Gift Tax: How It Works, 2025 and 2026 Exclusions and Limits

What kind of tax advice do you need?

✨ Get matched to a financial advisor for free

Powered by NerdWallet Advisory LLC

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is the gift tax?

The gift tax is a federal tax on transfers of money or property to other people who are getting nothing or less than full value in return. Two factors determine how much you can give away before owing taxes on the gifted amount: the annual gift tax limit and the lifetime gift tax limit.

Gift tax limit 2025 and 2026

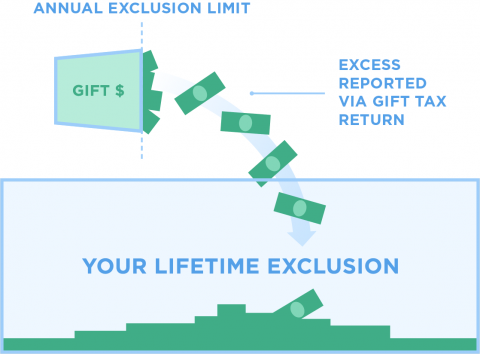

Exceeding the annual gift tax exclusion doesn't mean you have to pay a gift tax — it just means you need to submit IRS Form 709 to disclose the gift on what's known as a gift tax return. The amount of your contribution that exceeds the annual limit will then be subtracted from your larger lifetime gift tax exclusion (more on this later).

The annual gift tax exclusion is $19,000 in 2025 and 2026. Since this amount is per person, married couples get double the gift tax limit. This is the maximum you can give a single person without having to report it to the IRS.

How the gift tax exclusion works

The annual gift tax exclusion is a set dollar amount that you may give to someone without reporting it to the IRS. If you give away more than the annual exclusion amount in cash or assets (for example, stocks, land, a new car) to any one person during the tax year, you will need to file a gift tax return in addition to your federal tax return the following year.

The annual exclusion is per recipient, not the sum total of all your gifts. That means, for example, that you could gift $19,000 in 2025 and 2026 to your cousin, another $19,000 in 2025 and 2026 to a friend, another $19,000 in 2025 and 2026 to a neighbor, and so on without having to file a gift tax return.

If you’re married, you and your spouse could each give away $19,000 in 2025 and 2026 without needing to file a gift tax return. If you want to combine your annual exclusions to give someone a gift, you can choose to take advantage of "gift splitting".

Gifts between spouses are unlimited and generally don’t trigger a gift tax return. Although, if the spouse isn't a U.S. citizen, special rules may apply.

Know what counts. Gifts to qualified nonprofits are charitable donations, not gifts.

What's the difference? Gift tax vs. inheritance tax

It can be complicated, but the difference mainly comes down to timing. Here's a quick breakdown of how the two taxes generally work:

Gift tax: Assets you transfer to another person while you're alive can be considered gifts. If the value of the transfer exceeds the annual gift limit, you may need to file a gift tax return (but not necessarily pay taxes unless you exceed your lifetime gifting limit). The person who received the gift pays capital gains taxes if they later sell that asset for a profit.

Inheritance tax: Assets you bequeath to another person after your death are considered inherited. The person who inherits the assets is responsible for paying inheritance tax on the transfer, if applicable. There is no federal inheritance tax, but five states have inheritance taxes. The bill depends on the value of the transfer and the inheritor's relationship to you. The inheritor may owe capital gains taxes if they sell the assets later for a profit.

We’ll create a financial plan that looks at your cash flow needs, financial goals and estate plan to build your personalized gifting approach, so you can help the people you care about while staying on track for your own future.

NWWP is an SEC-registered investment adviser. Registration does not imply skill or training. Please see NWWP website for disclosures and important information.

What is the lifetime gift tax exemption?

In addition to the annual gift tax exclusion, you get a lifetime gift tax exclusion. Any amount you give over the annual limit is subtracted from your larger lifetime limit. Once you've gifted over your lifetime amount, you may begin to owe taxes.

