Tax Planning: 7 Tax Strategies and Concepts to Know

Know your bracket, how key tax ideas work, what records to keep and basic steps to shrink your tax bill.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Tax planning is the analysis and arrangement of a person's financial situation to maximize tax breaks and minimize tax liabilities legally and efficiently.

Tax rules can be complicated, but taking some time to know and use them for your benefit can change how much you end up paying (or getting back) when you file. Here are some key tax planning and tax strategy concepts to understand.

1. Understand your tax bracket

You can’t really plan for the future if you don’t know where you are today. So the first tax planning tip is to figure out what federal tax bracket you’re in.

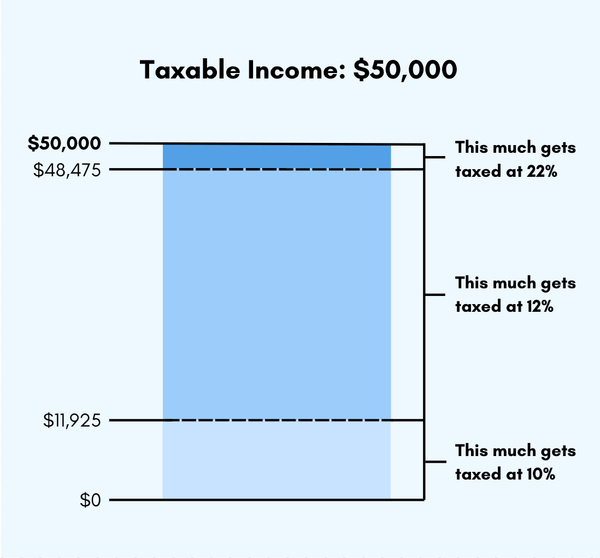

The United States has a progressive tax system. That means people with higher taxable incomes are subject to higher tax rates, while people with lower taxable incomes are subject to lower tax rates. There are seven federal income tax brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

No matter which bracket you're in, you probably won’t pay that rate on your entire income. There are two reasons:

The highest tax rate you'll pay is determined by your taxable income, which takes into account tax deductions. That’s why your taxable income usually isn’t the same as your salary or total income.

You don’t just multiply your taxable income by a tax rate. Instead, the government divides your taxable income into chunks and then taxes each chunk at the corresponding rate.

For example, let’s say you’re a single filer with $50,000 in taxable income. That puts you in the 22% tax bracket for the 2025 tax year (taxes filed in 2026). But do you pay 22% on all $50,000? No. Actually, you pay only 10% on the first $11,925, 12% on the amount between $11,926 and $48,475, and 22% on the remaining amount.

2. The difference between tax deductions and tax credits

Tax deductions and tax credits may be the best part of preparing your tax return. Both reduce your tax bill but in different ways. Knowing the difference can create effective tax strategies that reduce your tax bill.

Tax deductions are specific expenses you’ve incurred that you can subtract from your taxable income. They reduce how much of your income is subject to taxes.

Tax credits are even better — they give you a dollar-for-dollar reduction in your tax bill. For instance, a tax credit valued at $1,000 lowers your tax bill by $1,000.

$10,000 tax deduction | $10,000 tax credit | |

Your AGI | $100,000 | $100,000 |

Tax deduction | –$10,000 | |

Taxable income | $90,000 | $100,000 |

Tax rate* | 25% | 25% |

Calculated tax | $22,500 | $25,000 |

Tax credit | –$10,000 | |

Your tax bill | $22,500 | $15,000 |

*Example rate. The U.S. has a progressive tax system. | ||

3. Taking the standard deduction vs. itemizing

Deciding whether to itemize or take the standard deduction is a big part of tax planning because the choice can make a huge difference in your tax bill.

What is the standard deduction?

Basically, it's a flat-dollar, no-questions-asked tax deduction. Taking the standard deduction makes tax prep go a lot faster, which is probably a big reason why many taxpayers do it instead of itemizing.

Congress sets the amount of the standard deduction, and it’s typically adjusted every year for inflation. The standard deduction you qualify for depends on your filing status.

2025 standard deduction amounts (taxes filed in 2026)

Filing status | Deduction amount |

|---|---|

Single | $15,750. |

Married filing separately | $15,750. |

Head of household | $23,625. |

Married filing jointly | $31,500. |

Surviving spouses | $31,500. |

What does 'itemize' mean?

Instead of taking the standard deduction, you can itemize your tax return, which means taking all the individual tax deductions that you qualify for, one by one.

Generally, people itemize if their itemized deductions add up to more than the standard deduction. A key part of their tax planning is to track their deductions throughout the year.

The drawback to itemizing is that it takes longer to do your taxes, and you have to be able to prove you qualify for your deductions.

You use IRS Schedule A to claim your itemized deductions.

Some tax strategies may make itemizing especially attractive. For example, if you own a home, your itemized deductions for mortgage interest and property taxes may easily add up to more than the standard deduction. That could save you money.

You might be able to itemize on your state tax return even if you take the standard deduction on your federal return.

The good news: Tax software or a good tax preparer can help you figure out which deductions you’re eligible for and whether they add up to more than the standard deduction.

NerdWallet Wealth Partners can create a personalized plan that evolves with you, from this tax season to the next chapter. Start by answering a few questions.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

4. Keep an eye on popular tax deductions and credits

Hundreds of possible deductions and credits are available, and there are rules about who’s allowed to take them. Here are some big ones.

