies from our credit card writers |

• Chanelle Bessette: A Card for Every Case • Gregory Karp: Making Simplicity Rewarding • Melissa Lambarena: Two Cover the Bases and One’s on Deck • Robin Saks Frankel: Fund Summer Camp, Get 'Chase Trifecta' • Kimberly Palmer: Stretch the Budget With Cash Back • Claire Tsosie: I'm Disloyal, and It's Paying Off • Sara Rathner: Meet #TravelGoals Via Smart Swiping |

I used to clip coupons but had to stop because I was driving myself crazy. I'd buy 24 rolls of toilet paper, then see a coupon for 25 cents off, and I would get legitimately angry. I'm no psycholologismist, but that doesn't sound healthy. Neither does spending weeks treading water on a purchase because I'm worried about a rounding error's worth of rewards.

I still don't have my dishwasher. Because I waited until so close to Christmas, delivery was going to take a month, but it's coming. Until then, I'll just keep washing and drying and hoping and praying.

And trying to forget something I remembered while leaving Lowe's. If I had just used my Chase Freedom® to buy the dishwasher at a department store any time in the last three months of 2018, I could have gotten 5% cash back in one fell swoop. Dang it!

Find the right credit card for you.

Whether you want to pay less interest or earn more rewards, the right card's out there. Just answer a few questions and we'll narrow the search for you.