How to Earn Marriott Points

You can earn Marriott points through stays, credit card spending, transfers and a number of other ways.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

On this page

- Stay at Marriott hotels

- Reach elite status

- Open a Marriott credit card

- Refer a friend

- Transfer credit card points

- Convert United miles to Marriott points

- Book local experiences

- Host events and meetings at Marriott hotels

- Fly with Emirates

- Enroll in Eat Around Town

- Rent a car from Hertz

- Ride or eat with Uber

- Book a cruise

- Combine points with another Marriott member

- Purchase points

- Drink Starbucks

- How to earn Bonvoy points recapped

Marriott Bonvoy points can be redeemed at more than 8,000 hotels worldwide, making them some of the most useful hotel loyalty points on the market. But before you start redeeming Bonvoy points, you have to obtain them. When it comes to earning Marriott Bonvoy points, there are plenty of options.

Marriott Bonvoy points are worth 0.8 cent each according to NerdWallet's most recent valuation.

Below are all the ways you can earn Marriott points, with recommendations regarding the best and worst methods.

» Learn more: The complete guide to Marriott Bonvoy

Get the 'Cheat Codes' to Cheaper Travel

Unlocking the secret to saving a ton on travel is easier than you think. 📤 Our free newsletter shows you how in 5 min. or less.

Stay at Marriott hotels

The most obvious method of earning Marriott points is by staying at Marriott properties.

Marriott hotel brands

- AC Hotels.

- Aloft Hotels.

- Apartments by Marriott Bonvoy.

- Autograph Collection Hotels.

- Bulgari Hotels & Resorts.

- City Express.

- Courtyard by Marriott.

- Delta Hotels.

- Design Hotels.

- EDITION.

- Element by Westin.

- Fairfield by Marriott.

- Four Points by Sheraton.

- Gaylord Hotels.

- Homes & Villas by Marriott Bonvoy.

- JW Marriott.

- Le Méridien.

- Marriott.

- Marriott Executive Apartments.

- Marriott Vacation Club.

- Moxy Hotels.

- Protea Hotels.

- Renaissance Hotels.

- Residence Inn by Marriott.

- Ritz-Carlton Reserve.

- Sheraton.

- SpringHill Suites.

- St. Regis.

- The Luxury Collection.

- The Ritz-Carlton.

- TownePlace Suites.

- Tribute Portfolio.

- W Hotels.

- Westin.

However, the rewards earning rates aren’t the same across all Marriott brands.

You’ll earn 10 points per dollar spent at the following properties:

If you stay at the following properties, your earning rate goes down to 5 points per dollar:

- Apartments by Marriott Bonvoy.

- City Express.

- Element.

- Fairfield by Marriott Copenhagen Nordhavn (this is an exception to the Fairfield brand, which normally earns 10 Marriott points per $1).

- Four Points Express by Sheraton.

- Homes & Villas by Marriott Bonvoy.

- Protea Hotels.

- Residence Inn.

- TownePlace Suites.

Guests of the Marriott Executive Apartments will earn just 2.5 points per dollar spent.

Reach elite status

Frequent guests can reach elite status in the Marriott Bonvoy loyalty program. The more nights you stay at Marriott properties, the higher you climb up the elite ladder. With status comes an earning bonus on rewards (among other perks).

Here’s how many bonus points you’ll earn as a Bonvoy Elite member:

- Silver Elite: 10%.

- Gold Elite: 25%.

- Platinum Elite: 50%.

- Titanium Elite: 75%.

- Ambassador Elite: 75%.

For example, on a $100 hotel night (before taxes and fees) at a Westin property, you’d earn 1,100 Marriott points as a Silver Elite member (1,000 base points plus 100 bonus points), 1,250 points as a Gold Elite member, 1,500 points as a Platinum Elite member and 1,750 points as a Titanium Elite or an Ambassador Elite member.

Open a Marriott credit card

Co-branded Marriott Bonvoy credit card members can accelerate their points earning by charging purchases to their card issued by either American Express or Chase. Below are the card options, their earning rates and annual fees.

