Priority Pass Select: Complete Guide to Airport Lounge Access

Overcrowding has changed the game at Priority Pass lounges. Here's how to get real value from your membership.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

Priority Pass Select provides access to over 1,700 airport lounges worldwide through premium credit cards. Priority Pass Select membership is one of the most common ways to get into these lounges.

Sure, airport lounges are often seen as a luxurious escape from the crowded, hectic environment of the terminals. Reclining in a comfy armchair with complimentary snacks and a glass of wine sounds ideal, especially if you’re not paying extra for it. But overcrowding and declining service quality have diminished the experience at many locations.

After analyzing membership costs, lounge quality and alternatives, we've identified which credit cards deliver the best Priority Pass value and when you should consider other lounge access strategies.

» Learn more: How to choose a travel credit card

On this page

- What is Priority Pass Select?

- What you actually get

- Overcrowding at lounges

- How to maximize your Priority Pass membership

- Top credit cards offering Priority Pass Select membership

- What about buying Priority Pass membership outright?

- Priority Pass alternatives

- Priority Pass Select membership: Is it worth it?

What is Priority Pass Select?

Priority Pass Select is a membership perk that comes with many premium travel credit cards, often those with annual fees of $600 or more. While you can purchase a Priority Pass membership directly via various tiers (Standard, Standard Plus and Prestige), many travel credit cards include a version called Priority Pass Select.

Best Priority Pass cards

Annual fee

$795.

$395.

$895.

Priority Pass benefits

• Full Priority Pass Select membership.

• Includes two guests per visit.

• No restaurants.

• Full Priority Pass Select membership.

• Includes two guests per visit through 1/31/26 (charges per guest effective 2/1/26).

• No restaurants.

• Full Priority Pass Select membership.

• Includes two guests per visit.

• No restaurants.

Enrollment required. Terms apply.

Learn more

Apply for your Priority Pass membership

You can’t just flash your credit card to get into a Priority Pass lounge for free. You’ll need to have an actual Priority Pass card.

Some credit cards give you the option of adding a digital membership card, which you can access by downloading the Priority Pass app through Google Play or the Apple App Store and logging into your Priority Pass account. Today, most lounges accept digital membership cards.

Typically, you’ll have to apply for a Priority Pass card through a separate benefits page on your bank’s website. It can sometimes take a week or so after you apply for your card to arrive in the mail, so if you’re applying for a credit card specifically to get lounge access, leave enough time between your next trip so you can first receive the credit card, be able to access your card’s portal and then also apply for and receive your Priority Pass in the mail.

Having trouble? Call the number on the back of your card for help.

