Table of Contents

- Generation Debt Trap: who are UK consumers in debt to, and how much do they owe?

- Men and women: who’s borrowing the most?

- Energy bills: cold snaps and rising costs worry some more than others?

- Three quarters of Brits believe they will be debt-free within a year

- What are we using borrowed money for?

- Gen Z Brits feel the biggest financial impact from the cost of living crisis

- Majority of Brits concerned about falling into debt

With over two fifths of consumers (45%) saying they are currently in debt, and searches for ‘how long does it take to pay off debt?’ increasing by 160% in the past 10 months – a new survey suggests that lingering money worries could be affecting consumers across the UK.

NerdWallet UK has analysed consumer debt by surveying 2,000 UK adults aged 18 to 65-plus, to find out how much the average person currently owes, and their concerns surrounding the cost of living crisis and their future financial security.

Alongside the consumer survey, researchers used Google search trends data to see if consumers’ personal finance worries were being reflected in their searches. We reviewed a list of some of the UK’s most common money-related topics over the past year to determine whether search interest had increased or decreased, to identify the most pressing financial issues at the forefront of consumers’ minds.

Generation Debt Trap: who are UK consumers in debt to, and how much do they owe?

The term ‘debt help UK’ has seen a 185% increase in the past eight months, with 2.4k searches for the term in October alone. With debt clearly plaguing the minds of so many, who do consumers owe the most debt to, and how much do they currently owe?

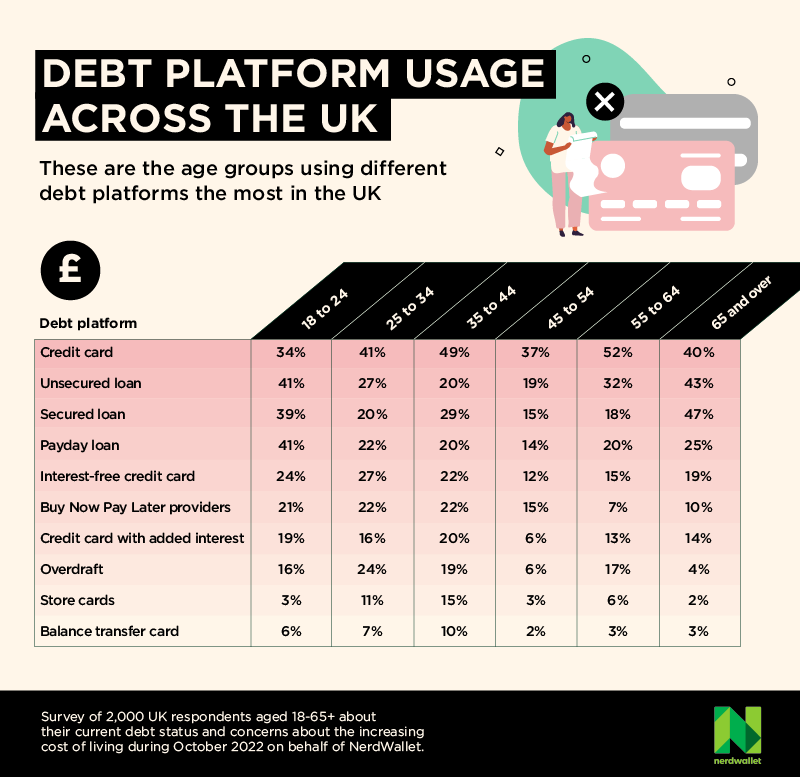

Debt accrued through credit cards remains the most common form of borrowing. Whether used for costly purchases, such as furniture and holidays, or simply relied upon for day-to-day living and paying the bills, more than two fifths (42%) of Brits polled admit to owing money through credit cards.

The second most common debt emerged as unsecured loans with 30% of respondents owing money here, followed by secured loans (29%). These types of debts are typically accumulated by those in need of a larger sum of money for significant purchases, such as a new car or home renovation.

The fact that almost one in four (23%) of respondents say they owe money to a payday loan lender suggests that many borrowers may be struggling to make ends meet and survive on their monthly income in the current financial climate.

With controversy surrounding Buy Now Pay Later (BNPL) options making the headlines during the ongoing financial crisis, results from the survey indicate that as many as one in six (15%) Britons owe money through this type of debt. Interestingly, women who took part in the survey (20%) are more likely than men (11%) to use BNPL options, such as Klarna, Clearpay or LayBuy, to spread the cost of purchases over a number of months.

Interestingly, a recent report by Citizens Advice has revealed that one in 12 people turned to Buy Now, Pay Later at the beginning of 2022 to cover basic costs such as food and toiletries.

The charity also found that young people, those currently in debt, and people claiming Universal Credit, are at least twice as likely to have used BNPL for essentials than the general population.