Marriott Bonvoy Bold® Credit Card

Welcome bonus: Earn 2 Free Night Awards (each night valued up to 50,000 points) after spending $1,000 on eligible purchases within 3 months of account opening with the Marriott Bonvoy Bold® Credit Card. Certain hotels have resort fees.

Earning rates:

- 3 points per $1 on Marriott purchases.

- 2 points per $1 on grocery stores, rideshare, select food delivery, select streaming and internet, cable and phone services.

- 1 point per $1 on all other purchases.

Other benefits:

- 5 Elite Night Credits per calendar year.

- Silver Elite status.

- No foreign transaction fees.

Annual fee:

Marriott Bonvoy Boundless® Credit Card

Annual fee: $95. Terms apply.

Welcome bonus: Earn 5 Free Night Awards (each night valued up to 50,000 points) after spending $3,000 on eligible purchases within 3 months of account opening with the Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Earning rates:

- 6 points per $1 on Marriott purchases.

- 3 points per $1 on grocery stores, gas stations and dining (up to $6,000 per calendar year).

- 2 points per $1 on all other purchases.

Other benefits:

- 15 Elite Night Credits per calendar year.

- Automatic Silver Elite status.

- Path to Gold Elite status after spending $35,000 on the card annually.

- Free night award every year at renewal (valued at up to 35,000 Bonvoy points).

- No foreign transaction fees.

Marriott Bonvoy Bountiful™ Card

Annual fee: $250.

Welcome bonus: Earn 85,000 Bonus Points after you spend $4,000 in purchases in your first 3 months from your account opening.

Earning rates:

- 6 points per $1 on Marriott purchases.

- 4 points per $1 on dining and grocery stores (up to $15,000 in combined purchases per calendar year, then 2 points thereafter).

- 2 points per $1 on all other purchases.

Other benefits:

- 15 Elite Night Credits per calendar year.

- Automatic Gold Elite status.

- 1,000 bonus Marriott points per paid eligible stay at Marriott properties.

- Free night award every year you spend $15,000 on the card (valued at up to 50,000 Bonvoy points).

- No foreign transaction fees.

Marriott Bonvoy Bevy® American Express® Card

Annual fee: $250 (see rates and fees).

Welcome bonus offer: Earn 85,000 Marriott Bonvoy® bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership. Terms Apply.

Earning rates:

- 6 points per $1 on Marriott purchases.

- 4 points per $1 at restaurants and U.S. supermarkets (up to $15,000 in combined purchases per calendar year, then 2 points thereafter).

- 2 points per $1 on all other eligible purchases.

- Terms apply.

Other benefits:

- 15 Elite Night Credits per calendar year.

- Automatic Gold Elite status. Enrollment required.

- 1,000 bonus Marriott points per paid eligible stay at Marriott properties.

- Free night award every year you spend $15,000 on the card (valued at up to 50,000 Bonvoy points).

- No foreign transaction fees.

- Terms apply.

Marriott Bonvoy Brilliant® American Express® Card

Annual fee: $650 (see rates and fees).

Welcome bonus offer: Earn 100,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership. Terms Apply.

Earning rates:

- 6 Marriott Bonvoy® points per $1 on Marriott purchases.

- 3 points per $1 at restaurants worldwide and on airfare.

- 2 points per $1 on all other eligible purchases.

- Terms apply.

Other benefits:

- $300 dining statement credit per year (issued in monthly increments of $25).

- 25 Elite Night Credits per calendar year.

- Automatic Platinum Elite status. Enrollment required.

- $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis.

- Global Entry / TSA PreCheck enrollment fee credit.

- Free night award every year at renewal (valued at up to 85,000 Bonvoy points).

- Priority Pass Select membership. Enrollment required.

- No foreign transaction fees.

- Terms apply.

Marriott Bonvoy Business® American Express® Card

Annual fee: $125 (see rates and fees).

Welcome bonus offer: Earn 3 Free Night Awards after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®. Terms apply.

Earning rates:

- 6 Marriott Bonvoy® points per $1 on Marriott purchases.

- 4 points per $1 at restaurants, U.S. gas stations, U.S. shipping and U.S. mobile phone services.

