Fidelity review 2026: Pros, cons and how it compares

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

+ 1 more

+ 2 more

Our Take

5.0

Fidelity offers $0 trading commissions, a selection of more than 3,200 no-transaction-fee mutual funds, top-notch research tools and a mobile platform. Its zero-fee index funds and strong customer service reputation are just icing on the cake.

Fees

$0

per trade for online U.S. stocks and ETFs

Account minimum

$0

Fees

$0

per trade for online U.S. stocks and ETFs

Account minimum

$0

Promotion

None

no promotion available at this time

Show details

Pros & Cons

Commission-free stock, options and ETF online US trades.

Large selection of research providers.

Strong customer service.

Expense-ratio-free index funds.

Highly rated mobile app.

High interest rate on uninvested cash.

Relatively high broker-assisted trade fee.

Compare to Similar Brokers

$0

$0

None

$0

$0

None

$0

$0

Get up to $1,000

Get more smart money moves — straight to your inbox

Become a NerdWallet member, and we'll send you tailored articles we think you'll love.

Full Review

Why trust NerdWallet's reviews: Read our methodology

Over 60 investment account providers reviewed and rated by our expert Nerds.

More than 50 years of combined experience writing about finance and investing.

Hands-on testing of the account funding process, provider websites and trading platforms.

Dozens of objective ratings rubrics and strict guidelines to maintain editorial integrity.

How do we review brokers?

All NerdWallet reviews and lists of the best investing products are created by our editorial team of full-time writers and editors, independent of any business relationships. In this case, our investing team's comprehensive review process evaluates and ranks the largest U.S. brokers by assets under management, along with emerging industry players. Our aim is to provide an independent, balanced assessment of providers to help arm you with information to make sound, informed judgments on which ones will best meet your needs. Our highest priority is maintaining editorial integrity.

We collect data directly from providers through detailed questionnaires, and conduct first-hand testing and observation through provider demonstrations. The questionnaire answers, combined with demonstrations, interviews of personnel at the providers and our specialists’ hands-on research, fuel our proprietary assessment process that scores each provider’s performance across more than 20 factors. The final output produces star ratings from poor (one star) to excellent (five stars).

For more details about the categories considered when rating brokers and our process, read our full methodology.

In this review of Fidelity

- Where Fidelity brokerage accounts shine

- Where Fidelity brokerage accounts fall short

- What type of investor should choose Fidelity?

- What the Nerds think 🤓

- Fidelity at a glance

- How to buy a stock on Fidelity

- How to sign up for a Fidelity account

- What do investors say about their experience with Fidelity?

- What to know about Fidelity's fees

- Fidelity's investment selection

- Fidelity's trading platform and apps

- Other key Fidelity features

- Reviewing Fidelity's IRAs

- Is Fidelity safe?

- Is Fidelity a good broker?

- Is a Fidelity brokerage account right for you?

Where Fidelity brokerage accounts shine

Well-rounded offering: Fidelity Investments offers $0 trading commissions,* no account fees that can erode returns, a swath of research offerings and an easy-to-use platform that advanced traders can customize.

Mutual funds: Fidelity has a strong reputation for its mutual funds. The broker has a large selection of no-transaction-fee funds, including its Fidelity Zero index funds, which have no expense ratio and no minimum investment requirement.** These investor-friendly practices save customers a lot of money.

Educational resources for all levels of investors: Fidelity's educational resources and research options are some of the strongest among the brokers we review. They include resources for both beginning retirement investors and active stock traders.

Where Fidelity brokerage accounts fall short

No futures trading: Fidelity offers fractional shares, forex and options trading, and a modest cryptocurrency program. However, it does not offer futures trading, which some investors may want.

Options contract fee: Some brokers have moved to completely free options trading, but Fidelity still charges $0.65 per contract.

Alternatives to consider:

For futures trading: Webull, Interactive Brokers, Charles Schwab

What type of investor should choose Fidelity?

Just about anyone. Fidelity has low costs, a great app, tons of educational content, advanced trading features and excellent customer support. Unless you're looking for futures, Fidelity will probably work well for you.

401(k) investors. If you have a 401(k), odds are good it's through Fidelity. If you want to view your 401(k) alongside your other investment accounts, it may be a good idea to keep all your accounts in one place.

What the Nerds think 🤓

Alana Benson, Investing Senior Writer

Alana Benson, Investing Senior Writer"I've had a Fidelity account for years but have never actually used the app. While testing the app for NerdWallet, I liked it so much that I ended up downloading it for myself.

