Average Credit Score by Age: Where Do You Stand?

Credit scores typically rise with age, but the “good” range — any score from the mid-600s to mid-700s — stays the same no matter how old you are.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Credit scoring companies don’t consider age when assigning scores, although age can have an indirect effect on a person's score. The length of a person's credit history and the number and types of credit accounts are just a few credit scoring factors that correlate with age.

Here’s a look at the average credit scores by age. See how your scores compare and learn more about how to take your credit to the next level.

What is the average credit score by age?

There isn’t just one average credit score for every age because many different credit scoring models exist. These are the averages for the two most popular models, FICO 8 and VantageScore 3.0, according to the score providers.

Average FICO 8 score by age

Here’s the breakdown of FICO 8 scores by age range as of April 2025:

| Age group | Average FICO 8 score |

|---|---|

| 18-29. | 678 |

| 30-39. | 688. |

| 40-49. | 702. |

| 50-59. | 721. |

| 60+. | 752. |

Scores get progressively higher with each age group.

Average VantageScore 3.0 score by age

VantageScore 3.0 data from October 2025 is on par with FICO’s. Younger generations have lower average scores than older generations.

| Age group | Average VantageScore 3.0 score |

|---|---|

| Gen Z (1997+). | 667. |

| Millennial (1981-1996). | 678. |

| Gen X (1965-1980). | 699. |

| Baby boomer (1946-1964). | 741. |

| Silent (1928-1945). | 752. |

While FICO and VantageScore take different approaches to age groupings — one uses roughly 10-year age ranges while the other uses broader generational ranges — the average scores for specific ages are similar to one another. For example, the average score for a 25-year-old is 678 and 667, respectively.

Stress less. Track more.

See the full picture: savings, debt, investments and more. Smarter money moves start in our app.

What is the average credit score overall?

The average FICO 8 credit score is 715, as of September 2025 . The average VantageScore 3.0 score is 702, as of March 2025 . Only adults in the two oldest age groups have average scores above these numbers, but the other groups aren’t too far behind.

How to check your credit score

Checking your credit score yourself is free and will not harm your score. You can get a free credit score through NerdWallet and many other financial websites. You might also find your credit score on your monthly bank statement or by logging in to your banking account.

Does age affect your credit score?

Your credit scores are not directly impacted by how old you are. Credit scoring companies don’t include ages in their calculations. However, age can play an important role in shaping your scores.

Length of credit history

The length of your credit history is one of the biggest factors that make up your credit scores. The longer an account has been open, the better, because it gives lenders more information to go off of when assessing risk.

Theoretically, your credit scores should get higher as you get older because the age of your credit accounts increases each year. However, if you close an account — particularly one with a high credit limit or that you’ve had for a long time — it could set you back.

Thin credit files

Younger adults are more likely to have thin credit files, meaning fewer accounts or credit types. Scoring models reward people with a mixture of revolving and installment credit. For example, having credit cards, an auto loan and a mortgage is better for your score than having only credit cards.

However, your record of paying bills on time and spending responsibly have a much stronger impact. Stumbles that drag down scores such as missing payments or a high credit utilization ratio can happen to anyone, young or old.

What is a good credit score for any age?

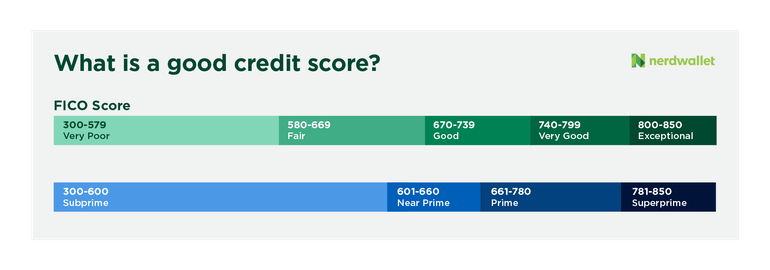

You might consider your score to be good if it meets or exceeds the average for your peers, but that isn’t the best gauge. Here's how FICO and VantageScore measure what's good.

FICO’s "good" range is 670-739, and scores between 740 and 799 are considered "very good" by the popular scoring company. VantageScore’s good range, which it labels “prime,” includes scores between 661-780.

A score that falls below these ranges is still good if it helps you do what you need or want to do, such as open a new credit card or rent the apartment you like.

Ways to build good credit

It’s normal for credit scores to go up and down, but if your score drops into an undesirable range, there are strategies you can try to help it:

- Check your credit reports to learn what may be causing the drop in your score and dispute any errors with the credit bureaus.

- Spend cautiously and pay your balances frequently to keep your credit utilization as low as possible. This might mean not waiting until your bill is due to pay off your balance but, instead, making smaller payments every other week.

- Set reminders or set up automatic payments on your credit accounts to ensure you pay bills on time.

- Ask your issuer for an increased credit limit. A larger credit limit drives your credit utilization down because now you have more available credit to your name. If your issuer doesn't approve the increase, consider adding a new card to the mix. Just be sure to space out your credit applications — every six months is a safe distance — to protect your score.

Credit scores, while important, are just one part of your financial picture. Broader financial health involves how you're positioned to manage financial stressors, as well as whether you're on track to meet financial goals.

» NEXT: Get your free credit report from NerdWallet

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

- 1. FICO. FICO Releases Inaugural FICO Score® Credit Insights Report Highlighting Major Shifts in Consumer Credit. Accessed Dec 5, 2025.

- 2. VantageScore. Consumers Show Discipline with Credit Balances; Average VantageScore Back to 702. Accessed Dec 5, 2025.

On this page

Related articles