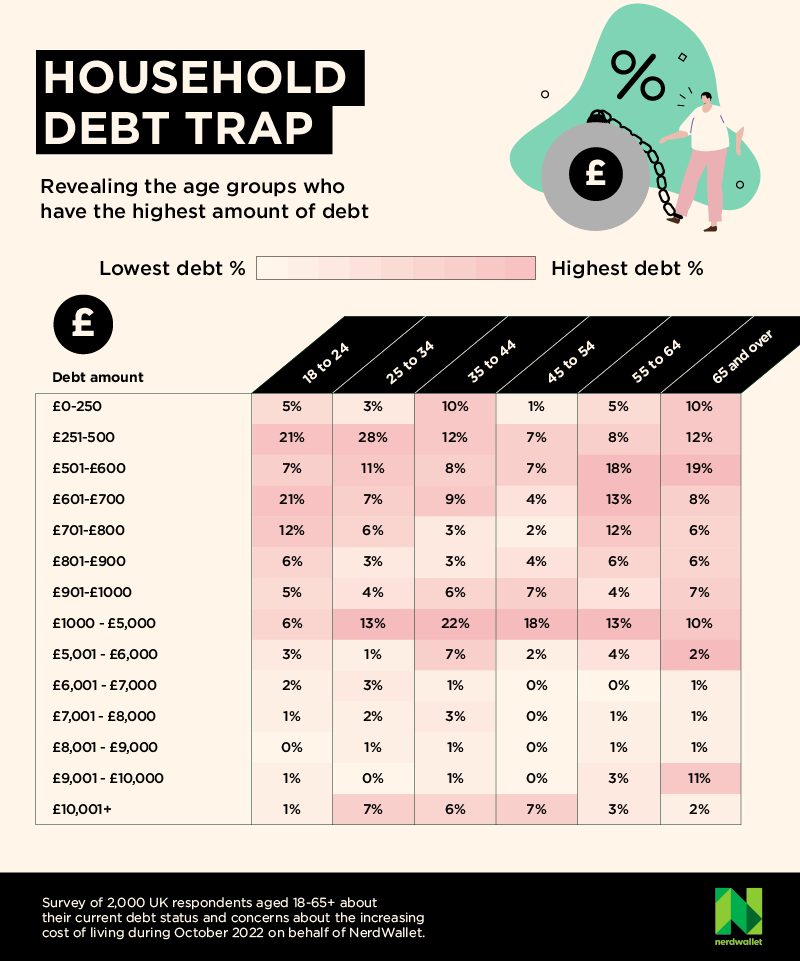

With results that indicate school leavers and university students as young as 18 are currently living in debt, we asked consumers of different age groups to give a breakdown of the amount of money they owe.

The research found that Gen Z’ers, aged 18 to 24, are accumulating different levels of debt. While just over one fifth (21%) claim to have £600 to £700 worth of debt, one in eight (12%) owe £700 to £800, and almost one in six (13%) are already carrying more than £1,000 worth of debt, despite their young age.

Taking a look at the most prominent amounts of debt held by older age categories, almost one in three (31%) of millennials, aged 25 to 34, state their debt totals less than £500. What’s more, one in five (20%) millennials and over a third (35%) of those aged 35 to 44 claim they currently owe between £1,000 and £10,000.

Somewhat unsurprisingly, results indicated that those aged 65 and over are struggling the least with debt, with almost half (49%) owing less than £700.

Men and women: who’s borrowing the most?