- 2 points per $1 on all other eligible purchases.

- Terms apply.

Other benefits:

- 15 Elite Night Credits per calendar year.

- Automatic Gold Elite status. Enrollment required.

- Free night award every year at renewal (valued at up to 35,000 Bonvoy points).

- An additional free night award after spending $60,000 on the card in a calendar year.

- No foreign transaction fees.

- Terms apply.

» Learn more: The best hotel credit cards right now

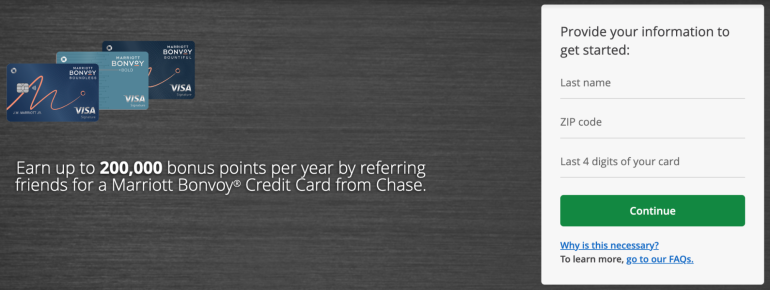

Refer a friend

If you already hold a Marriott Bonvoy credit card, an easy way to score some extra points is by referring a friend or family member for the card. Bonus values vary, but you can often get up to 40,000 points per person who gets approved for the card (annual limits apply).

Transfer credit card points

Marriott Bonvoy partners with two flexible rewards programs: American Express Membership Rewards and Chase Ultimate Rewards®. If you hold cards that earn either points currency, you can transfer points to Marriott at a rate of 1:1.

🤓 Nerdy Tip

NerdWallet values Marriott Bonvoy points at 0.8 cent apiece. However, AmEx and Chase points are usually worth at least 1 cent or more in their respective travel portals (depending on what card you have) or if you transfer to other high-value hotels or airlines. Convert United miles to Marriott points

Another point transfer option is available to United MileagePlus members who hold Premier elite status. Because of the partnership between Marriott and United, MileagePlus Premier members can transfer up to 100,000 miles to Bonvoy points per calendar year. The transfer rate is 1:1.

United miles are valued at 1.2 cents each, which is a higher valuation than of Marriott points, so proceed with caution. It might work out if you’re just a few thousand miles short of a high-value free hotel stay, but generally, we don’t recommend this method.

Book local experiences

Marriott has a Tours & Activities page where you can browse experiences run by locals in your travel destination.

Booking the activities through the designated page and adding your Marriott Bonvoy loyalty number will earn you points on the experience. Earning rates vary so you’ll have to do some math to figure out how many points per dollar you’ll earn with each tour.

Host events and meetings at Marriott hotels

Bonvoy members also can earn points by booking eligible meetings or hosting events at Marriott properties. You’ll earn 2 points per dollar spent on room rentals, food, beverages and audio/visual charges (up to 60,000 points for general members). Elite bonus earnings apply, meaning Titanium and Ambassador members can earn up to 105,000 Marriott points per eligible event.

Fly with Emirates

Another partnership worth mentioning is between Marriott and Emirates, the Dubai, United Arab Emirates-based carrier. Depending on your status tier in the Bonvoy program, you can earn extra points by linking your Marriott Bonvoy and Emirates Skywards accounts through Your World Rewards. On top of earning Skywards miles, Bonvoy Gold, Platinum, Titanium and Ambassador Elites will earn 3 points per dollar spent on flights.

Enroll in Eat Around Town

Eat Around Town by Marriott is a dining program that allows you to earn Bonvoy points for dining at thousands of participating restaurants across the U.S. and paying with a linked credit card.

You’ll earn Marriott Bonvoy points at the following rates (tax and tip included):

- General members: 4 points per $1.

- Bonvoy Elite members: 6 points per $1.

You’ll earn 6,000 Bonvoy points just for signing up for Eat Around Town and eating out within the first 60 days. Additionally, you’ll earn 1,000 points for every 10 dines you complete.