Fidelity's online experience feels a little old-fashioned, but the app is pretty slick. It's easy to find educational resources and view your portfolio. And if you end up wanting to talk to an advisor you can schedule a call right from the app."

Fidelity at a glance

Account minimum | $0 |

Stock trading costs | $0 |

Options trades | $0.65 per contract |

Account fees (annual, transfer, closing, inactivity) | Annual fee: $0 Inactivity fee: $0 Closing fee: $0 |

Interest rate on uninvested cash | 3.97% |

Number of no-transaction-fee mutual funds | 3,220 |

Tradable securities | Stocks, mutual funds, ETFs, options, bonds and fixed income, precious metals, crypto |

Trading platform | Three: Fidelity.com, mobile app, Fidelity Trader+ |

Mobile app | Available for iOS and Android |

Research and data | Several data providers, including Argus, Zacks, CFRA and S&P Global |

Customer support options (includes how easy it is to find key details on the website) | 24/7. Hours vary by contact method, but you can get help via phone, email, chat, over social media or at a physical branch. |

IRA match | None |

» Looking to switch brokers? View the best broker promotions right now

How to buy a stock on Fidelity

How to sign up for a Fidelity account

Opening an account with Fidelity is straightforward: You'll select the type of account you want — standard brokerage account, IRA, Roth IRA, etc. — and then provide a few details to confirm your identity, employment information and other personal information. Once you've done so, you'll create a username and password, and then Fidelity will walk you through the process of funding your new account by transferring money from a bank or other brokerage account.

If you have a workplace retirement plan such as a 401(k) and Fidelity is the account administrator, you may already have a login and password. Fidelity will ask you if you're already a Fidelity customer and if so, that will streamline the process — you can log into your account and Fidelity will pre-fill some information in the application from your profile.

What do investors say about their experience with Fidelity?

How we collect customer sentiment about Fidelity

NerdWallet's evaluations focus on data we collect, like account fees, portfolio diversification, features and account minimums, as well as our own experiences with the products we review. We include two factors that directly address customer service: Support availability and contact methods, and website transparency, which our team assesses by looking for key information on the provider's website, just as a potential customer would. But customer satisfaction is harder for us to directly assess. To offer a more complete evaluation, we've used an AI tool to comb Fidelity app reviews for iOS and Android. We then evaluate that data for consistent themes, both positive and negative. Due to the anonymous nature, we're unable to confirm these customer experiences as we normally would. The summary below is based on a year's worth of Fidelity reviews, ending Feb. 2025.

The Fidelity Investments app earns strong ratings in both the iOS and Android app stores, but written reviews in those app stores are more mixed.

iOS and Android reviewers both praise the app's ease-of-use for basic account monitoring, security features, and strong customer support (something that is rarely praised by users of the apps we review).

However, there were common negative themes among reviewers on both app stores: A recent update seems to have made navigation more difficult, according to many reviewers. Critical reviewers also called out difficulties with logins and password autofill features, and said that price data is not always up-to-date in the app and sometimes requires manual refreshing.

What to know about Fidelity's fees

Like other brokers, Fidelity eliminated commissions in 2019 for U.S. stock, ETFs and options trades. Options trades do carry a $0.65 per-contract charge, which is on the high side compared to other brokers (some of which have done away with options contract fees entirely).

But where Fidelity shines is account fees, or rather the lack thereof: Fidelity has eliminated nearly all account fees, including the transfer and account closure fees commonly charged by brokers.

Fidelity's investment selection

Fidelity allows investors to trade stocks, bonds, mutual funds, ETFs, options, forex and three cryptocurrencies: Bitcoin, Ethereum and Litecoin. The company also allows traders to purchase fractional shares, allowing investors to diversify into higher-cost stocks by buying a slice of a share rather than the full amount. Fidelity also supports trading in American depository receipts (ADRs), which allow investors to purchase stock in overseas companies.

Fidelity also offers a substantial selection of bonds. Investors' choices include FDIC-insured CDs and bond funds. Fidelity clients can also buy over 100,000 individual bonds, including corporate, municipal and government bonds.

Fidelity does not offer futures trading, and its Fidelity Crypto offering is limited compared to other brokers that offer crypto access like Robinhood. While the lack of those features would not dissuade most retirement investors, they are options active or advanced traders may like to have in their investing toolkit.

Mutual fund selection

Fidelity was the first broker to bring to market index funds with absolutely no expense ratio: the Fidelity Zero Total Market Index Fund, the Fidelity Zero International Index Fund, the Fidelity Zero Large Cap Index Fund and the Fidelity Zero Extended Market Index Fund.

