TurboTax Review 2025: Best Overall Tax Software

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

TurboTax is generally pricier than other tax software. Confident filers may not need all the bells and whistles that most TurboTax online products offer, but some people may find the streamlined program and the availability of human help worth the extra cost.

We’ve long praised TurboTax for its design and user experience. This year, we've rated TurboTax as the best tax software provider overall. They topped our list as the best for free filers, best for overall filing experience and best for ease of use.

TurboTax's prices

TurboTax has a lot going for it, but price isn’t on that list. The paid packages — the Deluxe and Premium — fall on the more costly end of the spectrum. Some people may not need support beyond TurboTax’s excellent user interface, but those who want a bit of extra help from a tax pro will need to upgrade to another package type — Live Assisted.

Just as with other providers we review, the free version is limited in what it can support, so it may not be a good fit for people with complex tax situations.

TurboTax's free version

TurboTax offers a free version that lets you file a Form 1040 and claim limited tax credits. Roughly 37% of taxpayers qualify.

The free package is designed for people with fairly simple tax returns. It won't handle itemized deductions or the full Schedule 1, 2 or 3 of Form 1040, but it can handle W-2 income, basic credits like the child tax credit and the earned income credit and student loan interest deduction.

| |

FREE | $0 + $0 per state filed. It allows you to file a 1040 for free, but you can’t itemize or file full Schedules 1, 2 or 3. Roughly 37% of taxpayers are eligible. TurboTax Free Edition supports a simple Form 1040 and no schedules except for the earned income tax credit, child tax credit and student loan interest. |

TurboTax paid packages

If you plan to deduct mortgage interest, report business or freelance income, or report stock sales or income from a rental property, you’ll have to select a higher-tiered package. The list price of those paid DIY programs — the Deluxe and Premium tiers — is routinely on the higher end of the spectrum, especially when adding the cost of a state return. And if you want access to human help, you’ll need to upgrade to the Live Assisted versions, which costs even more.

You may notice that, unlike other providers, TurboTax doesn’t have a standalone Self-Employed DIY package. That’s because, in recent years, the company consolidated its Premier package (for investors) and Self-Employed package (for freelancers) into that "Premium" package.

| |

PAID PACKAGES | Deluxe $79 + $64 per state. Itemize and claim several tax deductions and credits. Works well for business income but no expenses. Premium $139 + $64 per state. Investment reporting and rental income (Schedules D and E, and K-1s), plus business income, expenses on a Schedule C, home office deductions and features for freelancers. Access to tax pro support requires upgrading to TurboTax's Live Assisted packages, which range from $79 to $209, plus state fees of $59 to $69. Promotion: NerdWallet users can save up to an additional 10% on TurboTax. |

One note about prices: Providers frequently change them. Discounted services and packages may be available toward the beginning of the tax filing season, but these markdowns tend to be replaced with surge pricing closer to the tax filing deadline. You can verify the latest price by clicking through to TurboTax’s site.

TurboTax also offers desktop software, where your return doesn't reside in the cloud, but it’s not part of our review.

How we nerd out testing DIY tax software 🤓

Our reviewers — who are writers and editors on NerdWallet’s content team — do hands-on testing of every online DIY tax program featured in our analysis. By using these programs ourselves, we can provide detailed insights into the user experience.

We evaluate each tax software based on specific features and the actual experience of filing taxes using those features. This includes but is not limited to analyzing navigation, ease of accessing help, available import options and the quality of contextual guidance provided to users.

To ensure fairness and eliminate bias, our team collaborates to compare user experiences across products. Scoring is based on clearly defined criteria, which are weighted equally in the overall score. This approach ensures a balanced and reliable assessment of each tax software product.

TurboTax's ease of use

How it works

TurboTax’s interface is like a chat with a tax preparer. If you’re a new user, you’ll be asked to confirm a series of tax situations — such as whether you have dependents, donated to charity, received unemployment income or sold crypto or stocks during the last tax year — to determine which of TurboTax’s packages will best suit your specific situation. You’ll get a chance to confirm that the package you’re recommended is the one you would like to choose before you move on.

If you’re a returning user, information from the previous tax year will be preloaded into the program. You’ll be asked about life changes that occurred in the last year that might affect your tax picture, such as if you bought a new home or started freelancing.

