How Length of Credit History Affects Your Credit Scores

How long you've had credit affects your score. But paying on time and not using a lot of your limit matter more.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Whether you’ve had credit for six months or 20 years can make a difference in your credit scores.

A long track record without any major slip-ups suggests that your credit behavior will be similar in the future — and lenders and credit card issuers like that.

How does length of credit history affect credit scores?

Credit scoring company VantageScore combines two things in its scoring models — how long you’ve been using credit and what types of credit you have — into a single factor and considers it “highly influential.”

FICO credit scores break it out a little differently, with the length of your credit history accounting for 15% of your score and the mix of accounts making up 10%.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

Length of credit history vs. credit age

The "length of credit history" means how long any given account has been reported open, says Rod Griffin, senior director of consumer education and advocacy for Experian, one of the three major credit bureaus.

“Generally, the longer an account has been open and active, the better it is for the credit score," Griffin says. "That’s particularly true for an account with a positive payment history that has no delinquency.”

The credit scoring algorithms calculate the average of how long all your accounts have been open. That average age of accounts is your “credit age.”

It’s all but impossible to get a score higher than 800 if you’re young, because your credit age likely will be low.

What’s a good credit history length?

While credit bureaus and scoring companies don’t define exactly what counts as a “good” length of credit history, having at least a few years under your belt is helpful. In general, longer is better.

It can take decades to reach the highest credit score. FICO has reported that most people with an 850 score have lengthy credit histories, with their oldest account being 30 years old on average.

Credit age matters, but other factors matter more

While credit age matters for credit scoring purposes, the only thing you can do about it is to keep your credit accounts in good standing and avoid closing credit cards unnecessarily.

Being an authorized user on an old, established account in which the primary cardholder has excellent credit may help your score a little, but the passage of time during which you build or maintain good credit helps the most.

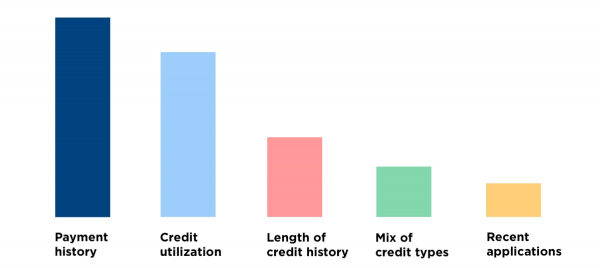

Keep length of credit history in perspective, though: It’s only one element influencing your credit scores, and not the most important one at that. Here's a breakdown of the factors that affect your credit scores:

The biggest effects on your credit scores come from:

- Payment history — making sure that you pay all bills on time.

- Credit utilization — using no more than 30% of your credit limits, and less is better.

If you use credit regularly and lightly, and pay your bills on time every month, you’re doing the two essential things to have a good credit score. Sit tight and the average age of accounts will take care of itself.

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Related articles