Investors can build a balanced — and virtually free — retirement portfolio with these zero-expense-ratio funds alone. Still, even the Fidelity index funds that charge an expense ratio undercut much of the competition on price.

Fidelity offers more than 3,200 mutual funds that carry no transaction fee.

Fidelity's trading platform and apps

Fidelity has two trading platforms, Fidelity.com and Fidelity Trader+. Both are free for all customers. Highlights include advanced screeners with research and strategy-testing tools based on 10 years of historical data.

How we nerd out testing trading platforms

Our reviewers — who are writers and editors on NerdWallet’s content team — do hands-on testing of every online broker platform in our analysis. That way, we can report on every aspect of the user experience, from funding a new account to placing trades.

We score each broker against criteria that factor in the capabilities offered and the actual user experience of trading with those capabilities. This includes how easy it was to sign up for and fund a new account. Note that a broker may score very highly for the platforms it offers but low for the experience of actually using that platform. Our analysis scores these criteria separately and weighs them evenly when factored into the broker’s overall score. As a result, a broker can offer an advanced trading platform. Still, if it is clunky to use or the process of opening an account is unnecessarily arduous, their score will reflect that.

Fidelity Trader+ is a downloadable desktop platform. The customizable platform includes intuitive shortcuts, a pre-built market, technical and options filters, advanced options tools and a multi-trade ticket that can store orders for later and place up to 50 orders at a time. Fidelity users can also trade over-the-counter securities and access IPOs.

The company's online trading experience offers an entry point for advanced traders and beginners who want the big picture on their finances. Its intuitive and easy-to-use interface allowed us to quickly explore Fidelity's offerings and compare investments without feeling pressured or confused.

Fidelity says its execution quality on trades is 98.89%, putting it in the top tier of providers we've reviewed. Clients can also trade certain investments outside of traditional market hours. Pre-market orders start at 7 a.m., and after-market orders are accepted until 8 p.m.

One note on Fidelity's business model: Though the company doesn't receive conventional payment for order flow on equities trades, there are some instances in which exchanges or brokers may pay Fidelity for sending them your trades.

Nerdy Tip

The average execution quality of all brokers we review was 97.51% as of Oct. 15, 2025. That means 97.51% of orders sold for at a price that was at or better than the National Best Bid and Offer. Executing at or above the NBBO means you may receive a price improvement or a better share price than you were originally quoted.

Mobile app

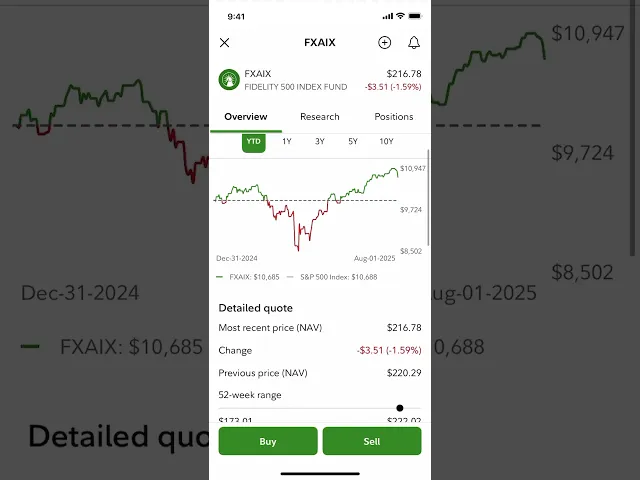

Our star rating here is based on how iOS and Android users score the broker's mobile apps, though we also test each app ourselves. Fidelity’s highly rated app includes real-time quotes, multi-leg options trading, a consolidated version of the company’s research offerings, and a notebook to save ideas and articles from your mobile browser.

The company has streamlined and simplified its app to support better trading, portfolio monitoring and research. The app includes a customizable newsfeed and allows you to schedule appointments with your existing Fidelity advisor.

Fidelity also offers a customized mobile app experience for the Fidelity Youth Account, an investment account designed for teenagers (ages 13 to 17).* We have not rated this separate app, but the youth account and app are worth a look for parents. The account allows a parent or guardian to monitor the teenager's activity and offers access to stocks and ETFs, including fractional shares.

Teenage account holders can also invest in select Fidelity mutual funds (including Fidelity ZERO funds, which have no expense ratio). Importantly, the account also puts some risky investments and investment strategies off limits, including options and margin trading. The app offers in-app educational resources, articles on investing and online research tools. Once the account holder reaches 18, the account will be a standard brokerage account.

Other key Fidelity features

Research and data

Fidelity is strong here, with stock research from several third-party providers, including Zacks Investment Research and Argus. The company offers ETF research from multiple providers and options strategy ideas from options analysis software LiveVol.