Rent a car from Hertz

Marriott members can earn 500 Bonvoy points on each car rental from Hertz. All you have to do is provide a Marriott loyalty number when reserving a car. It’s possible to request retroactive credit as long as it hasn’t been six months or longer since your rental date. Keep in mind that travel industry rates or any other promotional rates aren’t eligible for Marriott points accrual.

Ride or eat with Uber

Uber gives U.S.-based Marriott members an opportunity to earn some extra points. All you have to do is link your accounts and make eligible transactions through Uber or Uber Eats.

You’ll earn Bonvoy points at the following rates:

- 6 points per $1 on Uber Eats orders of at least $40 delivered to a Marriott hotel.

- 3 points per $1 on UberXL, Uber Comfort, Uber SUV and Uber Black rides.

- 2 points per $1 on Uber Eats orders of at least $40 delivered to any other address.

Book a cruise

Another way to get your hands on some Marriott points is by booking a cruise through the Cruise with Points program. Bonvoy members typically earn 3 points per dollar spent, and co-branded credit cardholders earn an additional 2 points (for a total of 5 points) on sailings booked through a dedicated partnership link.

Combine points with another Marriott member

If you’re short on points for a specific redemption, there’s a way to top up your Bonvoy account without actually earning points. You can ask a friend or family member to transfer you the points. This works especially well if the two of you are traveling together and want to take advantage of one person’s elite benefits.

For a successful transfer, both Bonvoy accounts must have been opened for at least 30 days with a qualifying activity or at least 90 days without a qualifying activity.

A member can transfer a maximum of 100,000 points per year; a member can receive a maximum of 500,000 points per calendar year. Member-to-member transfers are free, but you must transfer the points in increments of 1,000.

Purchase points

And lastly, if you’re truly in a pinch, you have the option to buy Marriott Bonvoy points. You must purchase a minimum of 1,000 points and can’t purchase more than 100,000 per calendar year.

New members must wait at least 30 days after creating an account to buy points. Unless there’s a promotion, Marriott points will cost you 1.25 cents, which is higher than their worth, so use this method only for a specific redemption.

Drink Starbucks

Coffee lovers can link Marriott Bonvoy and Starbucks Rewards accounts to earn points on qualifying purchases.

Upon completing three qualifying Starbucks transactions during a Marriott Bonvoy Week (communicated as such in Marriott Bonvoy and Starbucks® Rewards channels), members can earn 100 bonus Marriott Bonvoy points.

On the flip side, members can also earn Double Stars on qualifying Starbucks purchases made during an eligible stay at a participating Marriott Bonvoy hotel.

How to earn Bonvoy points recapped

With so many options for earning Marriott points, you can find several good ways to boost your hotel rewards balance. Staying at Marriott properties, earning through credit card spending and taking advantage of various partnerships provide some great earning methods.

Generally, we recommend staying away from purchasing points outright or transferring high-value currency into the Bonvoy program, but these methods can make sense if you can maximize the rewards and get outsized value by redeeming them for a free hotel stay.

To view rates and fees of the Marriott Bonvoy Bevy® American Express® Card, see this page. To view rates and fees of the Marriott Bonvoy Brilliant® American Express® Card, see this page. To view rates and fees of the Marriott Bonvoy Business® American Express® Card, see this page.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are some of the best travel credit cards of 2026:

- Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

- No annual fee: Wells Fargo Autograph® Card

- Flat-rate travel rewards: Capital One Venture Rewards Credit Card

- Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

- Luxury perks: American Express Platinum Card®

- Business travelers: Ink Business Preferred® Credit Card

Article sources

NerdWallet writers are subject matter authorities who use primary,

trustworthy sources to inform their work, including peer-reviewed

studies, government websites, academic research and interviews with

industry experts. All content is fact-checked for accuracy, timeliness

and relevance. You can learn more about NerdWallet's high

standards for journalism by reading our

editorial guidelines.

Limited Time Only: Earn $1,000 Toward Travel!

Capital One Venture Rewards Credit Card

Travel

For a limited time, the

Capital One Venture Rewards Credit Card is offering new cardholders an especially rich bonus: Enjoy $250 to use on Capital One Travel in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel!

More like this

Related articles