What you actually get

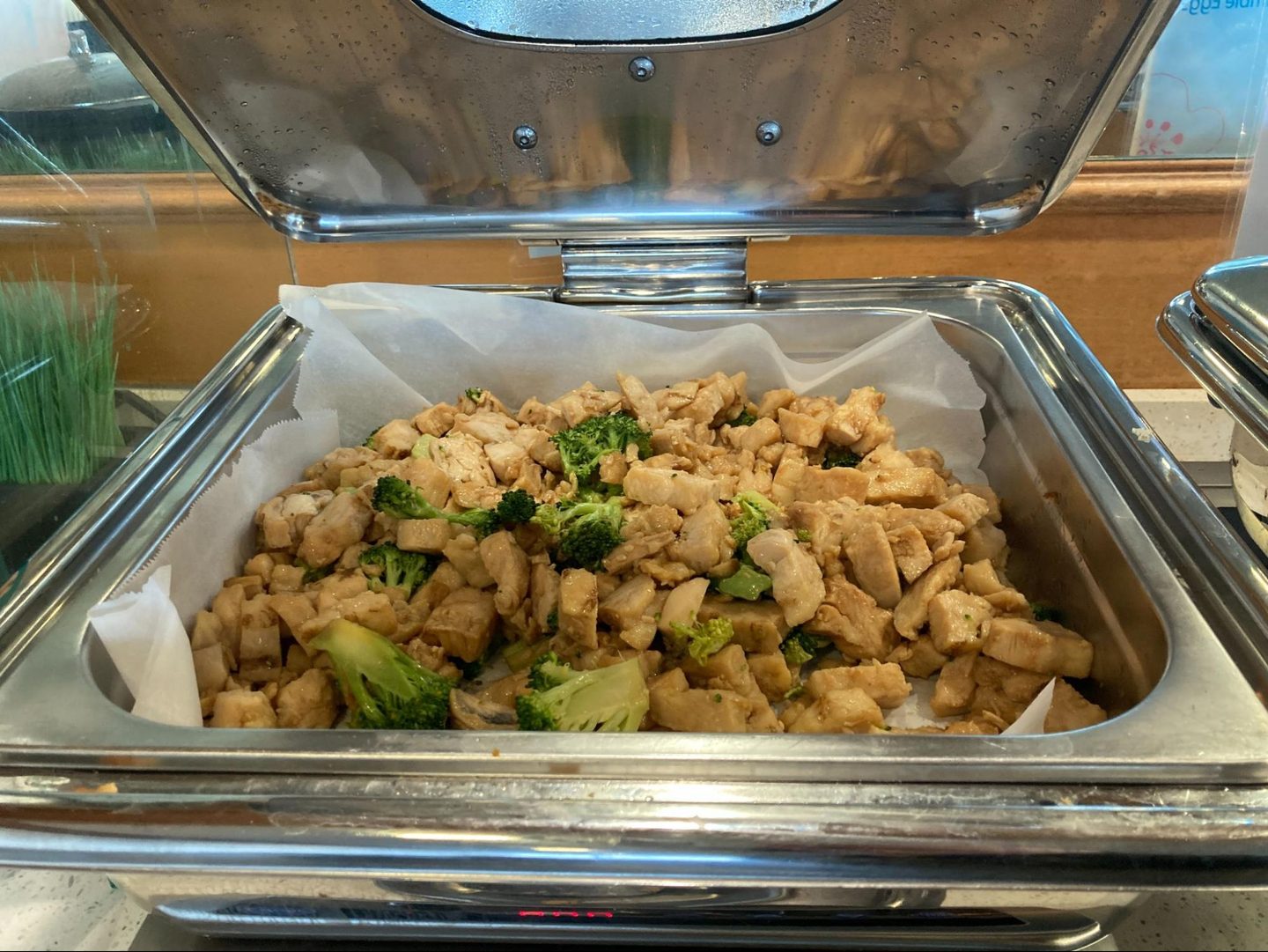

The appeal of airport lounges is access to quiet spaces with free food, drinks and Wi-Fi. Some airport lounges do deliver, but not always.

Inside, expect benefits that vary but may include:

- Free Wi-Fi.

- Complimentary food.

- Alcoholic beverages.

- Newspapers.

- Magazines.

- TVs.

- Air conditioning.

- Flight information.

- Some lounges even have conference rooms, fax machines, free spa treatments, private rooms to sleep and showers.

In reality, lounges have become increasingly crowded spaces with wait times, mediocre food and sometimes dirty facilities.

Still, they can be worth it if you travel frequently, know which lounges to avoid and have realistic expectations about amenities. If you can use them to avoid buying food or drinks at airports, you can save money on travel.

Priority Pass lounges are typically quieter than the rest of the airport. It's also generally acceptable to leave your bags at your seat (at your own risk, of course), whereas TSA announcements in the main airport warn against leaving bags unattended.

Wi-Fi tends to be faster and most lounges offer greater power outlet availability than what you’ll find in the main terminal, too.

And some lounges come with benefits that go far beyond those basics. In one Minneapolis/St. Paul, Minnesota, lounge, you can test out the indoor putting green. At the Gameway lounge at Los Angeles International Airport, your Priority Pass unlocks one hour of gaming plus a complimentary snack and drink.