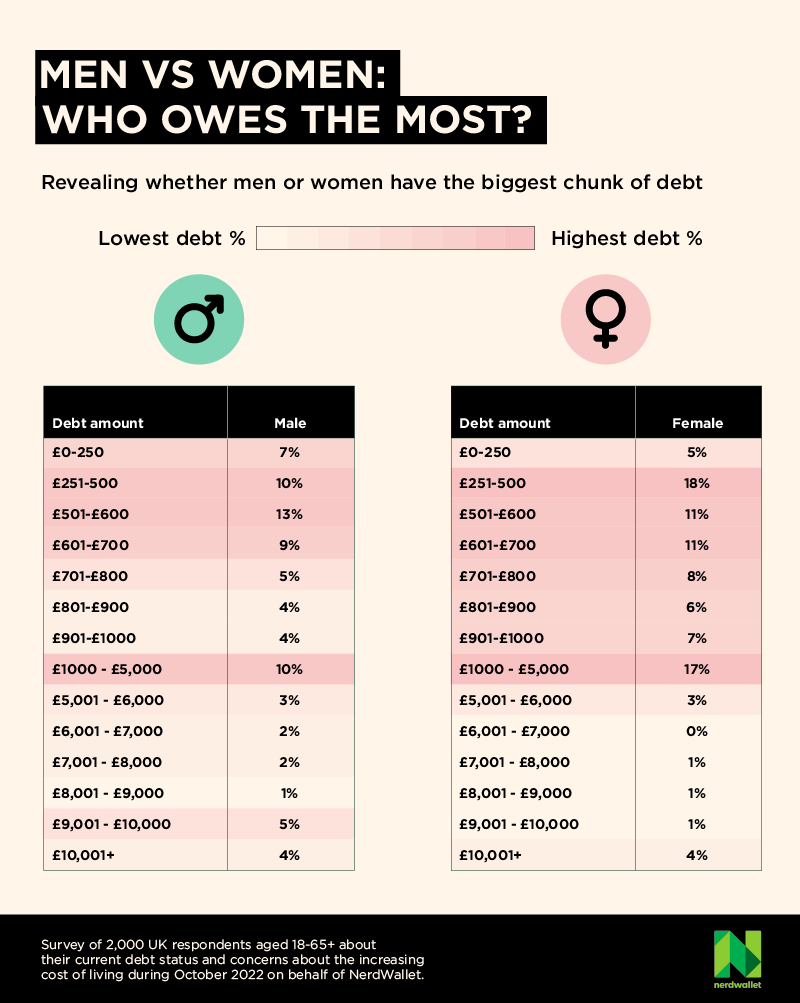

Gender is playing a part in how Britons are accumulating debt, with the breakdown of credit card and BNPL usage versus short- and long-term loans giving an insight into the differing financial priorities and responsibilities of British men and women.

While 83% of women and 62% of men admit to owing anything from no money at all to £5,000 debts, men (13%) are more likely than women (6%) to owe greater amounts of between £5,001 and £10,000.

That being said, it’s important to highlight how men are significantly more reserved about sharing the amount of debt they are currently in. One in five (20%) men preferred not to disclose how much debt they owed, as opposed to just 8% of women.

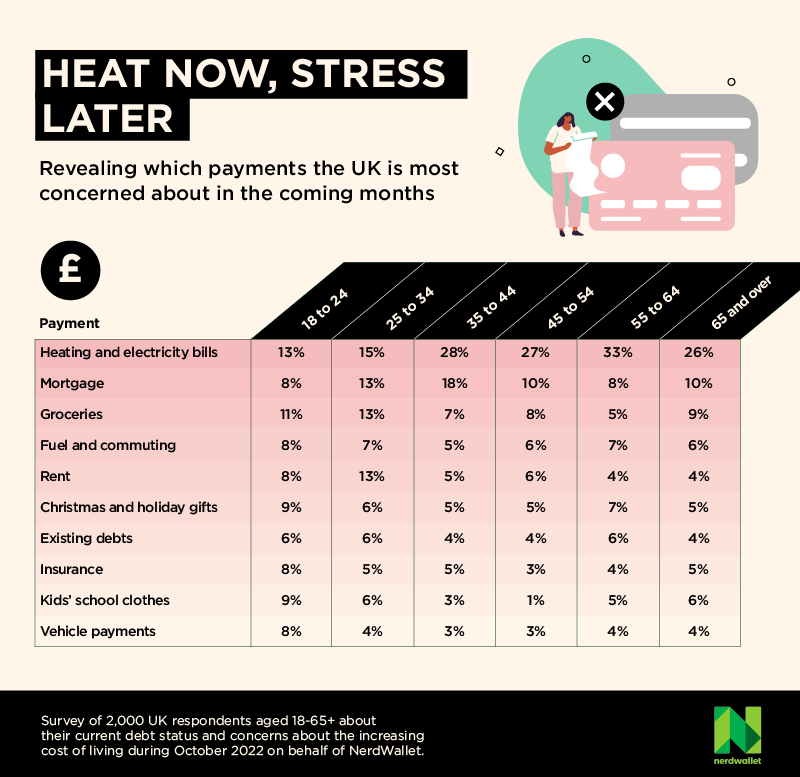

Energy bills: cold snaps and rising costs worry some more than others?

With many concerned about the rising cost of living and whether they will be able to afford their essential outgoings this winter, searches for ‘how to reduce energy bills’ have seen a 56% spike in the past 11 months, while searches for the term ‘energy bill payment’ have increased by 614% over the past 12 months.