Once you start working on your return, TurboTax will run you through a series of Q&A-style and fill-in-the-blank questions and import documents (e.g., W-2, 1099s) automatically where possible to eliminate time-consuming manual entry.

TurboTax’s interface shines here. Questions are friendly and phrased simply. Tax jargon is kept to a minimum, and all users — regardless of package type — can take advantage of the Intuit Assist function, which can field a wide variety of technical and tax questions or point you to resources for more help. This makes the process of filing your taxes generally seamless — the program never drops the curtain between you and the IRS forms. You simply answer questions, and your return gets filled in behind the scenes.

Nerd Tip 🤓

If you accidentally start working with a higher-tiered package, say the Premium version, and then realize the lower-tiered Deluxe might suit your needs, you’ll have to downgrade products. Thanks to an FTC ruling, this process is becoming much less cumbersome.

According to the provider, the easiest way to downgrade with TurboTax is to click the “Switch Products” button in the side panel of your return, which you can do in the browser without having to contact customer service. But note that you won’t be able to downgrade if you've already submitted a credit card payment.

A nice plus? When you downgrade, any information you’ve already plugged in will transfer, which means you don’t have to start from scratch. You can find more information on downgrading here.

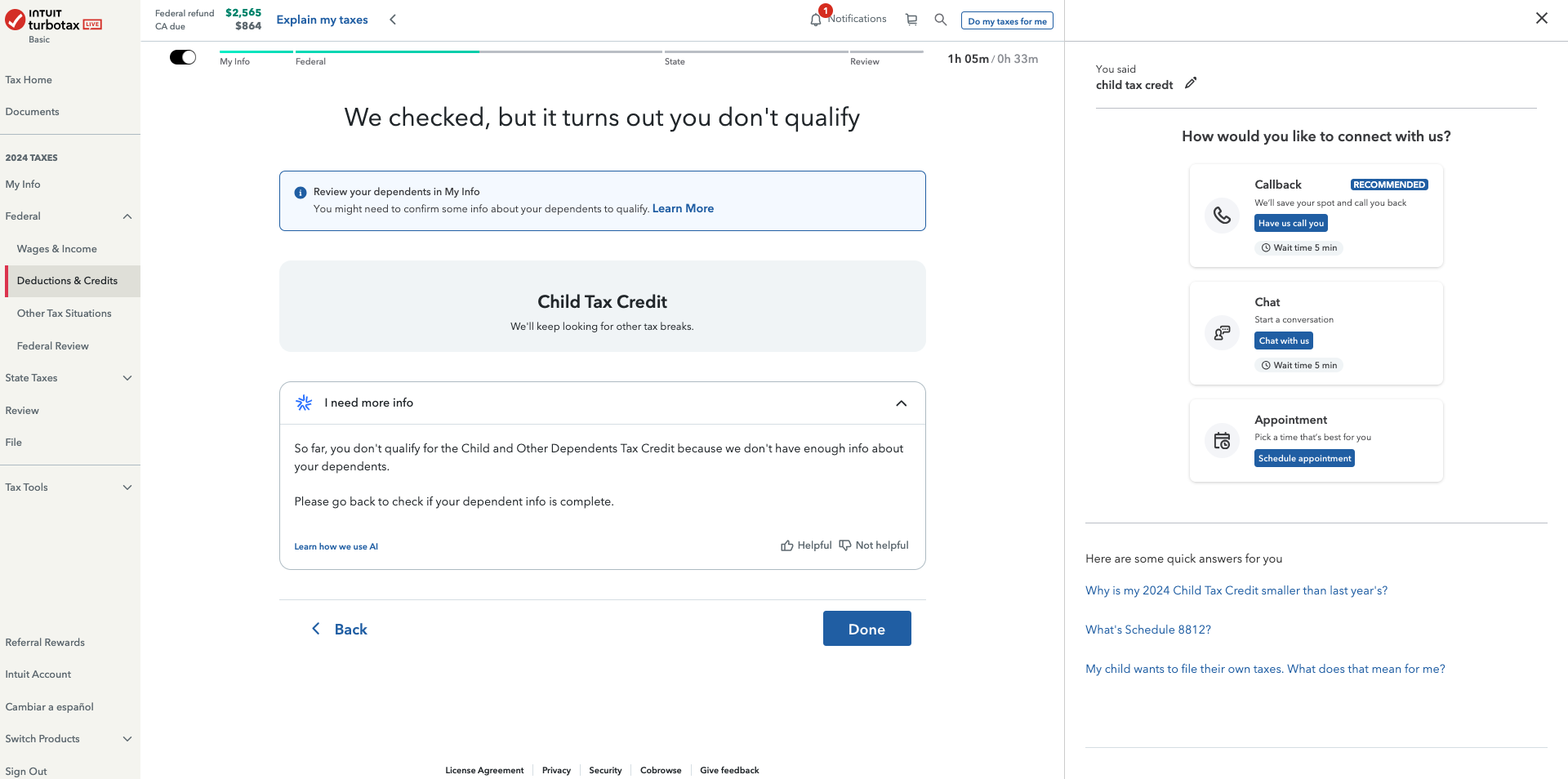

What it looks like

One of TurboTax’s most notable features is its contextual help in the form of videos, expandable sidebar information, and embedded links throughout the program that offer tips, explainers and other resources. Help buttons can also connect you to the searchable knowledge base, on-screen help and more.

As you make your way through the return, a banner running along the side keeps track of where you stand in the process and flags areas you still need to complete. You can also skip around if you need to — which is helpful if you want to get started on parts of your return but aren’t ready to fill out everything just yet.

A refund estimator is present on all pages. Not only does it tally up your estimated bill or refund, but it also provides a detailed breakdown of what factors are currently affecting it. We like that this helps you get insight into your full tax picture.

Editor's Note (Feb. 24): Some users have reported being unable to access the refund tracker until later in the filing process. We've reached out to TurboTax for comment, and they confirmed this is part of a known test. Per the provider, a majority of users should still be able to access and view the refund tracker, regardless of which stage of the return they are completing.

TurboTax also offers a “RaceMode” banner that times how long it takes you to finish your return. However, if you find the banner distracting, you can opt to turn off the function.

TurboTax's features

You can switch from another provider: TurboTax imports electronic PDFs (not scans of hard copies) of tax returns from H&R Block, TaxAct, TaxSlayer, Liberty Tax/Tax Brain and ezTaxReturn.