Stock quote pages show an Equity Summary Score, which consolidates the ratings from these research providers. It gives an “accuracy-weighted sentiment derived from the ratings of independent research providers on Fidelity.com."

This number of research firm offerings might seem like too much to wade through, but investors can take a short quiz to identify providers that match their investment style. A research firm scorecard evaluates the accuracy of the provider's recommendations.

Customer support options

Fidelity earns strong marks for educational tools and customer service options, including a network of more than 200 branches for in-person advice and educational options, and 24/7 phone, chat and email support. Fidelity’s Online Learning Center also offers a customized experience, using machine learning to surface educational materials that match the customer’s investing behavior.

High interest rate on uninvested cash

Fidelity automatically directs uninvested cash for brokerage and retirement accounts into a money market fund, which provides a high return relative to some other brokers, many of which pay no interest on uninvested funds. As of this review, its interest rate was nearly 4%, although that number fluctuates.

Fidelity Basket Portfolios

If you're looking for something between a robo-advisor and full DIY management, Fidelity can help. Their Basket Portfolios tool allows you to customize a portfolio, set your asset allocation and then automate contributions, which will be distributed across your portfolio based on your set allocation.

For example, if you want to invest in the 50 largest companies in the S&P 500 but exclude certain stocks (perhaps for moral or political reasons, or you already have substantial exposure to a specific company), you can create that portfolio using the basket feature, excluding any stocks you want. From there, you can specify how much money you want to go toward each stock with every contribution to the basket. Fidelity Baskets costs $4.99 per month, and can hold up to 50 stocks and ETFs.

Reviewing Fidelity's IRAs

Fidelity offers both traditional and Roth IRAs, as well as several types of IRAs geared toward self-employed people. IRAs are retirement savings accounts you open on your own, independent of any retirement plan that may be offered through your employer. IRAs have significant tax advantages, and experts recommend using them when saving for retirement. You can have an IRA in addition to a standard brokerage account that you use to invest for non-retirement goals or trade stocks. Unlike other brokers, Fidelity also offers access to crypto through IRAs.

Fidelity's IRAs bring everything to the table that Fidelity's standard brokerage accounts offer: Low fees, excellent educational resources, great customer service and lots of investable assets. IRA investors in particular may be most interested in gaining access to Fidelity's retirement tools and calculators. One thing that makes Fidelity's IRAs stand out? They offer IRAs for kids and small business retirement plans. Not every broker offers these specialty IRAs.

Is Fidelity safe?

Investing always involves taking risks, and you may wonder whether your investments are protected following recent bank failures. While brokerage accounts won’t protect you against investment losses, they carry other forms of insurance in the event of closure due to financial difficulty, bankruptcy, or unauthorized trading and theft.

According to Fidelity, Securities Investor Protection Corporation (SIPC) insurance covers all brokerage accounts, and uninvested cash balances below $5 million are eligible for Federal Deposit Insurance Corporation (FDIC) insurance. SIPC will reimburse a maximum of $500,000 in securities, and the FDIC will pay up to $250,000. Fidelity’s Customer Protection Guarantee offers additional fraud protection “for losses from unauthorized activity in your Covered Accounts occurring through no fault of your own.”

Is Fidelity a good broker?

Fidelity is a great broker. Fidelity receives our highest rating across almost every category, including fees, available investments, trading platforms, research and data and customer service. Fidelity is an excellent broker for beginner and advanced investors and the app is very easy to use. Plus, Fidelity has been around for over 70 years, which may give some investors peace of mind.

Is a Fidelity brokerage account right for you?

Fidelity is the rare broker that can serve both active traders and beginner retirement investors. The company brings it on every level, starting with a mutual fund selection that stacks up to any other broker and even includes free offerings. But Fidelity also offers features that matter to stock traders, including solid trading platforms, zero trade commissions and a wide range of research offerings. We can't think of an investor who won't be well-served by Fidelity.

Disclosures

*$0.00 commission applies to online U.S. equity trades and exchange-traded funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (historically from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. A limited number of ETFs are subject to a transaction-based service fee of $100. See full list at Fidelity.com/commissions. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Institutional® are subject to different commission schedules.

**Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

NerdWallet writers are subject matter authorities who use primary, trustworthy sources to inform their work, including peer-reviewed studies, government websites, academic research and interviews with industry experts. All content is fact-checked for accuracy, timeliness and relevance. You can learn more about NerdWallet's high standards for journalism by reading our editorial guidelines.

- 1.Fidelity. We Are Fidelity.Accessed Jul 31, 2025.