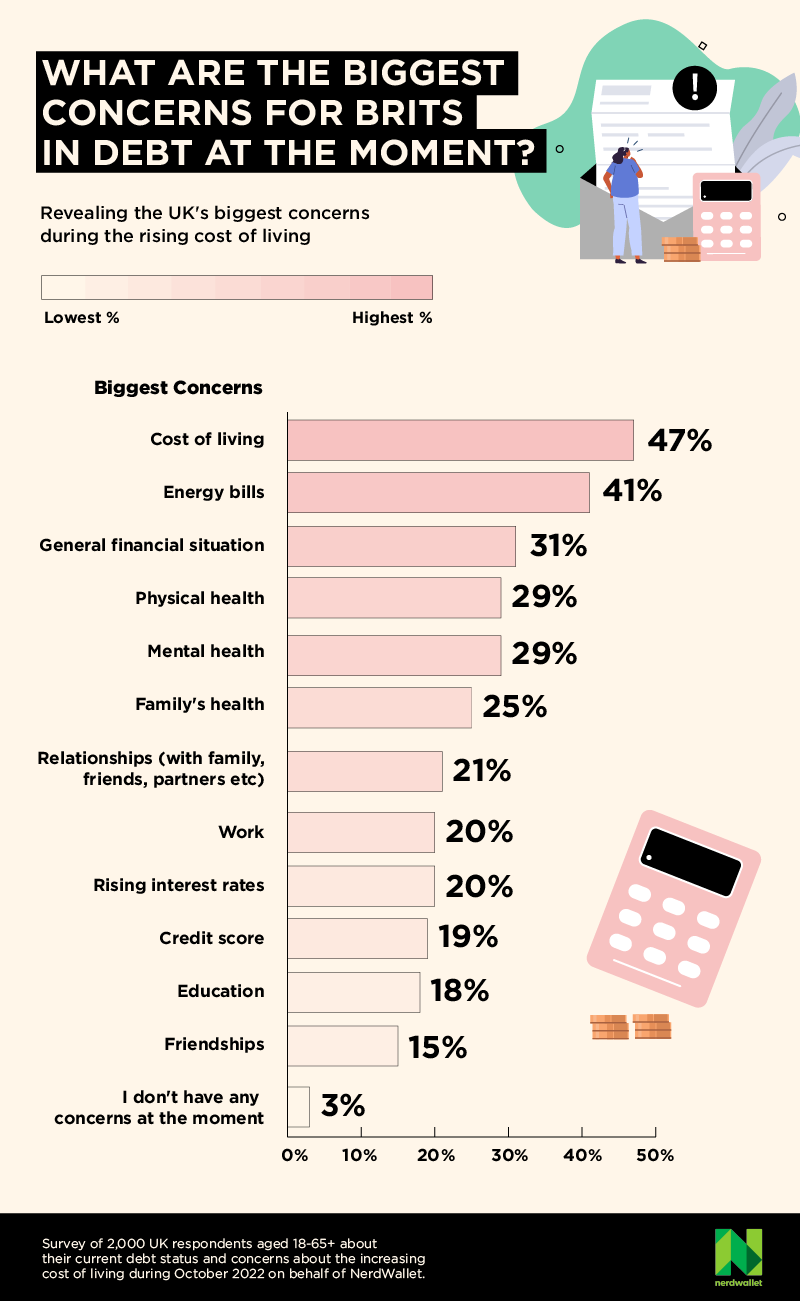

Looking at our findings, consumers seem to be split when it comes to what concerns them most about their debts, with almost half (47%) of respondents currently in debt saying that the cost of living is their biggest worry, while 41% highlighted that energy bills are their main concern.

Interestingly, while half of women are concerned about the cost of living crisis having a negative impact on their debts, just 37% of men have the same worries, potentially highlighting the wider financial issues some women may have to deal with regarding childcare costs, flexible working opportunities, and the gender pay gap.

The issue of rising energy costs and the ability to keep their home warm during the cold British winter affects the majority of bill-payers, but for those more vulnerable to the dropping temperatures and rising costs, concerns are considerably heightened.

While just under a quarter (24%) of Brits polled are worrying about paying for heating and electricity over the next 12 months, 49% of those aged 55 to 64 and 40% of those aged 65-plus disclosed that it was among their biggest concerns at the moment.

Looking into gender specific worries, women highlight a significantly bigger concern at the prospect of not being able to pay their energy bills (45%) than men (33%) do.