Other lounges have been known to have sleep pods, massages and even manicure services (though sometimes those incur an extra cost).

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Overcrowding at lounges

The growing number of Priority Pass members, combined with limited lounge spaces, has led to one common problem: overcrowding.

During peak travel times, you might find yourself waiting in line just to get into a lounge.

The Club SFO is not just the best Priority Pass lounge at San Francisco International Airport, but it’s one of the best you’ll find in the nation. But on one NerdWallet staffer’s past three visits, there was a queue just to register with the front desk (about five to 15 minutes each time). Upon arriving at the front of the line, travelers had to give a phone number, upon which they’d receive a text telling them when they could enter the lounge (which took another five to 15 minutes each time).

» Learn more: The best travel credit cards right now

That lounge can be worth the wait given its ample seating, thoughtful design and fresh food. But that’s hardly the case at other lounges.

Lounges that don’t limit guest access strictly sometimes end up leaving you searching for an available seat. You might be left settling for a table with the last person’s crumbs still strewn about. If you're traveling with high hopes of lounging in comfort, be prepared for potential disappointment.

The Premier Club at Kahului airport in Maui almost always has a line out the door with people on a waitlist. Once inside, there is hardly a place to sit with only cookies, coffee, tea and a soda machine. It’s hardly worth the effort, says one NerdWallet staffer that frequents the airport.

And food quality can vary. Some lounges offer hot meals local to the region. Others offer mediocre cold sandwiches, and sometimes only prepackaged snacks.

The Plumeria Lounge Honolulu, for example, is a mixed bag. Its main course consists of small, cold sandwiches and soup, although it can sometimes have hot food like Kalua pulled pork with Hawaiian bread rolls depending on the time of day.

How to maximize your Priority Pass membership

To truly benefit from your Priority Pass Select membership, be strategic:

Check lounge availability in advance

Not all airports have Priority Pass lounges, and those that do may have restrictions or limited hours. Use the Priority Pass app to confirm lounge availability and amenities at your airport.

Priority Pass lounges change frequently as the lounge network adds and removes locations. Generally speaking, though, these airports typically have Priority Pass lounges:

U.S. Priority Pass Locations

- Atlanta.

- Baltimore.

- Boston.

- Buffalo, N.Y.

- Charleston, S.C.

- Charlotte, N.C.

- Chicago.

- Cleveland.

- Colorado Springs, Colo.

- Dallas/Ft. Worth.

- Detroit.

- Fort Lauderdale, Fla.

- Greenville-Spartanburg, S.C.

- Honolulu.

- Houston.

- Indianapolis.

- Jacksonville, Fla.

- Kahului, Hawaii.

- Las Vegas.

- Little Rock, Ark.

- Los Angeles.

- Miami.

- Minneapolis/St. Paul.

- New Orleans.

- Newark, N.J.

- New York JFK.

- New York LaGuardia.

- NW Arkansas.

- Orlando, Fla.

- Philadelphia.

- Pittsburgh.

- Portland, Ore.

- Providence, R.I.

- Sacramento.

- Salt Lake City.

- San Francisco.

- San Jose, Calif.

- Seattle/Tacoma.

- St. Louis.

- Syracuse, N.Y.

- Tampa, Fla.

- Tucson, Ariz.

- Tulsa.

- Washington Dulles, D.C.

Arrive early — but not too early

If you want a better chance of actually enjoying the lounge experience, arrive early. Showing up with just enough time to board your flight might mean you don’t even get in — especially if the lounge is at capacity and there’s a line.

Just keep in mind that most lounges have a time limit on how early you can arrive. Typically, lounges won’t let you in more than three hours before your scheduled departure. But many make exceptions if you’re visiting as part of a layover.

Look beyond basic lounges

Some Priority Pass locations offer unique amenities like showers, private suites (for an extra fee), or even spa treatments. For example, Dallas-Fort Worth’s Minute Suites offer an hour of complimentary private space, which is ideal if you need to rest or work in silence.