Tax break | What it’s generally for |

|---|---|

Costs of adopting a child. | |

College education costs. | |

Losses on stock sales (to offset capital gains). | |

Giving money, cars, art, investments, household items or other things to charity. | |

Day care and similar costs. | |

Being a parent or caretaker with an eligible dependent. | |

For people or their spouses who retired on permanent and total disability. | |

Money for people below certain adjusted gross incomes. | |

Tax credit for people who purchase qualifying hybrid and electric vehicles. | |

A portion of your mortgage or rent; property taxes; utilities, repairs and maintenance; and similar expenses if you work from home. | |

Undergraduate, graduate or even non-degree courses at accredited institutions. | |

Unreimbursed medical costs over a certain threshold. | |

The interest portion of mortgage payments on a primary home. | |

Installing things that make a home energy-efficient. | |

Contributions to an IRA for people with incomes below certain thresholds. |

Note: The residential energy tax credits and EV tax credit have expired, but you can still claim them on your 2025 tax return if your qualifying purchase was before a specific date. Visit our related articles for more detailed information.

The more you earn, the more complex your taxes become. Learn the 10 traps to dodge.

on NerdWallet Wealth Partners' site. For informational purposes only. NerdWallet Wealth Partners does not provide tax or legal advice.

5. Know what tax records to keep

Keeping tax returns and the documents you used to complete them is critical if you’re ever audited. Typically, the IRS has three years to decide whether to audit your return, so keep your records for at least that long. You also should hang on to tax records for three years if you file a claim for a credit or refund after you've filed your original return.

Keep records longer in certain cases — if any of these circumstances apply, the IRS has a longer limit on auditing you:

Six years if you underreported your income by more than 25%.

Seven years if you wrote off the loss from a “worthless security.”

Indefinitely if you committed tax fraud or didn’t file a tax return.

Category | Items |

|---|---|

Income |

|

Expenses & deductions |

|

Home |

|

Retirement accounts |

|

Other investments |

|

» MORE: Reasons the IRS might audit you

6. Tweak your W-4

A W-4 tells your employer how much tax to withhold from your paycheck. Your employer remits that tax to the IRS on your behalf.

Here's how to use the W-4 for tax planning.

If you got a huge tax bill when you filed and don’t want to relive that pain, you may want to increase your withholding. That could help you owe less (or nothing) next time you file.

If you got a huge refund and would rather have that money in your paycheck throughout the year, do the opposite and reduce your withholding.

You probably filled out a W-4 when you started your job, but you can change your W-4 at any time. Just download it from the IRS website, fill it out and give it to your human resources or payroll team at work. You may also be able to adjust your W-4 directly through your employment portal if you have one.

7. Tax strategies to shelter income or cut your tax bill

Deductions and credits are a great way to cut your tax bill, but there are other tax planning strategies to know. Here are some popular ones.

Put money in a 401(k)

Your employer might offer a 401(k) plan that gives you a tax break on money you set aside for retirement.

The IRS doesn’t tax what you divert directly from your paycheck into a traditional 401(k).

In 2026, you can funnel up to $24,500 per year into an account. If you’re 50 or older, you can contribute up to $32,500. People ages 60 to 63 can contribute up to $35,750 because of the Secure 2.0 Act.

While these retirement accounts are usually sponsored by employers, self-employed people can open their own 401(k)s.

If your employer matches some or all of your contribution, you’ll get free money to boot.

Put money in an IRA

Outside of an employer-sponsored plan, there are two major types of individual retirement accounts: Roth IRAs and traditional IRAs.

You have until the tax deadline to fund your IRA for the previous tax year, which gives you extra time to do some tax planning and take advantage of this strategy.

The tax advantage of a traditional IRA is that your contributions may be tax-deductible. How much you can deduct depends on whether you or your spouse is covered by a retirement plan at work and how much you make. You pay taxes when you take distributions in retirement (or if you make withdrawals prior to retirement).

The tax advantage of a Roth IRA is that your withdrawals in retirement are not taxed. You pay the taxes upfront, so your contributions are not tax-deductible.

Earnings on your investments grow tax-free in a Roth and tax-deferred in a traditional IRA.

This table illustrates these accounts in action.

Open a 529 account

These savings accounts, operated by most states and some educational institutions, help people save for college.

You can’t deduct contributions on your federal income taxes, but you might be able to on your state return if you’re putting money into your state’s 529 plan.

There may be gift tax consequences if your contributions plus any other gifts to a particular beneficiary exceed $19,000 in 2026.

» MORE: Learn more about how 529s work

Fund your flexible spending account (FSA)

If your employer offers a flexible spending account, you can take advantage of it to lower your tax bill. The IRS lets you funnel tax-free dollars directly from your paycheck into your FSA every year. In 2026, the limit is $3,400.

You’ll have to use the money during the calendar year for medical and dental expenses, but you can also use it for related everyday items such as bandages, sunscreen and glasses for yourself and your qualified dependents. You may lose what you don’t use, so take time to calculate your expected medical and dental expenses for the coming year.

Some employers might let you carry over up to $680 to the next year.

Use dependent care flexible spending accounts (DCFSAs)

This FSA, with a twist, is another handy way to reduce your tax bill — if your employer offers it.

The IRS will exclude up to $7,500 of your pay that you have your employer divert to a dependent care FSA account, which means you’ll avoid paying taxes on that money. That can be huge for parents, because before- and after-school care, day care, preschool and day camps are usually allowed uses. Elder care may also be included.

What’s covered can vary among employers, so check out your plan’s documents.

Maximize health savings accounts (HSAs)

Health savings accounts are tax-exempt accounts you can use to pay medical expenses.

Contributions to HSAs are tax-deductible, and the withdrawals are tax-free, too, so long as you use them for qualified medical expenses.

If you have self-only high-deductible health coverage, you can contribute up to $4,400 in 2026. If you have family high-deductible coverage, you can contribute up to $8,750 in 2026. If you're 55 or older, you can put an extra $1,000 in your HSA.

Your employer may offer an HSA, but you can also start your own account at a bank or other financial institution.

ON THIS PAGE

ON THIS PAGE