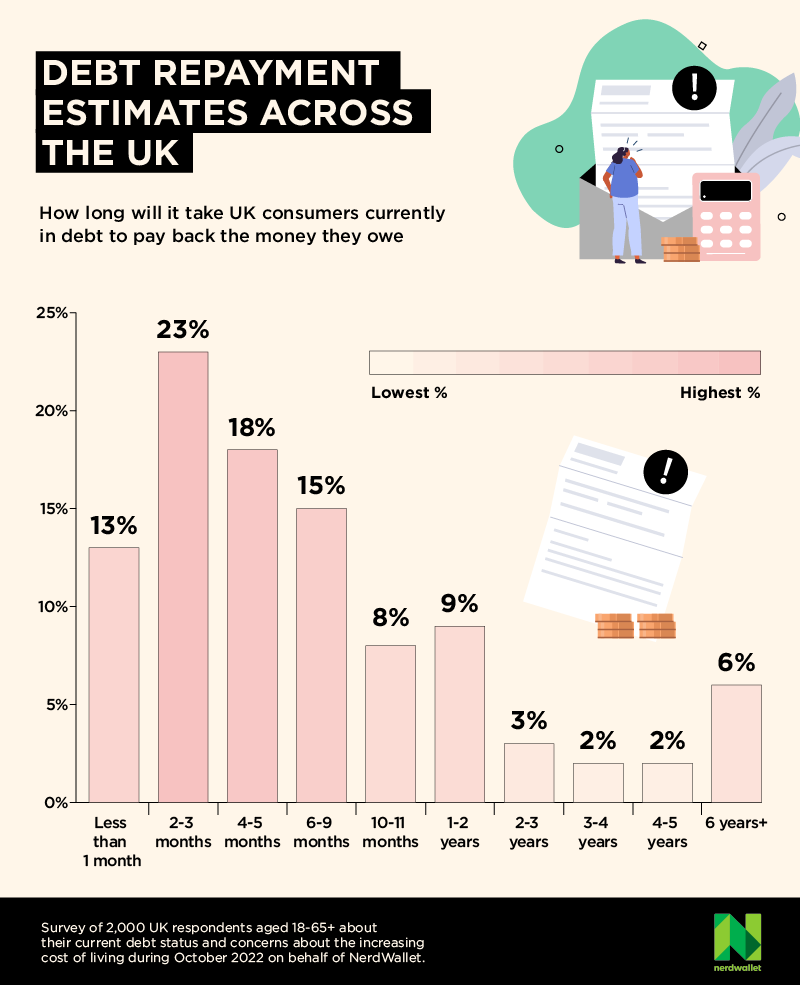

Three quarters of Brits believe they will be debt-free within a year

Google searches show that many consumers are focusing on getting out of debt as soon as possible. And the current cost of living crisis has acted as a warning sign for borrowers to clear as much debt as they can in case the financial crisis worsens.

It is therefore understandable to see that searches for the term ‘pay off debt quickly’ have increased by 140% during the last year, with 2.4k monthly searches.

But, despite the rising cost of living, optimism remains high, with more than three quarters (77%) of respondents believing they can be completely debt-free by this time next year. One in seven (13%) even say they could pay off their debts within a month.

However, those aged 18 to 34 are less hopeful of clearing their debts off quite so quickly, with 32% believing a year isn’t enough time to repay what they owe in full.

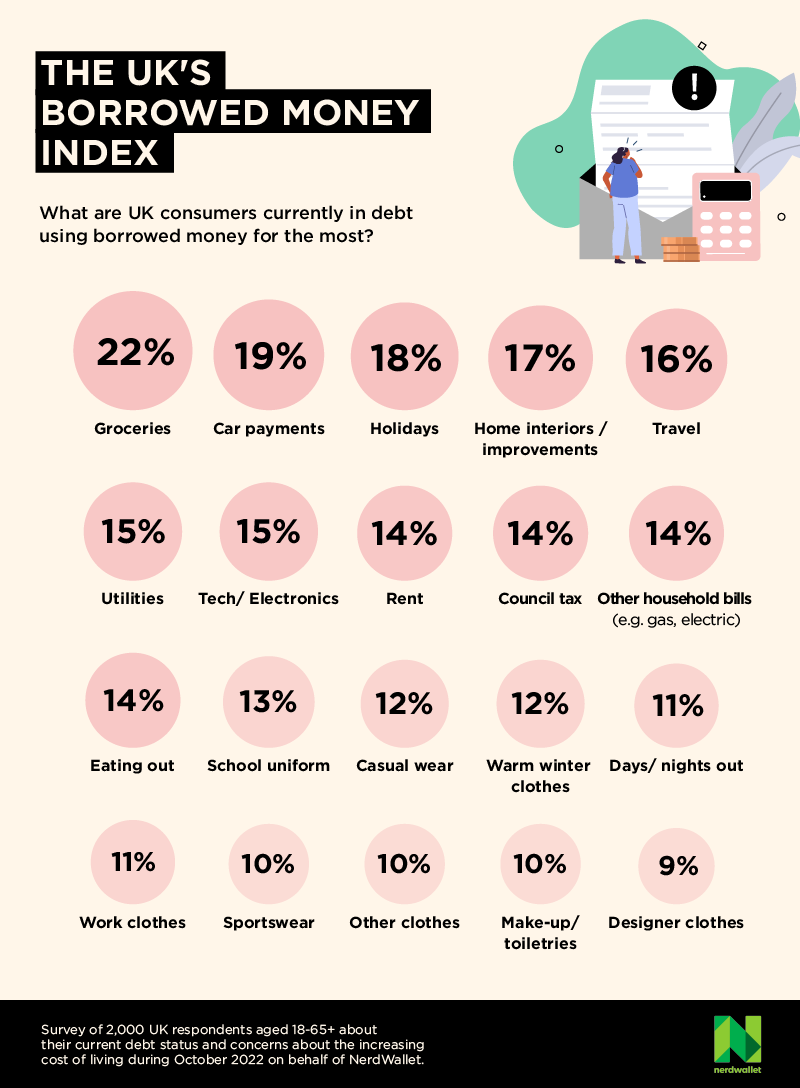

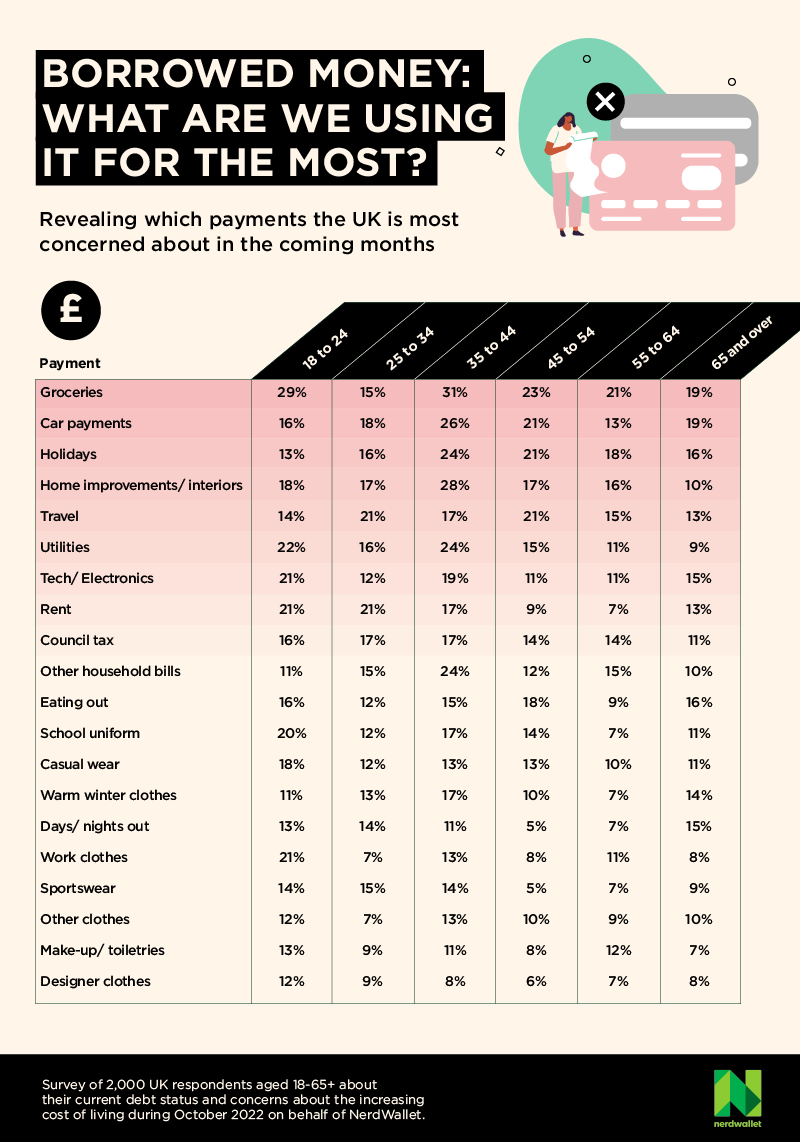

What are we using borrowed money for?

Consumers continue to borrow money on a regular basis to help fund and improve both their lives and the lives of their loved ones, but what is this borrowed money most commonly being used for in the current financial climate?

While it’s true that borrowers are still taking out credit cards and loans to prioritise luxury spends on holidays, cars, and material goods, the cost of inflation and rising prices – that aren’t rising in line with average wages – means that some are relying on credit in order to feed themselves and their families.

It is therefore not surprising to see that the term ‘cheapest supermarkets’ has seen a significant increase of 155% in the past eight months.

Just under a third (31%) of consumers aged 35 to 44, and 29% of those aged 18 to 24, admit to borrowing money to pay for groceries. Conversely, just 15% of those aged 25 to 34 say they used credit to pay for groceries.

Gen Z Brits feel the biggest financial impact from the cost of living crisis

Searches for ‘cost of living’ have increased by a staggering 5493% in the past 12 months, with the term being Googled 483,000 times in the previous month alone. But which demographics are feeling the greatest repercussions from the crisis?

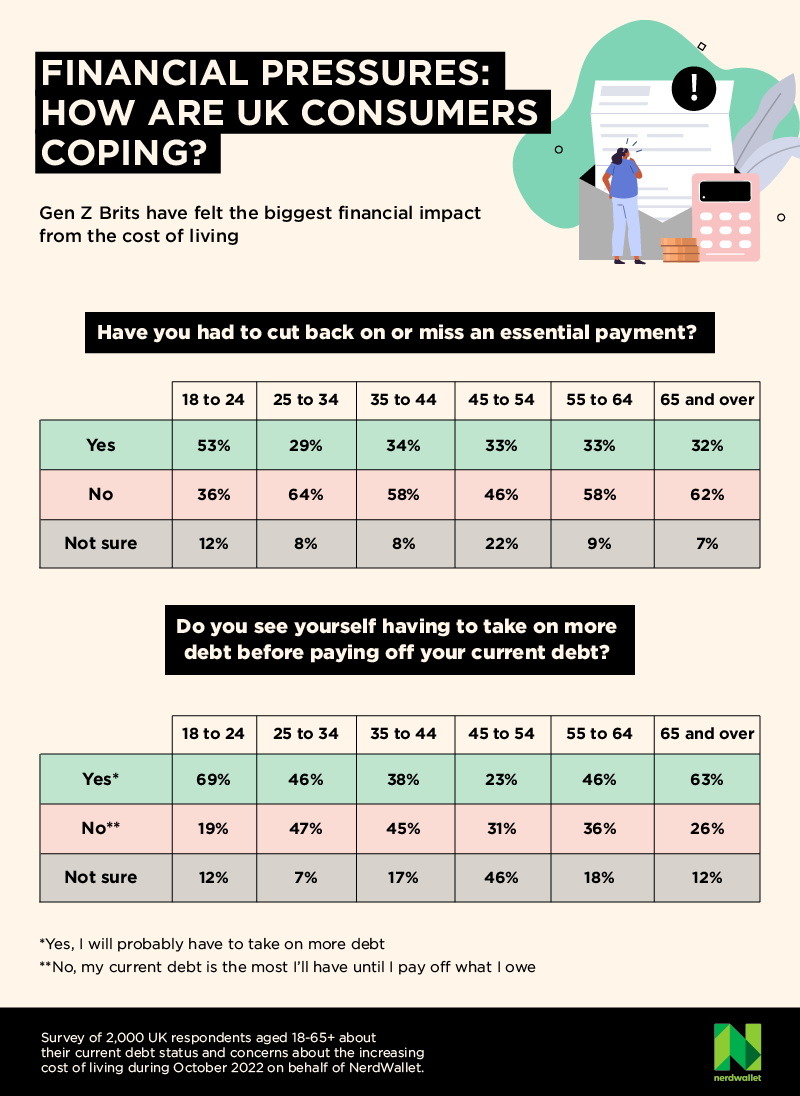

More than half (53%) of those aged 18 to 24 admit they have had to cut back on costs, or missed essential payments. And worryingly, more than two-thirds (69%) also predict they will likely need to acquire further debt to deal with future financial pressures.

On the other hand, consumers aged 25 to 34 appear to have experienced the least impact from the cost of living crisis, with 64% saying that they don’t yet feel the need to cut back or miss any essential payments.

Women are 6% more likely than men to admit they will need to take on further debt as the cost of living crisis continues.

Majority of Brits concerned about falling into debt

With a looming recession, rising interest rates, and fewer people able to save money for a rainy day, many households expressed concerns about falling into problem debt.

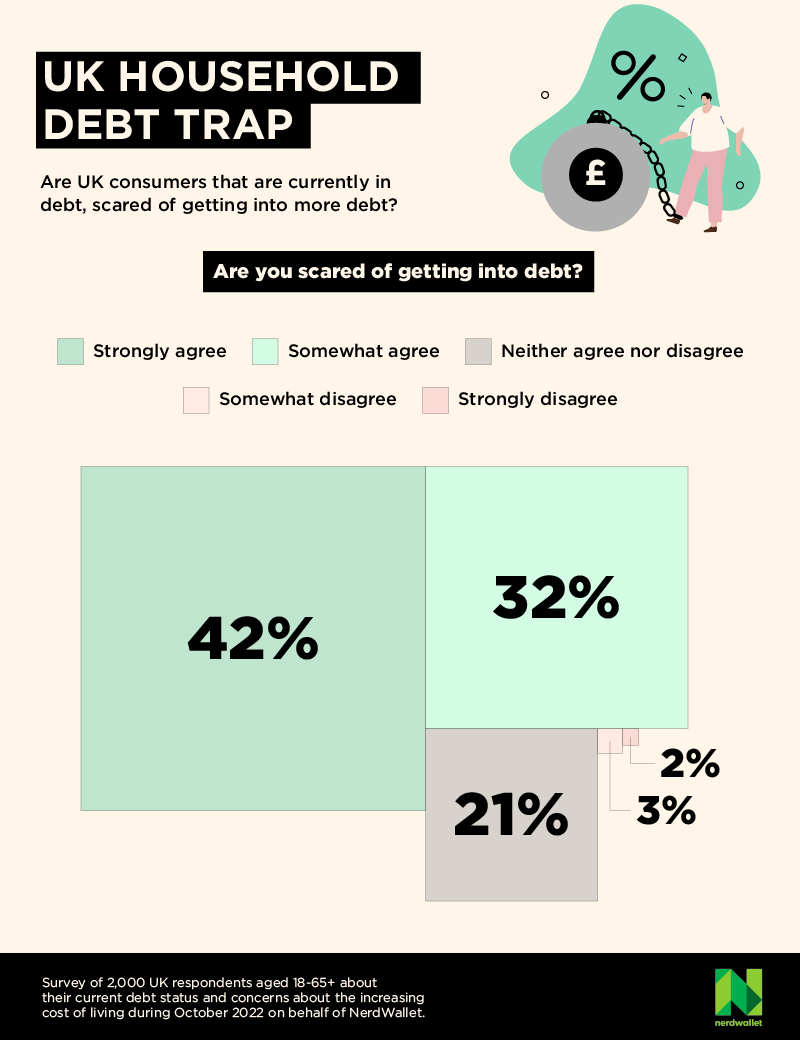

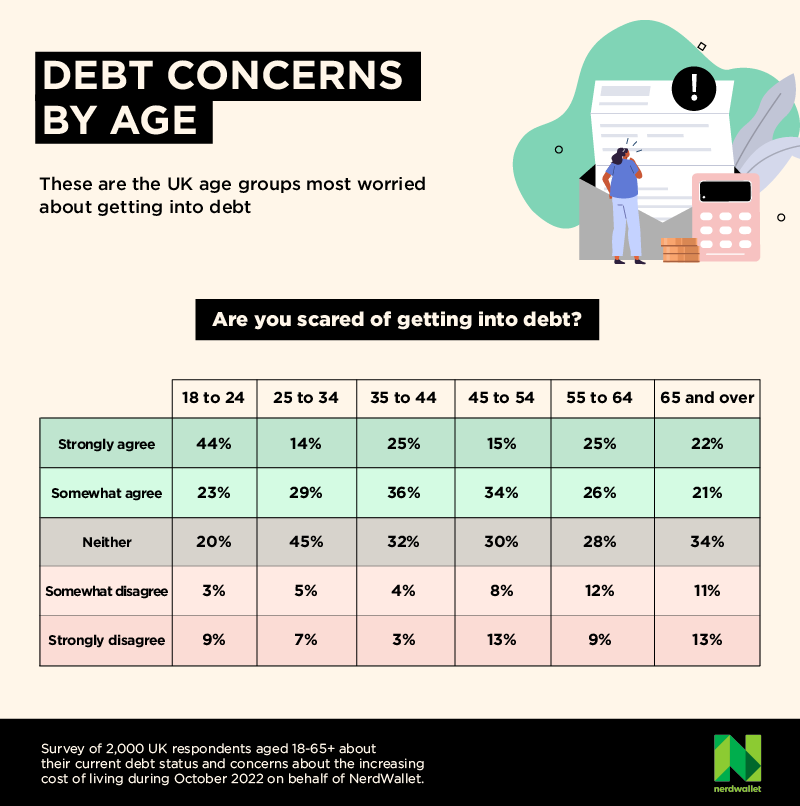

Almost three quarters (74%) of consumers currently in debt fear becoming trapped by debt in the future, the findings show.

Women were more likely to fear falling into problem debt than men. Some 60% of women admitted to debt concerns compared with just 41% of men, according to the findings.

If you need advice about problem debt, there are many organisations that offer free debt help and support, including debt charities, such as StepChange and National Debtline.

Methodology and data sources:

A nationally representative online survey of 2,000 UK adults aged 18 to 65-plus was conducted by OnePoll on behalf of NerdWallet UK during October 2022, to find out about’ the level of consumer debt and concerns about the increasing cost of living.

For the Google search trends, we created a list of the UK’s most searched-for financial topics over the past 12 months to determine whether search interest among consumers had increased or decreased.

Google search trends of respective cost of living search terms were compared from October 2021 to October 2022, unless the search term peaked at a certain time within the 12-month time frame and, in this case, the highest spike in searches was recorded.