Some airports, like San Francisco International Airport and Los Angeles International Airport, are fully connected post-security. This makes for a convenient way to access lounges in different terminals without having to clear the security screening again.

But not every airport is so convenient. For example, JFK is not fully connected between its terminals. Know where your desired lounge is in relation to your gate.

Top credit cards offering Priority Pass Select membership

Travel rewards credit cards offer a lot of perks and Priority Pass access is a big draw for frequent flyers. Chase, American Express, U.S. Bank, Citi and Barclays are some of the financial institutions issuing these cards.

Depending on the card issuer, authorized users may also receive complimentary access to lounges. As with general membership access, lounge visits beyond any free allowances provided as a part of a Priority Pass credit card benefit cost $35 per person, per visit.

Here are some of the best cards that offer Priority Pass membership, which can include unlimited visits for the cardmember and a guest policy that offers a varying number of free guest visits:

Capital One Venture X Rewards Credit Card and the Capital One Venture X Business

The Capital One Venture X Rewards Credit Card and the Capital One Venture X Business include access to Priority Pass Select and Capital One lounges. That's more access to airport lounges for a lower cost than most other premium travel cards.

The Capital One Venture X Rewards Credit Card has an annual fee of $395 and the following welcome offer: Earn 75,000 bonus miles when you spend $4,000 on purchases in the first 3 months from account opening, equal to $750 in travel.

The Capital One Venture X Business has an annual fee of $395 and the following welcome offer: Earn 150,000 bonus miles once you spend $30,000 in the first 3 months from account opening.

Chase Sapphire Reserve®

The Chase Sapphire Reserve® has an annual fee of $795, but its $300 travel credit offsets a portion of the cost.

Besides Priority Pass membership, other Chase Sapphire Reserve® benefits include a credit every four years toward your TSA PreCheck/Global Entry/NEXUS application, no foreign transaction fees and bonus points on certain spending categories.

This solid travel card has the following welcome offer: Earn 125,000 bonus points after you spend $6,000 on purchases in the first 3 months from account opening.

Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card is great choice for Marriott loyalists. It includes up to $300 in statement credits per calendar year (up to $25 per month) for eligible purchases at restaurants worldwide, which help offset the $650 annual fee (see rates and fees).

After the two complimentary guest visits, each additional guest is charged the same as the guest fee on the Standard Plus membership (currently $35). Enrollment required. Terms apply.

The American Express Platinum Card® and The Business Platinum Card® from American Express

Despite the hefty annual fees on the American Express Platinum Card® and The Business Platinum Card® from American Express, both cards include several offsetting credits that effectively reduce the fee.

The Priority Pass Select membership on these cards only includes complimentary access for one guest, and Priority Pass airport restaurants are not included. That said, both cards offer access to their own network of lounges. Enrollment required.

The cards include the American Express Global Lounge Collection which, in addition to a Priority Pass Select membership (enrollment required), provides access to AmEx’s Centurion Lounges and International American Express Lounges. Cardholders can also access the Delta Sky Club when flying Delta up to 10 visits per year (though they can earn unlimited Delta Sky Club visits if they spend $75,000 on the card in a calendar year). Terms apply. Enrollment required.

The American Express Platinum Card® has an annual fee of $895 (see rates and fees) and the current offer is: You may be eligible for as high as 175,000 Membership Rewards® Points after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer. Terms apply.

The Business Platinum Card® from American Express has an annual fee of $895 (see rates and fees) and the current offer is: Elevated Welcome Offer: Earn 200,000 Membership Rewards® points after you spend $20,000 in eligible purchases on the Business Platinum Card® within the first 3 months of Card Membership. Terms apply.

What about buying Priority Pass membership outright?

Purchasing a Priority Pass membership directly — rather than getting it through a credit card — is generally a poor value. These are the current prices for U.S. residents:

| Standard | Standard Plus | Prestige | |

|---|---|---|---|

| Annual Fee | $99. | $329. | $469. |

| Member Fee | $35. | 10 free visits, then $35. | All visits free. |

| Guest Fee | $35. | $35. | $35. |

If you travel just once or twice a year, you’d be better off purchasing day passes to lounges. And in the cases of some lounges, the day pass rate is far higher than any value the lounge would actually deliver. In those cases, find a good airport restaurant and spend your money there instead.