The gift tax return that you need to file if you exceed the annual limit simply keeps track of that lifetime exclusion. So if you don't gift anything during your life, then you have your whole lifetime exclusion to use against your estate when you die.

“Think about buckets or cups,” says Christopher Picciurro, a certified public accountant and co-founder of accounting and advisory firm Integrated CPA Group in Michigan. Any excess over the annual limit “spills over” into the lifetime exclusion bucket.

Lifetime gift tax exemption amounts for 2025

The lifetime gift tax exemption is equal to the federal estate tax exemption. The federal estate tax ranges from 18% to 40% and generally only applies to assets over $13.99 million in 2025 or $15 million in 2026.

Lifetime gift tax exemption example

If you gave your brother $50,000 in 2025, you used up your annual exclusion. The bad news is that you’ll need to file a gift tax return , but the good news is that you probably won’t pay a gift tax. Why? Because the extra $31,000 ($50,000 - $19,000) simply counts against your lifetime exclusion. If you give your brother another $50,000 this year, the same thing happens: you use up your annual exclusion and whittle away another portion of your lifetime exclusion.

» MORE: Learn how estate tax works

What is the gift tax rate?

The gift tax rate ranges from 18% to 40%. Of course, there are exceptions and special rules for calculating the tax, so check the instructions for IRS Form 709 for all the details.

We’ll create a financial plan that looks at your cash flow needs, financial goals and estate plan to build your personalized gifting approach, so you can help the people you care about while staying on track for your own future.

NWWP is an SEC-registered investment adviser. Registration does not imply skill or training. Please see NWWP website for disclosures and important information.

Common gift tax return triggers

Sharing is caring, but some situations inadvertently lead to a gift tax return, pros say.

Gifting large sums of money to family

If grandparents put, say, $40,000 in a 529 plan for a grandchild, that may trigger the gift tax exclusion because it's over the limit.

A special rule allows gift givers to spread one-time gifts across five years’ worth of gift tax returns to preserve their lifetime gift exclusion.

» MORE: Learn how inherited IRAs work

Paying for vacations, cars or other stuff

If you gift your child $40,000 to help with wedding costs or offer to pay for an expensive honeymoon, this could trigger a gift tax return.

If you’re paying tuition or medical bills, paying the school or hospital directly can help avoid the gift tax return requirement (see the instructions to IRS Form 709 for details).

Giving a laid-back loan

Lending money to friends and family can be tricky, and the IRS can make it even worse. It considers interest-free loans as gifts. Or, if you lend them money and later decide they don't need to repay you, that's also a gift.

Setting up joint bank accounts

“Let’s say you live near Grandma, so for convenience, we're going to put you on Grandma's bank account. Guess what just happened?” Picciurro says. “If you're put as a joint [owner] on a bank account with somebody and you have the right to take the money out at any time, essentially Grandma is giving you a gift.” This applies to joint accounts when the other owner is not your spouse.

» Need more guidance? See our roundup of the year's best financial advisors

SoFi Checking and Savings Member FDIC |  CIT Bank Platinum Savings Member FDIC |  Citizens Access Savings Member FDIC |

|---|---|---|

APY3.30% With $0 min. balance for APY | APY3.75% With $5,000 min. balance for APY | APY3.15% With $0.01 min. balance for APY |

Bonus$300 Requirements to qualify | BonusN/A | BonusN/A |

Frequently asked questions

Who pays the gift tax?

The giver, not the recipient, typically pays the gift tax. According to the IRS, money or property that is transferred to another person without receiving anything in exchange is a gift.

However, if the assets later produce income (such as interest or dividends), the recipient will generally have to pay taxes on that income. Also, keep in mind that while there is no federal inheritance tax, some states may impose their own.

Is the gift tax deductible?

Gifts of cash or property to family or friends are not tax-deductible. Only charitable donations to qualified nonprofits may be tax-deductible.

ON THIS PAGE

ON THIS PAGE