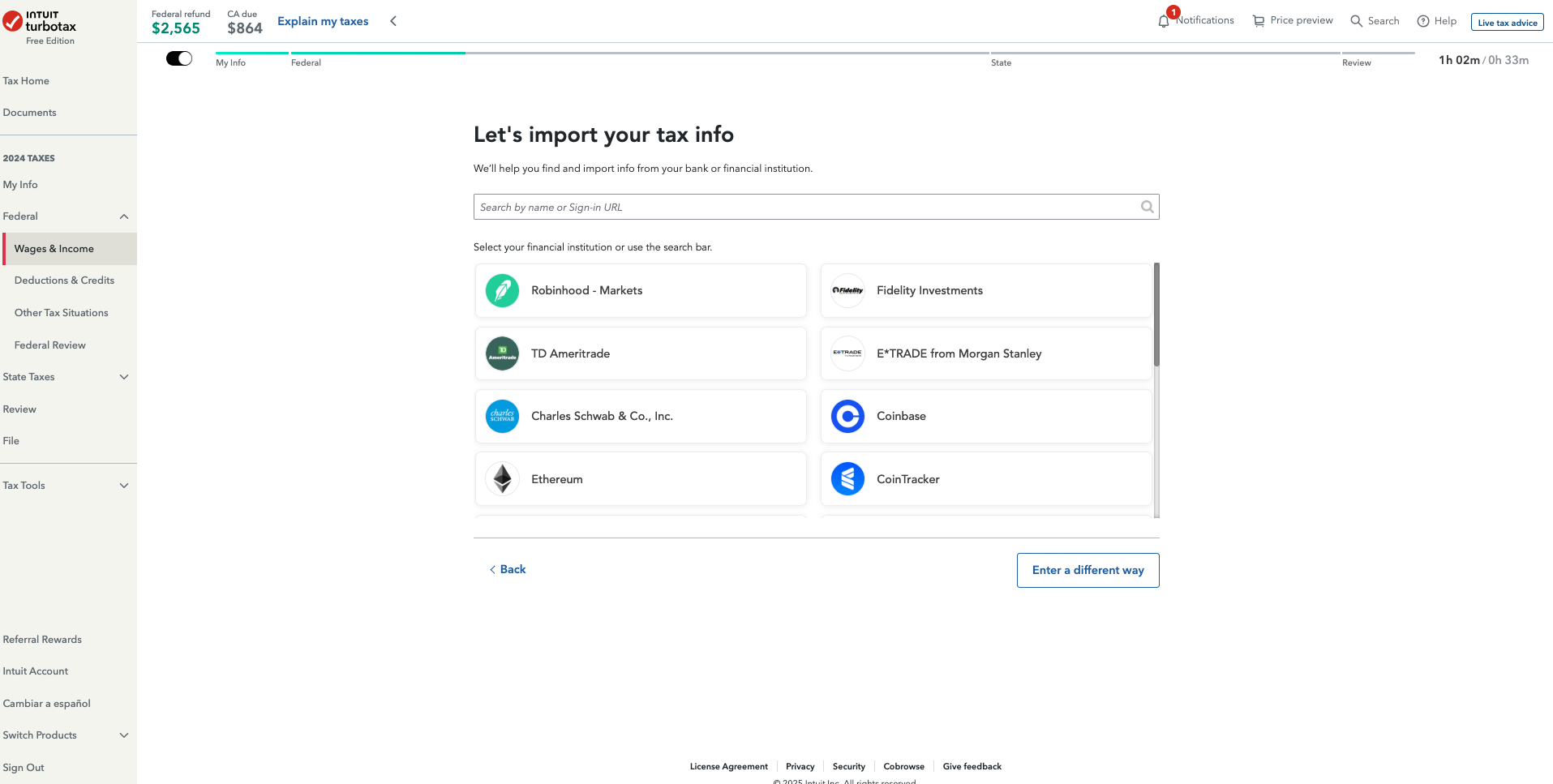

Auto-import certain tax documents: You can automatically import W-2 information from your employer if it's partnered with TurboTax, but you can also take a picture of your W-2 and upload it to transfer the data to your return. The Premium version also lets you upload 1099-NECs and 1099-Ks from clients via photo, as well as import income and expenses from Square, Uber and Lyft. TurboTax also boasts a large number of import partners (review them here).

Crypto support: TurboTax’s Premium package eliminates one of the biggest pain points for cryptocurrency investors — manual entry. Users can import up to 20,000 crypto transactions at once.

Donation calculator: The Deluxe and Premium packages integrate ItsDeductible — a feature and standalone mobile app — that’s helpful for quickly finding the deduction value of donated clothes, household items and other objects.

Platform mobility: Like many other providers, TurboTax lets you access and work on your return across devices: on your computer via the website or on your phone or tablet.

Spanish language support: New this year, TurboTax allows users of its online products to complete their taxes in Spanish if preferred.

TurboTax's human tax help

TurboTax Live Assisted

One of TurboTax’s most notable tax help options is TurboTax Live Assisted. It’s a service that you can add to every package for an additional fee, and it gets you screen sharing, phone or chat access to tax pros who can help you with questions that arise as you fill out your return. From Jan. 29 through the April tax filing deadline, you can schedule a chat with a tax pro seven days a week, from 5 a.m. to 9 p.m. Pacific time.

Taxpayers are matched with a pro based on the question they have, and you can request a new tax pro if you’re not satisfied with the one assigned to you. According to TurboTax, its pros are either tax experts or TurboTax employees who have gone through vetting and internal training. Once you’re connected with your pro, you’ll also get to see their credentials. The Live Assisted option also gets you a final review with a tax pro before you file.

TurboTax Live Full Service

TurboTax also offers Live Full Service, which does away with tax software altogether. Instead, you upload your tax documents and a human puts together your tax return. You’ll be matched with a tax preparer, meet on a video or phone call before they begin working, and then you’ll meet again when your return is ready for review. The preparer files the return for you, and if you choose to use Full Service next year, you can even request to work with the same tax pro if they’re available.

Live Full Service starts at $129. Per the company, this base price includes a W-2 and 1040. The state fee is additional. The final price of Live Full Service may vary based on your actual tax situation and forms used or included with your return.

Intuit TurboTax Verified Pro

For the second year in a row, TurboTax will give some Full Service filers the option to work with a local tax pro in person if they prefer face-to-face help. The company says the local pro is vetted by Intuit, but beware that you’ll be venturing outside the TurboTax world. This means the pro may have different work hours, and the services they offer may be different from those advertised by TurboTax. For people who would prefer full-service, in-person prep from a tax pro working directly within a stricter provider network, H&R Block’s offices might be a better fit.

What the Nerds think 🤓

Sabrina Parys, editor/content strategist

"TurboTax’s user experience is smooth, intuitive and well designed. Importing documents is straightforward, and the interface provides step-by-step guidance, so you’re never left unsure of what to do next. I sometimes need more time to work on a section before I’m ready to finish it, so the ability to move between different parts of your return without losing momentum is incredibly useful. The refund tracker offers a detailed breakdown of your numbers, giving you a clear understanding of how your refund or bill is calculated — helpful for both beginners and experienced filers.

"TurboTax also demonstrates how AI can be genuinely helpful. The Intuit Assist feature provides easy access to information, blog posts and the company's extensive community support pages. I’ve found it to be a handy tool to turn to whenever you have questions or need more clarity on a topic."

TurboTax's customer support options

Here are some of the various ways you can find answers and guidance when filing your return with TurboTax.

Ways to get help

General guidance: Searchable knowledge base, forums, calculators and video tutorials are helpful for research on the fly.

Tech support: TurboTax also has an online support page that covers basic questions taxpayers may have about the product or their return, as well as a community forum. Paid packages get access to a TurboTax specialist as well as phone support.

Intuit Assist: TurboTax’s digital chatbot, powered by AI, is available to all filers, regardless of package type.

TurboTax's audit support

Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software. First, be sure you know the difference between "support" and "defense." With most providers, audit support (or "assistance") typically means guidance about what to expect and how to prepare — that’s it. Audit defense, on the other hand, gets you full representation before the IRS from a tax professional.

TurboTax gives everyone free audit support from a tax pro to help you understand what’s going on if you get that dreaded letter about your tax return; if TurboTax can’t connect you with a pro, you’ll get a refund, or $30 if you used the Free Edition. If you want someone to represent you in front of the IRS, you’ll need TurboTax’s audit defense product, called MAX. It runs an extra $39.99 and includes features such as identity theft monitoring, loss insurance and restoration help.

TurboTax refund options

No matter how you file, you can choose to receive your refund in several ways:

Direct deposit to a bank account, brokerage or IRA.

Transferred to your Credit Kama Money Spend account (up to five days early).

Paper check.

Apply the refund to next year’s taxes.

Directing the IRS to buy U.S. Savings Bonds with your refund.

You also have the option of paying for the software out of your refund. But there’s usually a $40 charge to do so.

How TurboTax compares

Promotion: NerdWallet users get 20% off federal and state filing costs. | |

| |

Promotion: NerdWallet users can save up to an additional 10% on TurboTax. | |

Promotion: NerdWallet users receive 20% off federal filing costs on Classic, Premium, and Self-Employed packages with the code "Nerd20". |

These star ratings are based on a tax provider's free tier score. For more detailed scoring, see the full product details above. Providers frequently change pricing. You can verify the latest price by clicking through to each provider's site.

Bottom line: Is TurboTax right for you?

With its intuitive design and variety of human support options, TurboTax is, in many ways, the standard for the do-it-yourself tax-prep industry. However, its products come at a price, and confident filers might find that similar offerings from competitors provide a better value.

» How does TurboTax stack up against the competition? TurboTax vs. H&R Block and TurboTax vs. TaxAct

Methodology

NerdWallet’s comprehensive review process evaluates and ranks the largest online tax software providers. Our aim is to provide an independent assessment of available software to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

We collect data directly from providers, do first-hand testing and observe provider demonstrations. Our process starts by sending detailed questions to providers. The questions are structured to equally elicit both favorable and unfavorable responses. They are not designed or prepared to produce any predetermined results. The provider’s answers, combined with our specialists’ hands-on research, make up our proprietary assessment process that scores each provider’s performance.

The final output produces star ratings from poor (1 star) to excellent (5 stars). Ratings are rounded to the nearest half-star. For more details about the categories considered when rating tax software and our process, read our full methodology.

DIVE EVEN DEEPER IN TAX SOFTWARE