But if you are a frequent traveler, and the airports you frequent have good Priority Pass lounges, these memberships could make sense.

Priority Pass alternatives

If your local airport’s Priority Pass lounges are overcrowded or underwhelming, your airport might have other lounge alternatives — and they’re generally (though not always) better than the Priority Pass lounges.

Some of the most popular Priority Pass alternatives include:

Centurion Lounges

Access to Centurion Lounges is generally only open to cardholders of the American Express Platinum Card® and The Business Platinum Card® from American Express. To enter, cardholders must present their Amex Platinum card, a same-day boarding pass and government-issued ID.

These lounges tend to be among the best of the best, offering complimentary showers and chef-curated meals. For example, the lounges offer robust buffets designed by local chefs in many cities, including Mashama Bailey and Kwame Onwuachi.

These lounges have strict entry policies, including limited access only within three hours of departure at the airport. Additionally, cardholders must pay $50 per guest ($30 for children ages 2-17) unless they have spent $75,000 or more on the card within a calendar year, in which case complimentary guest access is available. Terms apply.

Those restrictions have significantly cut down on overcrowding at Centurion Lounges (though even NerdWallet staffers have still found queues to get into some Centurion Lounges). Much like Priority Pass, experience varies by specific lounge.

American Express Platinum Card® holders pay a hefty annual fee of $895 (see rates and fees), but it can be worth it given that card membership unlocks access to all sorts of airport lounges, including access to Escape Lounges and Lufthansa Lounges (when flying with a confirmed seat on a same-day Lufthansa Group boarding pass).

Capital One Lounges

Capital One Lounges have gained a reputation for offering a high-end lounge experience that competes well with AmEx’s Centurion Lounges.

These lounges provide a more modern, sleek atmosphere with features like craft cocktails, grab-and-go food stations, workspaces and even wellness rooms for activities like meditation and yoga. The Capital One outpost at Dallas Fort Worth International Airport has a room with Peloton bikes.

The Capital One Venture X Rewards Credit Card provides complimentary access to Capital One lounges for the cardholder, but additional guests cost extra ($45 per adult guest and $25 per guest 17 and under). Cardholders can unlock complimentary guest access if they spend $75,000 a year on their card. Though the Capital One Venture X Rewards Credit Card has a much lower annual fee than many of its competitors at $395, it also includes Priority Pass Select membership (no free guests, even if you meet the spending threshold).

Airline-branded lounges

Many airlines also operate their own lounge networks, such as Delta Sky Club and American Airlines Admirals Club. These lounges sell their own memberships that anyone can buy and enjoy when flying on that airline or one of its partners. Also, people flying in premium fare classes or who hold top-tier, airline-branded credit cards enjoy access. Like Priority Pass lounges, airline lounges can have a line to get inside. But the quest to unlock access can make sense for some travelers, especially those close to reaching airline elite status.

These lounges tend to be more luxurious than Priority Pass lounges. The Delta Sky Club in LAX has an outdoor sky deck featuring a bar that rivals any trendy rooftop bar.

Priority Pass Select membership: Is it worth it?

While Priority Pass Select membership can enhance your airport experience, overcrowding means it’s not always the sanctuary it once was. Make the most of your Priority Pass Select membership by being strategic, planning ahead and understanding the limitations.

Because lounge quality varies so dramatically by airport, check reviews of your home airport’s lounge to see how it stacks up — and to help decide if pursuing Priority Pass membership is a worthwhile endeavor.

To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page.

To view rates and fees of the American Express Platinum Card®, see this page.

To view rates and fees of The Business Platinum Card® from American Express, see this page.

To view rates and fees of The Hilton Honors American Express Business Card, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles